Positioning for a Rebound in Developed International Equities

Over the past few years, many investors have avoided developed international equity markets. Anemic growth, disappointing economic data and geopolitical uncertainty blunted sentiment for most of the decade. Add Brexit, trade tensions with the U.S. and an investable universe that’s structurally underweight the best-performing sector of most benchmarks (technology), and you see why some investors have been skeptical.

Reasons for Optimism

We’ve recently noticed a reversal in sentiment toward developed equity markets, and attribute it to a few developments:

- Recent inflows into developed international ETFs, after dismal outflows to begin the year, suggest investors are starting to close underweights.

- Economic data may be showing signs of bottoming. Recent upticks in industrial production in Europe signal the outlook could be stabilizing.

- Confidence in the new leadership at the European Central Bank (ECB). President Christine Lagarde, who began her term last month, is a new personality in Brussels and is characterized as a pragmatic negotiator rather than a conventional technocrat.

One of our preferred ways to invest in developed international markets is the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG).

Performance that Speaks for Itself

While performance in most developed markets has lagged that of the U.S., the performance record for IHDG stands out.

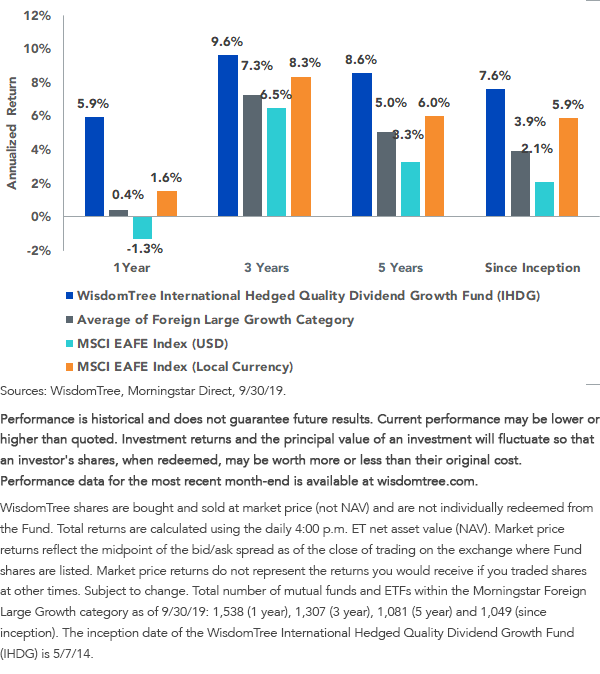

Over the past 1-, 3-, 5-year and since-inception periods, the Fund has comfortably outpaced the average return of funds in its Morningstar peer group, the Foreign Large Growth category.

It has also outperformed the return of the MSCI EAFE Index in both local currency and USD terms. To our mind, this highlights the benefits of our stock selection process as well as the impact that a currency-neutral approach can have on total returns in international investing.

Figure 1: Annualized Return of Peer Group and MSCI EAFE Index

For standardized performance of IHDG, please click here.

While IHDG has generated excess returns, it has also been remarkable for the consistency of its outperformance. Over the 1-year and 3-year periods, it was consistently a top performer and was in the top 1% of all funds in its category over the 5-year and since-inception timeframes.

Figure 2: Percentile Ranks versus Morningstar Foreign Large Growth Category

Looking Under the Hood

Launched in 2014, the Fund combines two features that we have written about extensively: the quality factor and currency-hedging.

In our view, quality is especially important in today’s market environment. IHDG’s emphasis on quality is derived from return-on-equity and return-on-asset screens, which can add defensive characteristics to a portfolio. It also helps allocate to companies with the potential to grow their dividend payments, which requires both financial health and effective use of retained income. The focus on quality has tended to tilt the Fund’s portfolio away from the financial sector, historically one of the largest weights in the MSCI EAFE Index, which has underperformed significantly since the global financial crisis.

Additionally, over the last five years, the most important “factor” for international returns was whether or not you were betting on the dollar to weaken.

You can see this clearly in the bar chart above figure 1, as the average Foreign Large Cap Growth manager outperformed the broad MSCI EAFE Index in U.S. dollars by 1.7%, but these same managers still trailed the broad MSCI EAFE Index measured in local currency. Clearly, picking the right factor didn’t overcome the active manager decision to adopt currency risk.

Isn’t it ironic? The active stock manager says they are good stock pickers, not currency experts. We ask them then, why do they like to bet that the dollar will decline forever as they do in unhedged strategies. Why not focus on their core competency and just pick good stocks, while hedging their bet on the direction of the dollar?

WisdomTree believes the incremental currency risk is not worth the reward unless you have conviction that foreign currencies are set to appreciate.

The Path Forward

For the first time in a while, developed equity market sentiment is rebounding.

We maintain that a quality stock selection process coupled with a currency-neutral approach should be important parts of equity allocations.

Fortunately, IHDG provides both and has the potential to reward accordingly.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.