The Barbell Solution: Q4 Update

The volatility in Treasury (UST) yields since Labor Day is a real-time example of what investors have been faced with recently regarding the direction of interest rates. While 2019 thus far has been, generally, a year of falling rates as compared to the 2018 experience, going forward, the path seems less certain for a host of reasons, including trade uncertainty, global growth concerns, Federal Reserve (Fed) policy and thus far the lack of a recession. Against this investment backdrop, we continue to advocate for investors to consider the barbell approach when looking for fixed income solutions for 2020 and beyond.

So, what exactly do I mean by volatility in Treasury yields? In last week’s blog post “As the World Turns,” I highlighted how the UST 10-Year yield has seesawed by 40 basis points (bps) on two different occasions within the last two months or so. Since then, a mini-rally has taken place, dropping the rate back down another 10 to 15 bps from its most recent high of 1.94% just a week or so ago.

In addition, based on Fed Chairman Powell’s congressional testimonies last week, it certainly appears as if the mid-cycle adjustment rate cuts have come to an end. While further rate cuts seem to be off the table for now, the bar to reverse course and raise rates has also been elevated. However, as we’ve seen just within the last year, a Powell-led Fed can change its collective mind at any point depending on the data.

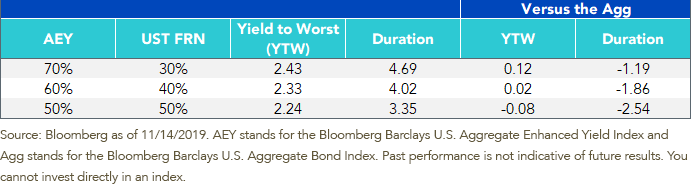

For definitions of terms in the chart, please visit our glossary.

A question an investor may want to ask is, “Why try to predict where rates are going to go in such an environment?” That’s where the barbell solution comes into play, allowing investors the means to toggle weights between short and intermediate or longer durations to suit their investment needs while not playing the role of rate forecaster. As the reader may recall, we use Yield Enhanced (AEY) and U.S. Treasury floating rate (UST FRN) strategies, and compare the results to the widely followed benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index (Agg). As we get ready for Thanksgiving next week (can you believe it’s that close?), our Q4 barbell update above highlights three potential scenarios to consider (see accompanying table). In each instance, investors may attain an “Agg-like” yield while potentially reducing duration anywhere from 1 to 2½ years.

Conclusion

The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY), which seeks to track the the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index, and the WisdomTree Floating Rate Treasury Fund (USFR), which seeks to track the Bloomberg U.S. Treasury Floating Rate Bond Index (UST FRN), can be used as the two “weights” discussed here. The barbell strategy laid out in this blog post offers investors a core-strategic solution that is designed to help fixed income investors navigate the waters that loom ahead without making a high-conviction bet on where rates are headed in this seemingly ever-changing interest rate landscape.

Unless otherwise stated, data source is Bloomberg, as of November 14, 2019.Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. The value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Funds’ portfolio investments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for a discussion of risks.