Avoiding the Junkyard

There’s nothing like a Friday downgrade surprise from the ratings agencies. But what if there was a fixed income strategy that could potentially neutralize such news events while also avoiding the junkyard?

Let’s take a look at the most recent case study: Joining a ratings action by Fitch on February 14, S&P also moved to downgrade Kraft Heinz Company’s (KHC) long-term debt to high yield (HY), or junk status. With two out of three major rating agencies now in HY, KHC became the latest “big-name” credit issuer to gain attention for losing its investment grade (IG) status.

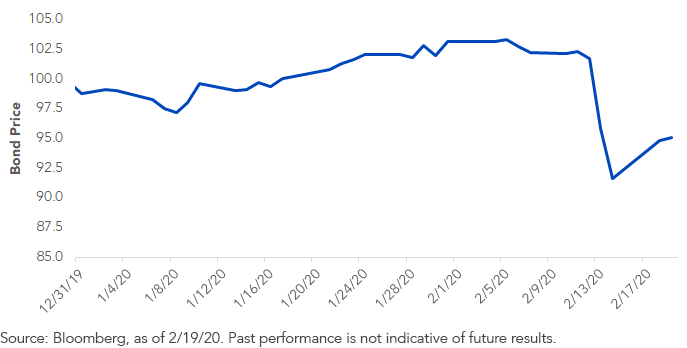

Needless to say, prices on Kraft’s bonds sold off materially, in some cases more than 10%. Consider the price of the Kraft Heinz largest corporate bond (4 3/8% due 6/1/46), with an amount outstanding of $3 billion. After disappointing earnings and the downgrades by S&P and Fitch, the bonds fell from $101.75 on Wednesday, February 12, to $91.58 by end of day on Friday, February 14, a drop of 10.2 cents on the dollar. By Wednesday, February 19, the bonds have recovered by 3.47 cents on the dollar but still are significantly depressed.

Large KHC Bond Price (12/31/19–2/19/20)

KHC 4 3/8 6/1/46

In addition to prices falling because of investors reassessing the riskiness of Kraft’s bonds, dropping from IG to non-IG status presents technical headwinds. There are many investment mandates that restrict a fixed income portfolio to only investment-grade securities, and after a downgrade to HY, there may be forced sales that drive prices down further.

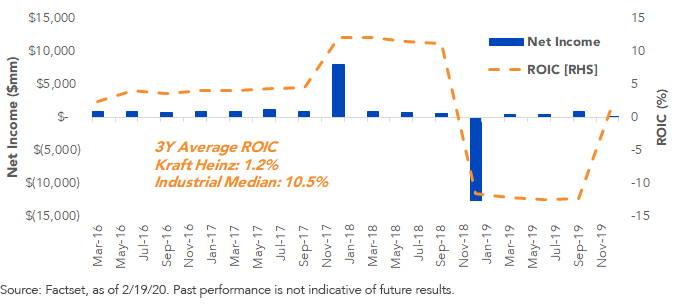

WisdomTree believes that there are trends in corporate bond fundamentals that can be used to systematically identify problematic credits. Our WisdomTree Corporate Bond Indexes use three metrics to screen out bonds: return on invested capital (ROIC), total debt to total assets, and free cash flow to debt service. All three metrics screened poorly for Kraft Heinz, and the corporate bond for Kraft was subsequently excluded from the WisdomTree Corporate Bond Indexes.

One metric that stood out was ROIC, which deteriorated significantly over the past two years. The large drop in ROIC in Q4 2018 was due to a fall in net income, an input into the ROIC ratio. Kraft Heinz had a $16 billion goodwill and intangibles write-off. This one-time write-off occurred because management believed they were overvaluing their brands.

Kraft Heinz Quarterly Net Income and Return on Invested Capital

Conclusion

The bottom line is that this screening process enabled us to avoid having KHC in both of our strategies, the WisdomTree U.S. Short-Term Corporate Bond Fund (SFIG) and the WisdomTree U.S. Corporate Bond Fund (WFIG). That’s what we call avoiding the junkyard…

Unless otherwise stated, all data sourced is Factset as of February 19, 2020.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Funds attempt to limit credit and counterparty exposure, the value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Funds’ portfolio investments. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.