Don’t Count Your Dividend Chickens

Investors can normally rely on the stability of dividends. A company cutting its dividend is typically a significant negative signal in U.S. markets, making cuts rare among the largest dividend payers. In times of stress, companies tend to cut share buybacks first, which are viewed by investors as more discretionary, before touching dividend payouts.

But 2020 has been far from normal times.

And within mid- and small-cap companies, the picture for dividend cuts has been more challenged than for large-cap companies. Investors would be remiss to count their dividends before they are paid out.

Who Pays Dividends

This trend of smaller companies more significantly slashing payouts isn’t surprising. During an economic slowdown, smaller companies usually have less credit access to sustain cash flows and thinner profit margins, making them relatively more burdened by a sales slowdown.

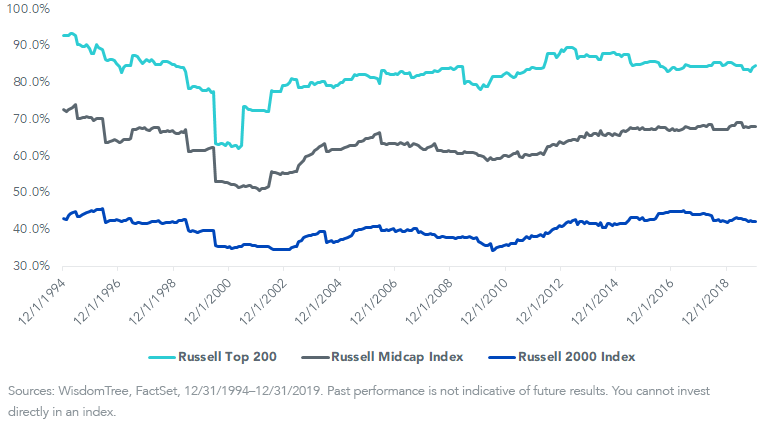

The number of mid- and small-cap dividend payers had been increasing in the years since the financial crisis. The nearly 70% of companies in the Russell Midcap Index that paid dividends was nearly a 20-year high. This means there was a healthy and diverse base of companies paying out dividends before cuts began—particularly for mid-caps.

Percent Index Constituents Dividend-Payers

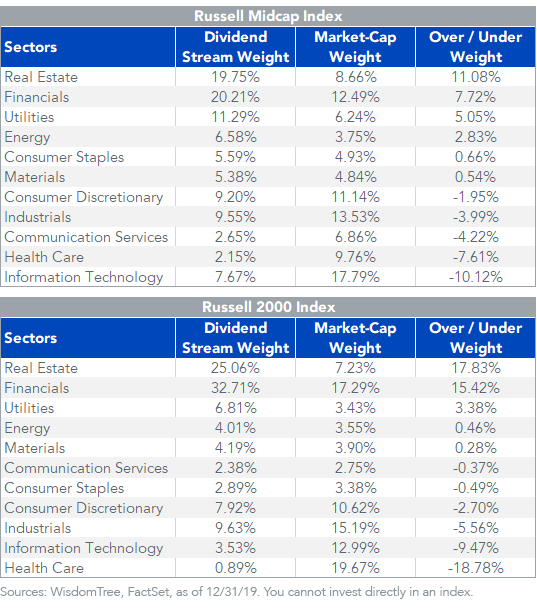

The mid- and small-cap sectors that pay out the most in dividends are Financials and Real Estate, making up a disproportionate amount of the Dividend Stream® weight. In the Russell Top 200, Information Technology is the largest dividend-paying sector but accounts for only about 17% of the weight. This is much smaller than the 33% that comes from Financials alone in the Russell 2000.

In mid- and small caps, few dividends come from the growthiest sectors that have held up the best during the pandemic.

This has hurt strategies that favor the more value-tilted, dividend-paying sectors in mid- and small caps relatively more than similar strategies focused on large caps.

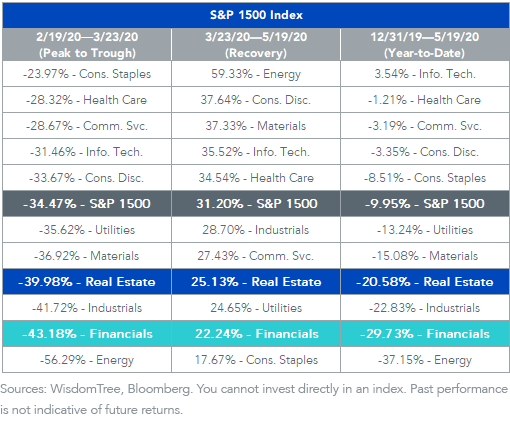

The best-performing sectors in 2020 have been those more resilient to work-from-home trends (Information Technology) and those typically more defensive (Health Care). The worst-performing have been more cyclically oriented value sectors like Energy, Financials and Industrials.

Market Prices Following Dividends

This year’s underperformance of mid- and small caps relative to large caps can in some ways be traced to what is happening to dividends.

Take a quote from a recent note from Morgan Stanley Research:

[i]n an era of sound bites and headlines, it's easy to forget why one really owns stocks –i.e. for the future claims on excess cash flows to be distributed to shareholders. In short, the current price of a stock should reflect the discounted value of future dividends to the equity stakeholder.1

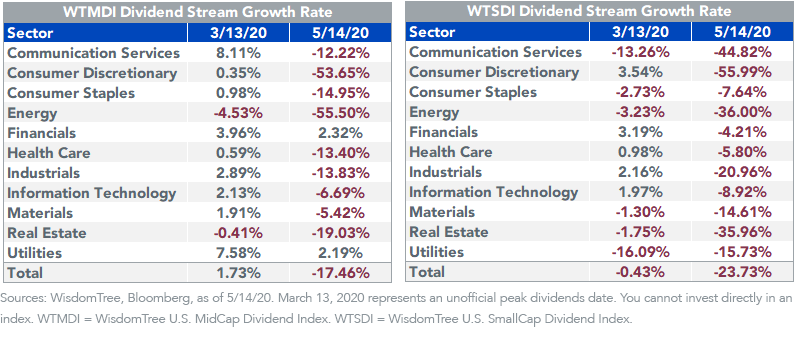

While the WisdomTree U.S. LargeCap Dividend Index has shed under 3% from its indicated Dividend Stream in 2020, the mid- and small-cap dividend indexes have seen cuts of 17%–24%. And while some sectors in the large-cap index have actually seen notable dividend growth—primarily Health Care, Utilities, Materials and Tech—cuts have been widespread across sectors in smaller market caps.

Dividend Stream Growth from November 30, 2019 (Latest Index Rebalance)

With the backdrop of dividends under acute pressure for mid- and small-cap companies, the question then becomes how much of the negative is already baked into market prices.

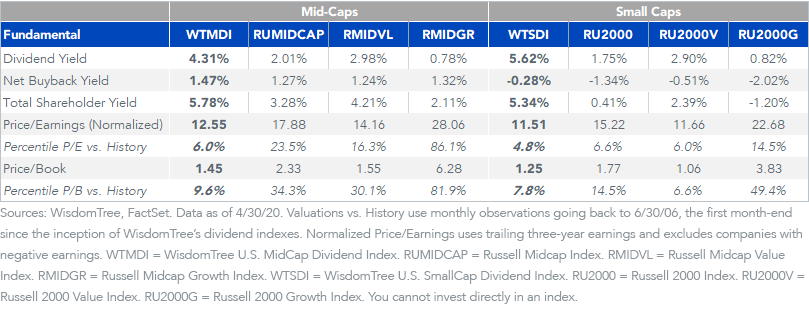

Trailing total shareholder yields of greater than 5% for the WisdomTree U.S. MidCap Dividend Index (WTMDI) and the WisdomTree U.S. SmallCap Dividend Index (WTSDI) are an imperfect reflection on what investors should expect going forward. However, on a relative basis to the broad market cap-weighted, value and growth benchmarks, they offer significant yield premiums.

On a normalized price-to-earnings basis, the mid- and small-cap dividend indexes are at the sixth and fifth percentiles relative to their histories. This compares to the S&P 500 Index, which is trading at a 21x normalized P/E ratio—this is the 78th percentile over the same period.

Small Value Premium via Dividend Weighting

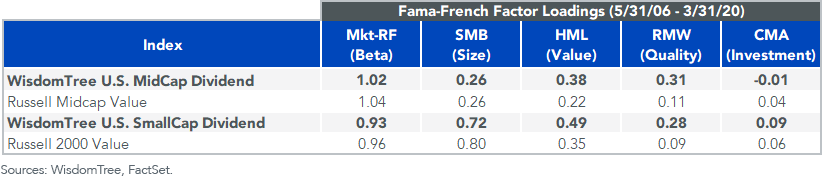

WisdomTree’s dividend-weighted mid- and small-cap indexes have high loadings to the size and value premiums. This is mainly driven by under-weights to the Information Technology and Health Care companies that pay very little dividends and over-weights to Financials.

Relative to the Russell value benchmarks, these indexes have higher loadings to the quality—or profitability—factor. By giving greater weight to companies that pay higher cash dividends, the dividend indexes have an indirect tilt to companies with higher earnings that have a greater ability to pay out more in dividends.

For definitions of terms in the table, please visit our glossary.

Preparing for the Reopening

Historically, small value tends to outperform large cap during recoveries—the opposite of what works best during the recession phase. But investors may rightly question being “too early to the party” on a recovery trade.

For strategic asset allocators, a combination of more richly valued, high-quality large-cap stocks may pair well with smaller cap stocks with some of the most depressed valuations in their history. While timing when the payoff will come for small-cap value will be difficult, history suggests the rewards could be significant.

1Morgan Stanley Research, “Weekly Warm Up: A Pause to Refresh; Dividends Matter,” 5/4/20.