Our New Growth Leaders Strategy—Reintroducing the Platform Business Model

WisdomTree is relentlessly focused on creating better ways to invest, and that includes continuously reevaluating and improving the positioning of our existing strategies.

We recently announced enhancements to our new WisdomTree Growth Leaders ETF (PLAT) that we believe position the Fund for both future potential outperformance within the important growth category but also, critically, reduced tracking error to the major growth benchmarks.

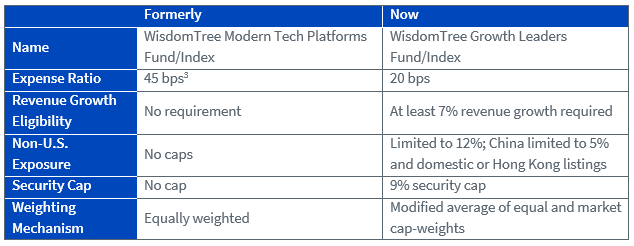

PLAT continues to provide exposure to high-growth companies that operate platform-based business models. But the index PLAT is designed to track, the WisdomTree Growth Leaders Index1, has migrated from an equal-weighted and global strategy to one that incorporates market capitalization and a greater focus on the U.S.—to have less deviation relative to traditional U.S. large-cap growth benchmarks.

More common holdings at the top of PLAT does not mean it is purely a strategy that tracks a growth benchmark.

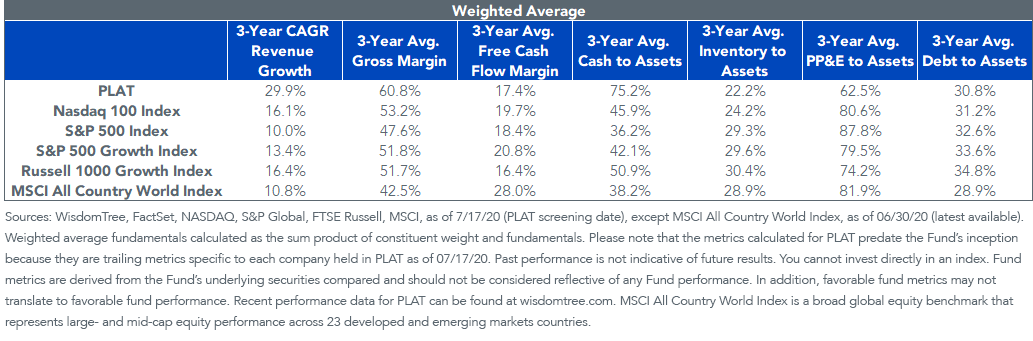

The new WisdomTree Growth Leaders Fund has companies with historical three-year sales growth rates that are more than double those of companies in the traditional S&P 500 and Russell 1000 Growth indexes, besides sharing four of the same top five holdings.2

The key to PLAT’s elevated growth rates partly comes from being more focused on, and selective about, companies with the strongest growth rates. What PLAT’s constituents have in common is that they are platform-based businesses.

Summary of Methodology Enhancements

Why Platform Businesses Are the Growth Leaders

Platform businesses aim to create value by connecting interdependent groups (e.g., Uber connects a rider with a driver), while traditional businesses create value through linear production or supply (e.g., Ford or Hertz produce/buy cars for sale/rent).4

We believe the competitive advantage of platform businesses lies in their ability to scale quickly and efficiently beyond the capability of linear businesses. This scale advantage stems from two major sources:

- Platforms Benefit from Network Effects: The value of a platform’s network increases for existing users as the network grows and new users are added (e.g., additional riders increase the value of Uber’s network for drivers, and vice versa).

- Platforms Benefit from Near-Zero Marginal Costs: There is little to no cost to add a user to the network or to facilitate a marginal transaction between users (e.g., after the expense of developing the Uber app, there is nearly zero cost per download or ride booking). In contrast, a linear business will reach a size where the marginal cost of additional production/supply outweighs the benefit.

WisdomTree licenses data from Applico, a platform consulting business, to help identify companies with these distinct platform characteristics.

We also added revenue growth requirements to emphasize exposure to growth leaders and platforms that are continuing to scale.

The result of the enhancements to PLAT’s methodology is a 51-stock basket with leading growth, margin and capital efficiency metrics:

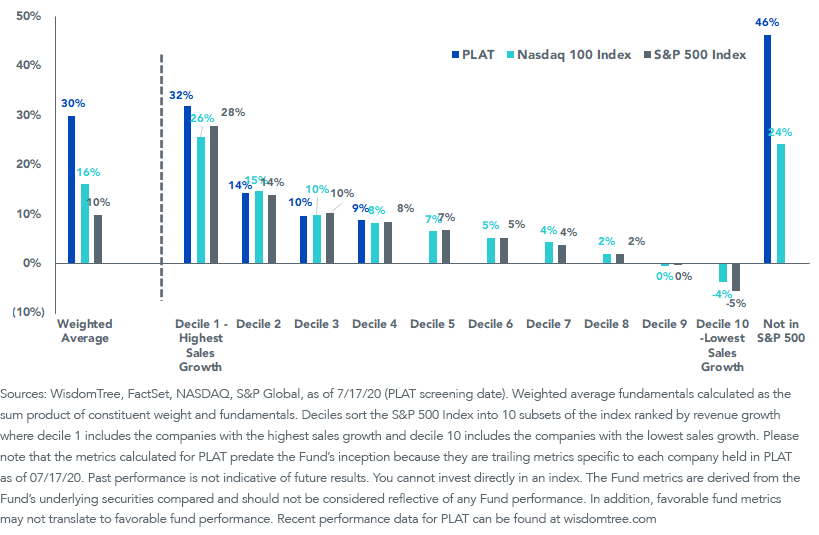

- PLAT boasts revenue growth two to three times that of the S&P 500 and NASDAQ 100 indexes, and the 30% sales growth figure is competitive with the top decile of companies in the S&P 500 with fastest growth.

PLAT Generated Revenue Growth Above the Top Decile of the S&P 500 Index

- The structural advantages of platforms are exemplified by PLAT’s higher gross margins and lower asset intensity.

For definitions of terms in the table, please visit our glossary.

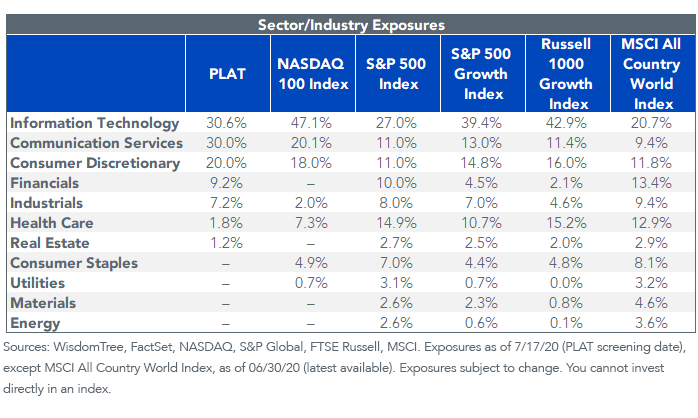

- Platforms have disrupted many sectors of the global economy—PLAT provides diverse sector exposure across real estate, payments, modern media, content production and transportation.

By targeting companies operating large, scalable networks that disrupt the competitive landscape, PLAT offers investors a differentiated way to access growth.

We have high conviction in the potential for platform businesses to outperform and to gain market share at the expense of traditional, linear businesses—while doing so with better economies of scale and potential for long-term profitability.

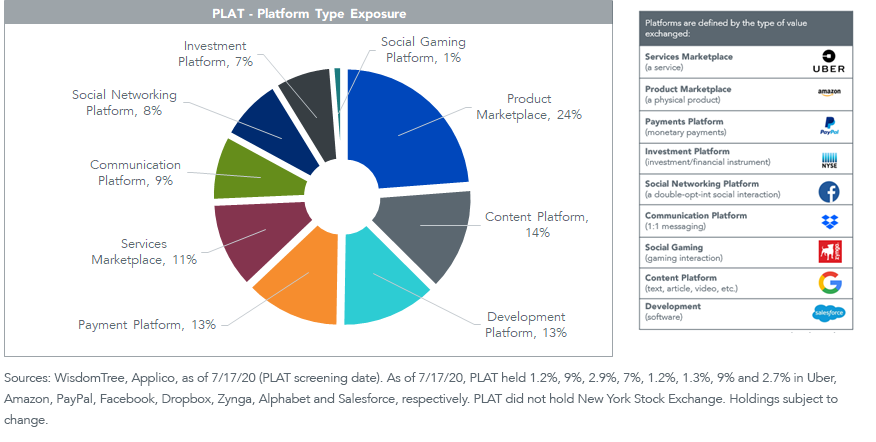

A list of the types of platforms that PLAT includes and representative companies of each type of platform model is below. For more information on PLAT, visit the Fund details page: WisdomTree Growth Leaders Fund.

1The WisdomTree Growth Leaders Fund seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Growth Leaders Index.

2Sources: WisdomTree, FactSet, S&P Global, FTSE Russell, as of 7/17/20 (PLAT screening date).

3Basis point: 1/100th of 1 percent.

4As of 7/17/20 (PLAT screening date), PLAT held 1.2% of its weight in Uber. PLAT did not hold Hertz or Ford.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Diversification does not eliminate the risk of experiencing investment losses.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.