ETF Creation/Redemption Process: Behind the Scenes

Exchange-traded funds (ETFs) can offer an attractive and efficient way for investors to gain access to all aspects of the marketplace and have greatly leveled the investment landscape in terms of availability to all asset classes and regions. As ETFs continue to grow in assets and scope of coverage, we are often asked these questions: What is an ETF creation or redemption? How does that work? What function does that provide, and does an investor make that decision? Let’s go behind the scenes of the life of a trade and discuss what the creation/redemption process is and how it fits into the trade life cycle.

How Does the ETF Creation/Redemption Process Work?

The creation/redemption mechanism allows for the increase or decrease of ETF shares based on demand without impacting other investors of the fund. This is an important contrast to a mutual fund where any buying or selling in the fund impacts all investors. If there is increasing demand for a specific ETF, new shares can be created to meet that demand in exchange for underlying assets, and if demand decreases, shares can be reduced by exchanging shares for assets. This flexible process is done solely by what is called an authorized participant, or AP. What is key to highlight is that the investor never makes the decision to create or redeem; that is simply a back-office function that is determined by the broker.

Illustrating the Life Cycle of a Trade

To illustrate how this process works, let’s follow the life cycle of a trade. In this example, John Doe at Smith Capital wants to purchase 500,000 shares of a new ETF. Since the fund is new, the on-screen volume is minimal, but John knows that the ETF structure allows him to purchase shares of the ETF with efficient pricing because of the creation/redemption functionality.

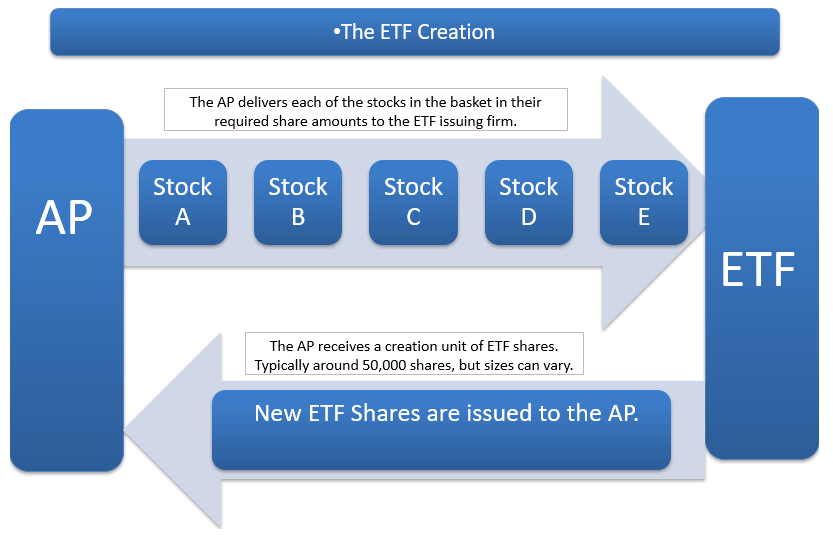

ETF Creation Process

- John goes to his broker and gives him the order to buy 500,000 shares of an ETF.

- The broker sells the ETF shares to John at a specific price. As mentioned before, the process of buying the ETF is seamless for John the investor, and his work is done.

- Behind the scenes on the back end, the broker has determined that, due to the increased demand by John, he as an authorized participant must create new ETF shares. He is now short the ETF shares since he sold them to John.

- The broker then buys the basket of securities held by the ETF to hedge himself and is now long the basket and short the ETF.

- The broker then delivers the basket of securities to the ETF issuer, initiating a creation.

- The broker receives new ETF shares from the issuer in return and flattens out his short ETF position.

As you can see, John has nothing to do with the creation process, but the mechanism allows him to purchase a large number of ETF shares to meet his demand. This process works in reverse in terms of a redemption.

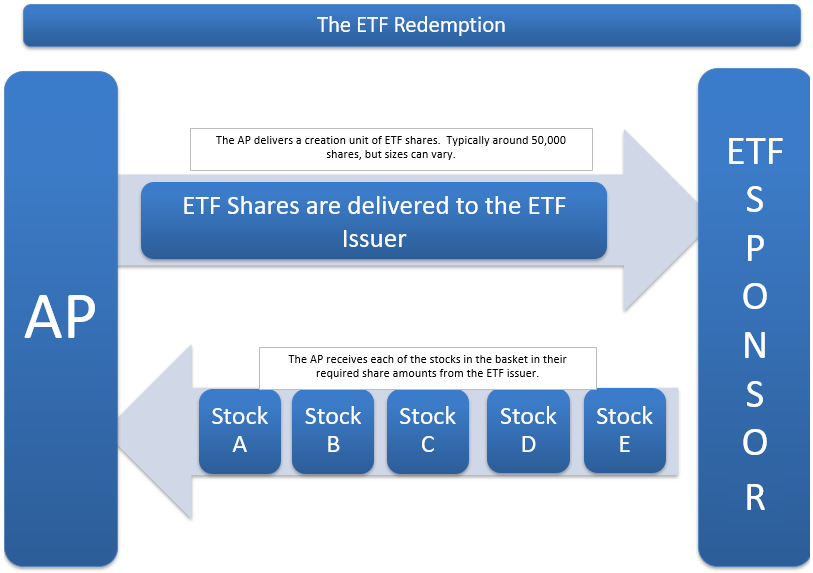

ETF Redemption Process

- John goes to his broker and gives him the order to sell 500,000 shares of the ETF.

- The broker buys the ETF shares from John at an agreed-upon price.

- The broker determines if a redemption is necessary due to the decrease in demand and is now long the ETF since John sold the shares back to him.

- The broker then sells the basket of securities held by the ETF to hedge his position and is now short the basket, long the ETF.

- The broker delivers the ETF shares to the ETF issuer, initiating a redemption.

- The broker receives the basket of securities from the issuer and flattens out the short basket position.

Again, John had nothing to do with the redemption process; it was a simple back-office procedure that allowed the ETF shares to fluctuate with the demand for the ETF. What is important to remember is that the creation/redemption function is a behind-the-scenes tool, and it is determined by the broker to match demand, not by the investor.

The creation/redemption mechanism has numerous benefits that can foster the efficiency of the ETF structure. We believe it is the flexibility and transparency of the ETF that can encourage multitudes of market makers to support the product. All these factors allow for ETFs to trade as close to fair value, or the fund’s NAV, as risks and costs allow. Additionally, the creation/redemption process allows for tax efficiency, especially compared to mutual funds. Finally, the creation/redemption functionality allows an ETF to expand or contract with fluctuating client demand. The creation/redemption process can be extremely advantageous, but it is vital to remember that this is a back-office function performed by the market makers to help benefit investors.