How to Combat Market Uncertainty while Maintaining Your Equity Exposure

2019 proved to be a year full of surprises. Despite the threat of a trade war and an increasingly gloomy economic outlook, equity market gains combined with falling interest rates made 2019 one of the best years for investment returns. Unfortunately, going forward, investors are likely to see a lower return environment, on average, for both equities and fixed income.

These challenges create headwinds when it comes to achieving investor goals with traditional portfolio approaches. A simple 60% stock/40% bond portfolio1 might not be the most appropriate vehicle in such a challenging market environment.

The WisdomTree 90/60 U.S. Balanced Fund (NTSX) was designed to help investors create more optimal portfolio blends and magnify portfolio exposures through the prudent use of leverage. While NTSX does not borrow to gain additional exposure, it does use futures contracts to enhance the capital efficiency of the Fund. As we show in the chart below, NTSX has been quite effective over its short life span in generating excess returns versus a 60/40 portfolio.

NTSX vs. 60% Stocks/40% Bonds

For standardized performance of NTSX, please click here.

The Design of NTSX

The NTSX portfolio is constructed with three components: equity, cash and bond futures. For every $100 invested in NTSX, $90 of it is invested in equity, creating a portfolio of 500 large-cap U.S. stocks weighted by market capitalization to provide broad exposure to U.S. equities. The remaining $10 is kept in short-term collateral and earns returns comparable to U.S. Treasury bills. To help magnify the benefits of the asset allocation, $60 worth of bond futures is overlaid on top of the $90 worth of equity exposure and $10 of cash collateral. These treasury futures are laddered (equal-weighted) across the 2-, 5-, 10- and 30-year segments of the yield curve to diversify interest rate risk. The average effective duration for the fixed income portion of NTSX will typically be 7 to 7.5 years and generally is meant to offer the duration profile of traditional aggregate bond indexes.2 The combined exposure of NTSX can, in our view, be employed as a way to add more fixed income diversification to a straight equity portfolio.

NTSX’s Tax-Efficiency

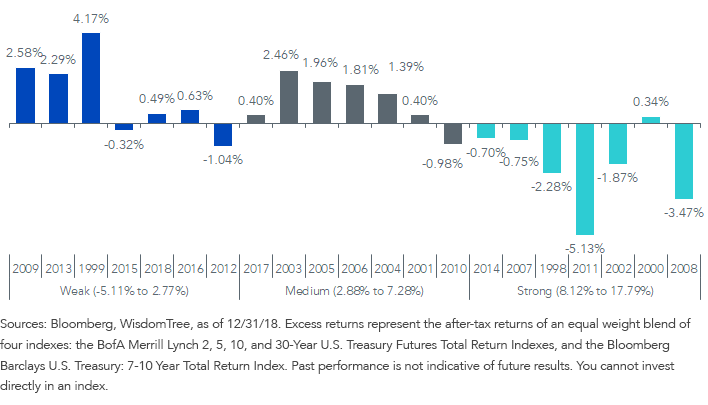

For U.S. investors, fixed income total returns are primarily driven by interest income. If cash bonds are held in taxable accounts, any income distributions are typically subject to ordinary income tax rates of up to 39.6%. By comparison, capital gains on Treasury futures contracts are taxed at 60% long-term, 40% short-term capital gains rates.

During periods of weak fixed income performance (typically associated with rising interest rates), an investor who has direct exposure to bonds may experience unrealized principal losses due to decreases in the bond’s price. However, they will still need to pay ordinary income taxes on the coupon payments during this time. On the other hand, had that investor gained fixed income exposure via bond futures, they would not be subject to taxes if their position declined in value. Additionally, any losses could be carried forward3 to offset any future gains.

During periods of medium bond performance (flat rates), an investor who has direct exposure to bonds could experience no change to the price of the bonds they hold, but still pay ordinary income tax on the coupon payments. An investor with exposure to bond futures will see the price of the futures contract increase in order to compensate them for their interest income (futures contracts do not make coupon payments). These gains would be taxed at 60% long-term, 40% short-term capital gains rates.

In periods of strong bond performance (falling rates), direct exposure to bonds would tend to be more tax-efficient than exposure via bond futures. In this scenario, investors with direct bond exposure will still be paying ordinary income tax on distributions but will not have to pay taxes on the appreciation of the bond’s price until the bond is sold. For investors with exposure via bond futures, the prices of their positions will increase due to an increase in bond prices and compensation for interest income. These gains would be subject to 60% long-term, 40% short-term capital gains rates.

U.S. Treasury Futures (After tax) Excess Returns Over 7-10 Year Cash Bonds (After tax)

During Different Rate Environments

Conclusion

As we progress into a period of more market uncertainty, investors who seek to reduce risks in their portfolios can use NTSX to help manage those risks. NTSX can serve as an appropriate vehicle to introduce treasuries and alternatives to portfolios, allowing investors to diversify their investments to tone down the uncertainties that the market may bring in 2020.

1As measured by the S&P 500 Index (60% stocks) and the Bloomberg Barclays U.S. Aggregate Index (40% bonds), as of 11/30/19.

2Such as the Bloomberg Barclays U.S. Aggregate Bond Index.

3Carry forward: Refers to the situation when investment loss can be used to offset a capital gains liability.Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided in this article are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.