Are You Ready for a Cyclical Reversion?

Things have changed.

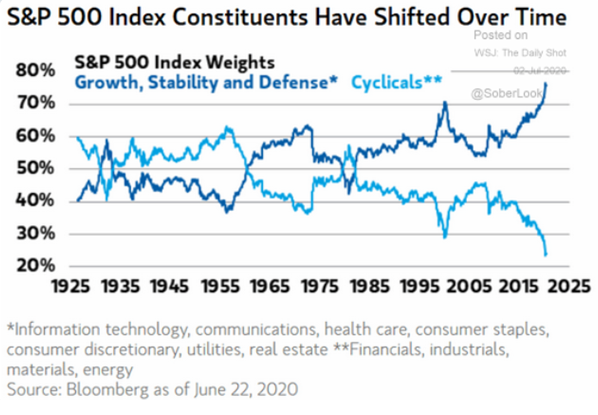

Looking at 100 years of data, the below chart from Morgan Stanley shows that cyclical sectors have never had a lower weight in the S&P 500.

Growth, stability and defense sectors have never had a greater weight—now more than three-quarters of the Index.1

Cyclical sectors are Financials, Industrials, Energy and Materials.

Growth, stability and defense sectors are Tech, Communications, Health Care, the Consumer sectors, Utilities and Real Estate.

So much of market performance can be attributed to this sector classification.

The growth, stability and defense sectors have fared particularly well during the 2020 pandemic. Tech-enabled growth company employees were able to work effectively from home. The counter-cyclicality of defense sectors shined through as people stayed at home, stocked up on staples and streamed movies from the couch.

Cyclicals had their revenue wiped out directly by, or as a close byproduct of, the economic shutdown.

- The airlines and airplane manufacturers within the Industrials sector had their businesses grind to a halt.

- Banks had to provision losses for soured loans.

- Energy companies had to write down asset values from plunging oil prices.

- Materials businesses were impaired by a standstill in construction activity.

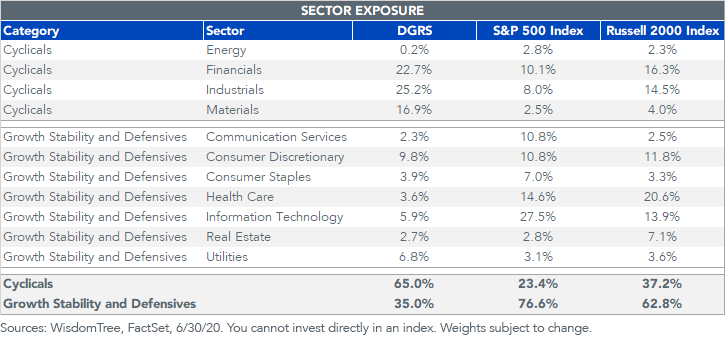

So, a question: If we emerge from the pandemic shutdown with a more cyclical rebound and better economic environment heading into 2021, how can we get cyclical sector exposure when the traditional indexes keep lowering their weight to these sectors?

One idea with sector exposures that’s almost the opposite of the S&P 500 is our U.S. SmallCap Quality Dividend Growth Fund (DGRS).

First, small caps have historically tended to be more cyclical than large caps by their nature. Because they have less diversified businesses, they are often more tied to economic fluctuations.

But, from sector categorization, this cyclicality is ultimately reinforced and accentuated.

Instead of having less than 24% in cyclical sectors, DGRS has 65%, with more than double the Financials sector weight, three times the Industrials sector weight and more than six times the Materials sector weight. Energy is the only sector that didn’t qualify for an over-weight within the cyclical category.

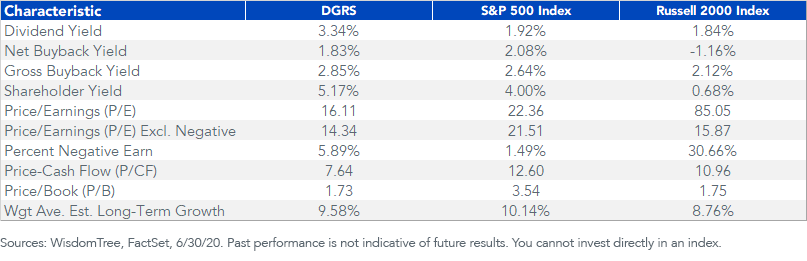

On a pure valuation basis, people often think of small caps as being particularly expensive—more than 30% of the Russell 2000 is currently unprofitable, after all. That’s up from about 20% pre-pandemic.

But as of June 30, only about 6% of DGRS was unprofitable. More companies will become unprofitable as earnings come in. Even including these negative earnings, the trailing 12-month price-to-earnings (P/E) ratio was six multiple points below that of the S&P 500.

People tend to not think of small caps for dividends, because 50% of the Russell 2000 is non-dividend payers. But this basket of lower-multiple small caps does have a considerably higher dividend yield than the S&P 500.

These dividends were also not coming at the expense of buybacks, as the trailing 12-month net buyback yield was similar to that of the S&P 500. For a small-cap basket this is fairly unique as small-cap indices generally tend to issue shares and see negative net buyback ratios.

For standardized performance of DGRS, please click here.

For definitions of terms in the table, please visit our glossary.

We have been hosting weekly conference calls with Professor Jeremy Siegel where he outlines a view for a strong economy in 2021, supported by very robust growth in the M1 money supply measures and all the pandemic relief efforts. Siegel believes that, as we regain confidence to open the economy in 2021, all this liquidity pumped into the system will likely support higher inflation and potentially a cyclical rebound.

The big market cap indexes keep lowering exposure to these sectors, per the chart above. For investors seeking to add exposure to that cyclical growth story, DGRS could be a very good option to reflect this growth rebound.

For advisors who use model portfolios in their practice, DGRS is also the small-cap strategy that WisdomTree includes in model portfolios we created with Professor Siegel.

1The Wall Street Journal’s Daily Shot email series recently featured this chart.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Professor Jeremy Siegel is a Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and WisdomTree Asset Management, Inc. This material contains the current research and opinions of Professor Siegel, which are subject to change and should not be considered or interpreted as a recommendation to participate in any particular trading strategy or deemed to be an offer or sale of any investment product, and it should not be relied on as such. The user of this information assumes the entire risk of any use made of the information provided herein. Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

For Financial Professionals: In the event that you subscribe to receive a WisdomTree Model Portfolio, you will receive investment ideas from WisdomTree in the form of a model portfolio. The information is designed to be utilized by you solely as a resource, along with other potential sources you consider, in providing advisory services to your clients. WisdomTree’s model portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for your clients’ accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a model portfolio or any securities included therein for any of your clients. WisdomTree does not have investment discretion and does not place trade orders for any of your clients’ accounts. Information and other marketing materials provided to you by WisdomTree concerning a model portfolio—including holdings, performance and other characteristics—may not be indicative of your client’s actual experience from investing in one or more of the funds included in the model portfolio. The model portfolios, allocations and data are subject to change.

For End Users: WisdomTree’s model portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s model portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s model portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. The model portfolios, allocations and data are subject to change.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.