Refreshing Valuations for Large-Cap Quality

Increasing portfolio quality is a theme many investors flock to during recessions.

You might worry that rotation and flows to quality strategies push up valuations to premium prices, hurting the prospects of forward-looking returns. But WisdomTree has a potential solution. We have a family of quality dividend growth strategies that combine elements of screening for profitability (high return on equity (ROE) and return on assets (ROA)) and strong earnings growth expectations.

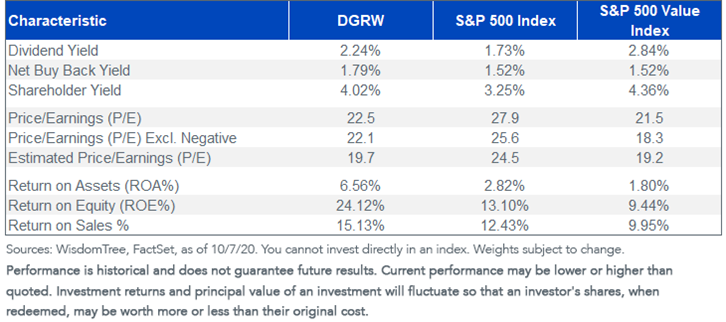

Because of the profitability focus and the dividend requirement, one of the interesting parts of our U.S. Quality Dividend Growth Fund (DGRW) is that it is trading at price-to-earnings (P/E) multiples that resemble the characteristics of “value” sides of the market, but with significantly higher quality ratios.

While the S&P 500 Value Index has a return on equity of 9.4%—below the S&P 500 level of 13.1%—DGRW has an ROE of more than 24%.

Aggregate Characteristics

Please click here for standardized and the most recent month-end performance.

For definitions of terms in the table, please visit our glossary.

Let’s look at some of the nuance of this strategy.

Dividends Under Pressure

The broad universe of value strategies and dividend-paying stocks has come under pressure in 2020 as many companies were forced to scale back or cut their dividends.

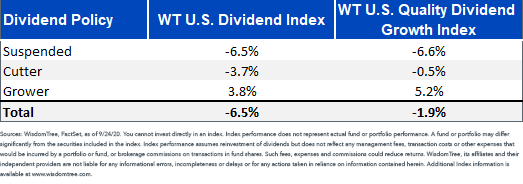

Less Likely to Cut Dividends: Whereas 272 companies, or 13%, of the 1,471 dividend payers in the WisdomTree U.S. Dividend Index either cut or suspended dividends in 2020, less than 8% of the 300 companies in the WisdomTree Quality Dividend Growth Index cut or suspended dividends in 2020.

Quality More Likely to Grow Dividends: Quality companies also tend to be able to grow dividends faster over time, and they were stress-tested during this pandemic. Whereas 54% of the broad universe of 1,471 dividend payers have grown their dividends in 2020, 64% of the Quality Dividend Growth Index have.

Being less likely to cut dividends and more likely to grow them adds up. The WisdomTree U.S. Quality Dividend Growth Index currently only sees a decline of less than 2% in its total Dividend Stream®, whereas the broad index Dividend Stream is down 6.5%.

Total Change in Dividend Stream by Dividend Action in 2020

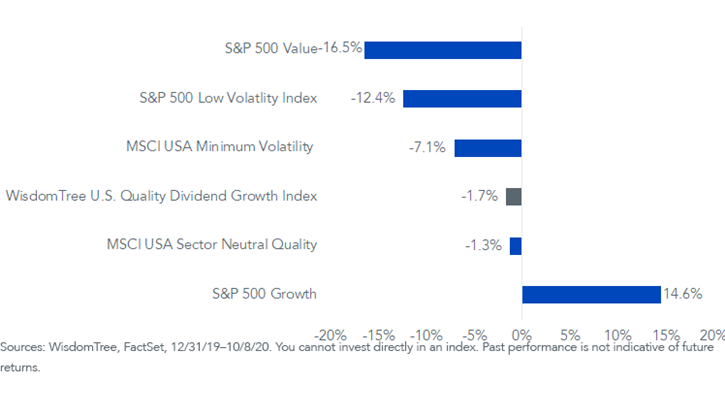

2020 Factor Returns—Low Risk Lags

In recent years, investors have flocked to “low-risk” funds that track indexes like the MSCI USA Minimum Volatility and the S&P 500 Low Volatility—adding $36.5 billion to such funds between 2017 and 20191.

But these strategies haven’t been a ballast during the coronavirus storm. The MSCI USA Minimum Volatility lagged the S&P 500 by 7.1% this year. The S&P Low Volatility has lagged by more than 12%.

Excess Return vs. S&P 500 Index

For definitions of terms in the chart, please visit our glossary.

Growth strategies, led by technology shares that benefited from the economic shutdown, have dominated all other factors, with a more than 3,000 basis point (bps) spread between growth and value.

Remarkably, the WisdomTree U.S. Quality Dividend Growth Index only trailed the S&P 500 by 170 bps this year without holding 7 of the 10 largest contributors to S&P 500 performance—many of the non-dividend-paying technology stocks.

For investors concerned about the top-heavy, growth-led run in the broad benchmark, our quality dividend growth strategy—which combines elements of quality and value—looks like an attractive alternative for widespread uncertainty and market volatility.

1Jason Zweig, “Some Investors Tried to Win by Losing Less. They Lost Anyway,” Wall Street Journal, 9/18/20.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.