This Is How We Did It

Financial markets experienced one of their best years in recent history in 2019. All major asset classes had positive returns and in most cases exceeded their trailing 15-year average1.

Investors might assume that investing in the “market” would’ve been the best way to reap the benefits of such an environment.

But WisdomTree, through its systematic approach of seeking higher risk-adjusted returns by deviating from traditional market cap weighting, was able to exploit certain investment factors (or themes) that outperformed in 2019.

How did we do it? Below are some of the key themes we implement in our strategies that resulted in outperformance.

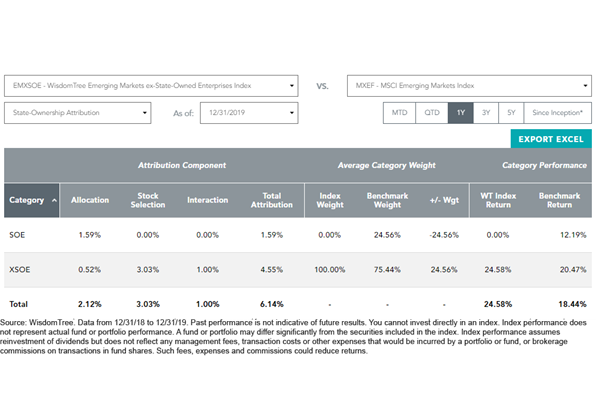

1. Removing State-Owned Enterprises (SOEs) in Emerging Markets (EM)

The WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) had a whopping 576 basis points (bps) at NAV outperformance versus the MSCI Emerging Markets Index. For standardized performance of XSOE, please click here.

XSOE identifies and removes from its universe EM companies that can be subject to management conflicts of interest as a result of the local government having an ownership stake in excess of 20% (SOEs).

By removing these companies and reweighting those remaining using a modified market cap, XSOE accesses regional growth and governance being over-weight in the Consumer Discretionary and Information Technology sectors and under-weight in the Financials and Energy sectors.

XSOE’s methodology is the main driver of its outperformance, since last year non-SOE companies within MSCI EM Index outperformed the overall index by 200 bps2 while SOEs lagged by more than 600 bps. Staying away from state-owned enterprises has proven to lead to excess return since the Fund’s inception more than five years ago.

XSOE seeks to track the price and yield performance before fees and expenses of WisdomTree Emerging Markets ex-State-Owned Enterprises Index, shown below

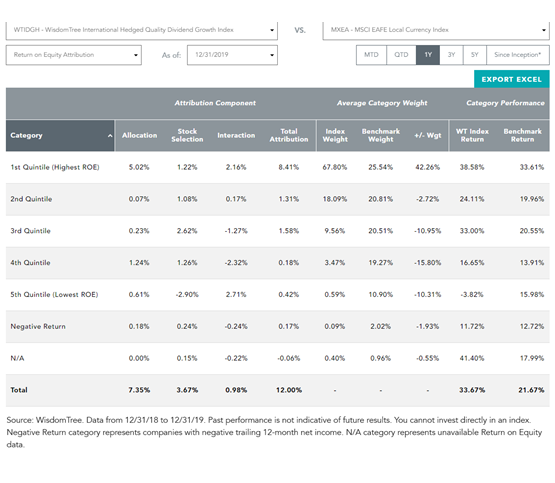

2. Over-weighting Profitability (Quality)

The WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) outperformed its benchmark, the MSCI EAFE Local Index, by 11.05% at NAV last year. For standardized performance of IHDG, please click here. IHDG seeks to invest in developed international companies that have strong profitability metrics and foreseeable growth—quality companies.

Using return on equity (ROE) as a proxy for quality, the highest quintile of quality companies in the international developed market3 last year outperformed the MSCI EAFE Index by 12 percentage points in local currency terms. Those with lowest quality underperformed by 5%.

IHDG’s significant over- and under-weights in these categories (in reference to the highest quintile in the table below), along with its currency hedge, has allowed it to generate significant excess returns.

IHDG seeks to track the price and yield performance, before fees and expenses of the WisdomTree International Hedged Quality Dividend Growth Index, shown below.

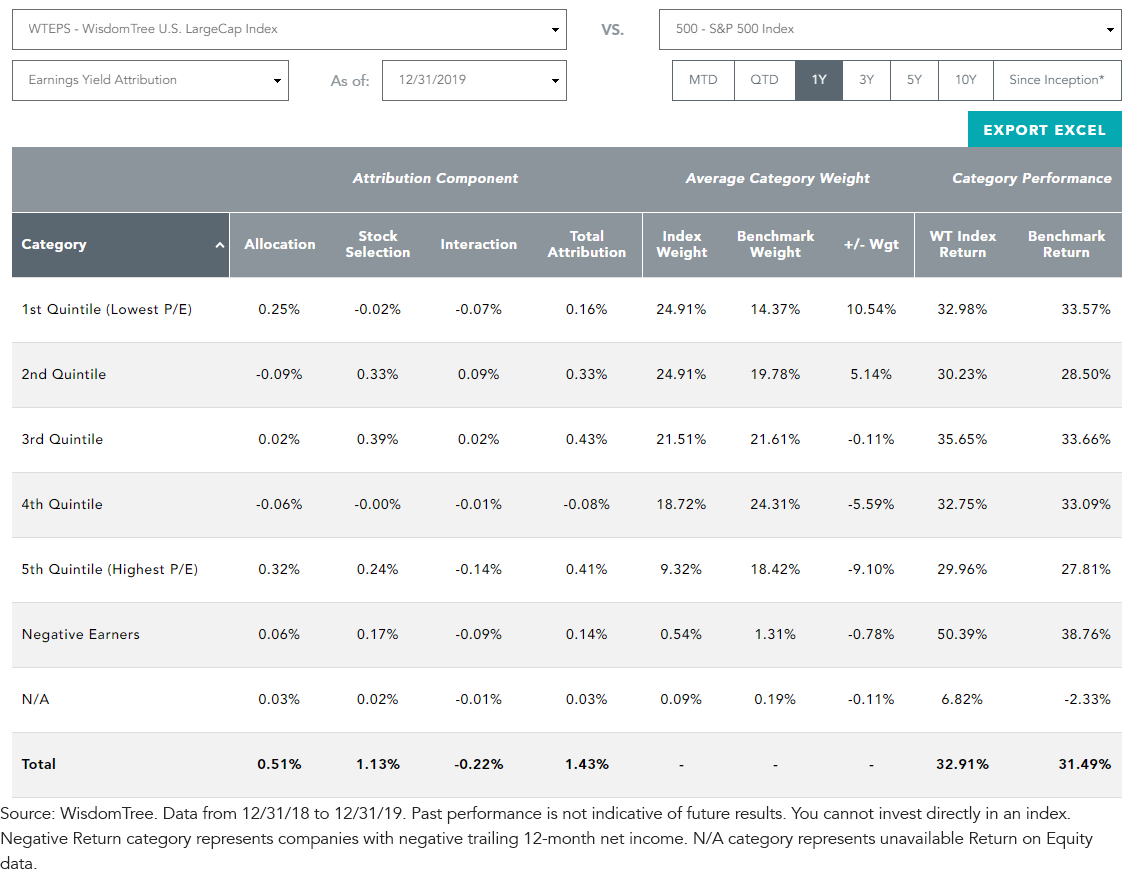

3. Controlling Valuation

The WisdomTree U.S. LargeCap Fund (EPS), which weights the 500 largest profitable companies in the U.S. market by the proportion of their earnings, outperformed the S&P 500 Index by 1.12% at NAV in 2019.

EPS’s methodology results in a lower aggregate valuation price-to-earnings (P/E). For standardized performance of EPS, please click here.

In 2019, the most expensive companies (shown in the first quintile of the table below) in the S&P 500 underperformed the overall index by close to 500 bps, while the cheapest companies outperformed by 200 bps. EPS’s under- and over-weights in these respective categories translated to excess returns.

EPS seeks to tracks the price and yield performance before fees and expenses of WisdomTree U.S. LargeCap Index, shown below.

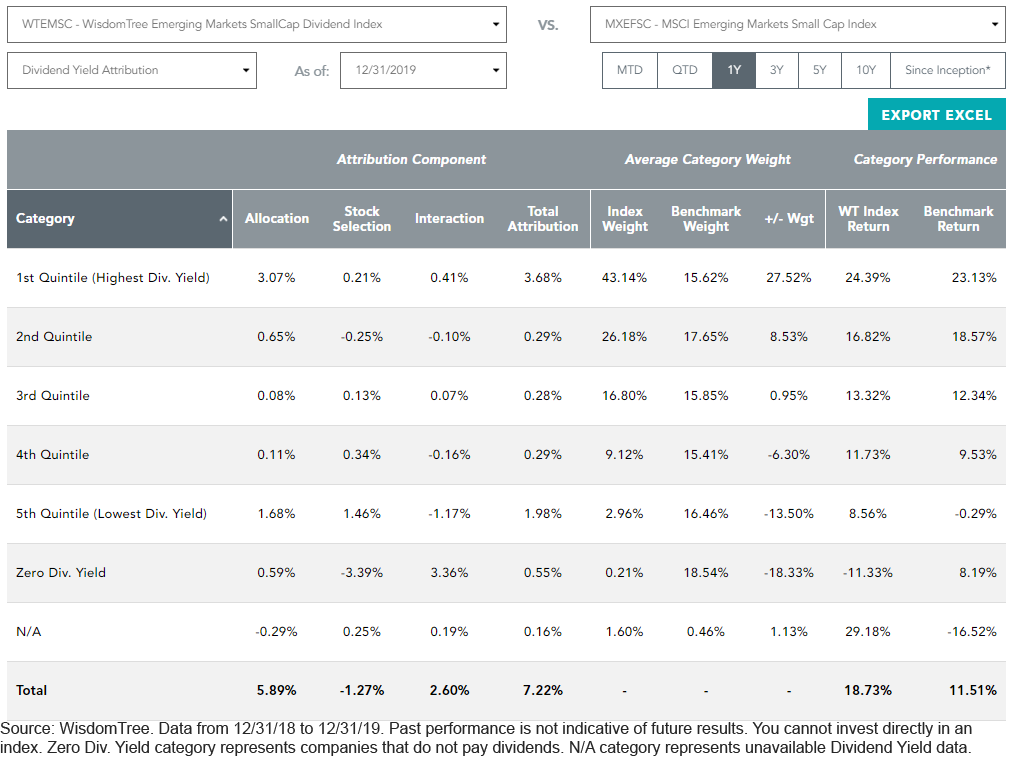

4. Weighting by Dividends

WisdomTree pioneered fundamentally weighted funds in emerging markets.

The WisdomTree Emerging Markets SmallCap Dividend Fund (DGS), launched in 2007, weights all small-cap dividend payers by the proportion of their U.S. dollar dividend payments. This results in DGS being over-weight in the highest dividend yield quintile in the EM small-cap space, while under-weighting the lowest dividend quintile along with non-dividend payers.

In 2019, the highest-yield quintile of DGS outperformed the broad MSCI Emerging Market Small Cap Index by 11.5% at NAV while the lowest dividend yield and non-dividend paying group lagged by 11% and 3.5%, respectively. This was the main driver to DGS beating its benchmark by 7.41% over the year.

DGS seeks to track the price and yield performance before fees and expenses of the WisdomTree Emerging Markets SmallCap Dividend Index, shown below. For standardized performance of DGS, please click here.

What Lagged? Small Value

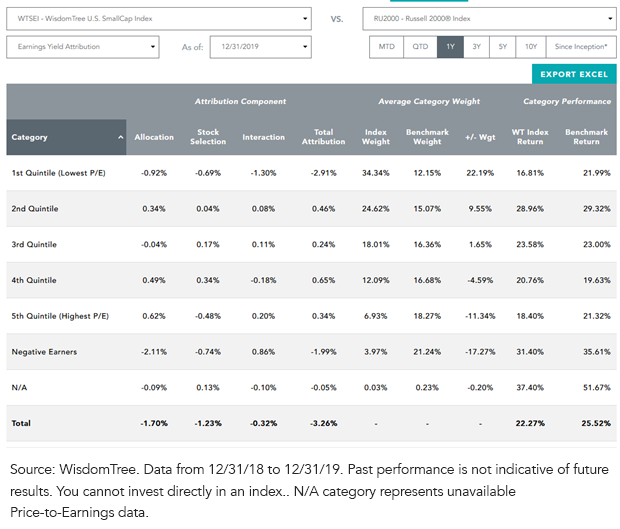

WisdomTree’s fundamental-weighting approach to U.S. small caps faced a more challenging environment.

Companies with negative earnings—which do not get included in the earnings-weighted WTSDI—outperformed the broader Russell 2000 Index by over 1,000 bps. The lowest P/E quintile, on the other hand, lagged by about 250 bps. For EES standardized performance please click here.

During a year when small-cap profit growth was negative, investors seemed to be reaching for growth out of unprofitable biotech and tech companies.

With a potential reacceleration in economic growth in 2020, a rotation into small value has become a popular theme across sell-side research4 in year-ahead forecasts.

EES seeks to track the price and yield performance before fees and expenses of the WisdomTree U.S. SmallCap Index , shown below.

Conclusion

What works one year can sometimes be a good harbinger of the year to come—or not.

The whole 2010s seemed in favor of high P/E ratio growth companies. By the end of 2019, there seemed to be a modest shift away from high-P/E large caps, perhaps a sign of a shift toward value.

Small-cap growth continued on a tear last year. For bargain hunters, we believe 2020 may offer a good entry point for small-cap value stocks.

Internationally, companies with higher profitability could continue demonstrating solid performance as European and Far East markets look to sustained growth. While in EM, we believe non-state-owned Enterprises will continue outperforming the broad market, taking advantage of their solid governance and growth.

Unless otherwise stated, all data is from WisdomTree and FactSet as of December 31, 2019.

1Bloomberg, as of January, 24 2020

2This refers to the category of state-owned companies within XSOE.

3The universe is: Companies incorporated in Japan, the 15 European countries, Australia, Israel, New Zealand, Hong Kong and Singapore.

4Research published by brokerage firms.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. The Funds invest in the securities included in, or representative of, their respective Index regardless of their investment merit, and each Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. The Funds invest in the securities included in, or representative of, their Index regardless of their investment merit, and each Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of DGS, this Fund it may make higher capital gain distributions than other ETFs.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.