Real Estate Is Having a Moment

For definitions of terms and Indexes in the chart, visit our glossary.

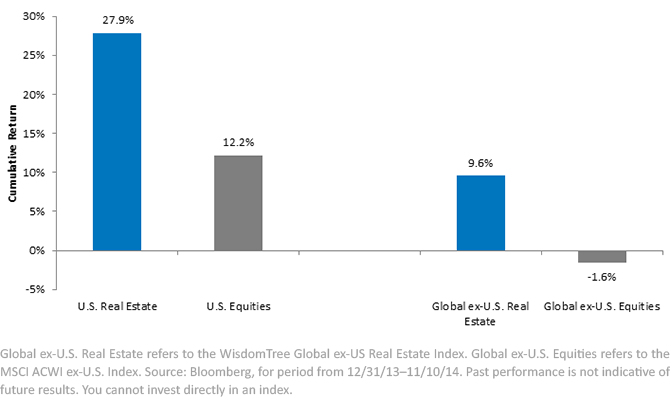

• Global ex-U.S. Real Estate Outperforms Global ex-U.S. Equities: Just as we observed in the U.S., real estate also outperformed broad equity markets in the global ex-U.S. space.

- Australia, Hong Kong and Singapore exposures within Global ex-U.S. Real Estate are notable. Each averaged a double-digit weight for the year-to-date period, and each delivered strongly positive performance.

- Negative performance at the country level over this period was limited for Global ex-U.S. Real Estate—the only markets that were negative with exposures greater than 1.0% were Japan, China and Brazil. In the case of Brazil and Japan, significant portions of those returns were currency-driven.

So, Is Real Estate Still Attractive?

Both within and outside of the U.S., real estate outperformed broader markets. However, behind Global ex-U.S. Real Estate is an important rebalancing methodology that brings constituent weights back toward a measure of relative value—something that is especially important after periods of strong performance. This occurs once per year and is based on a screening run on September 30.

U.S. Real Estate does not rebalance back toward a measure of relative value.

• Valuation Impacts of Rebalance: The rebalancing mechanism within Global ex-U.S. Real Estate focuses on dividends, so it isn’t surprising if the dividend yield of the Index increases—a fact that we observed this year, going from 4.3% to 4.5%. The price-to-earnings (P/E) ratio is not directly focused upon as part of the rebalance, but it did drop slightly, from 10.4x to 10.3x. Since it’s true that a P/E ratio may not be the best valuation ratio to use for real estate, we also note that the price-to-book ratio was unchanged, holding steady at 0.95x.2

• Important Country Impact of Rebalance: Generally speaking, the country exposures of Global ex-U.S. Real Estate did not shift to a great degree, but one shift in particular is worth noting. The rebalancing process ended up adding 1.6% to Japan. During 2014 leading up to September 30, real estate within Japan was a poor performer, so it makes sense that weight was added to an underperforming market. However, as of an October 31, 2014, announcement, we also know that the Bank of Japan has tripled its annual purchases of Japanese real estate investment trusts (REIT)s, pursuant to its quantitative and qualitative monetary easing policy.3 It’s possible that this could be a catalyst for better performance out of Japanese real estate, but only time will tell for sure.

• U.S. Real Estate vs. Global ex-U.S. Real Estate: The other part of the discussion is clearly the comparison between U.S. and non-U.S. real estate. Intuition tells us that, since U.S. Real Estate performed approximately three times as strongly, it is likely more expensive, but the critical question is, how much more? As of the September 30, 2014, index screening:4

- U.S. Real Estate had a dividend yield of 3.63%, nearly 1.0% below that of Global ex-U.S. Real Estate.

- U.S. Real Estate had a price-to-book ratio of 2.3x—more than twice that of Global ex-U.S. Real Estate.

The bottom line: While there is no way to be certain of future performance, we think that it could be beneficial to consider diversifying exposures to U.S. Real Estate—which has performed well—with Global ex-U.S. Real Estate.

1Source: Bloomberg, 12/31/13–11/10/14. Refers to performance of the S&P 500 Index for U.S., MSCI Emerging Markets Index for emerging markets and MSCI EAFE Index for developed international.

2Sources for bullet: Bloomberg, Standard & Poor’s, with data measured as of 9/30/14 index screening.

3Source: “Expansion of the Quantitative and Qualitative Monetary Easing,” Bank of Japan, 10/31/14.

4Source for sub-bullets: Bloomberg, as of 9/30/14.

For definitions of terms and Indexes in the chart, visit our glossary.

• Global ex-U.S. Real Estate Outperforms Global ex-U.S. Equities: Just as we observed in the U.S., real estate also outperformed broad equity markets in the global ex-U.S. space.

- Australia, Hong Kong and Singapore exposures within Global ex-U.S. Real Estate are notable. Each averaged a double-digit weight for the year-to-date period, and each delivered strongly positive performance.

- Negative performance at the country level over this period was limited for Global ex-U.S. Real Estate—the only markets that were negative with exposures greater than 1.0% were Japan, China and Brazil. In the case of Brazil and Japan, significant portions of those returns were currency-driven.

So, Is Real Estate Still Attractive?

Both within and outside of the U.S., real estate outperformed broader markets. However, behind Global ex-U.S. Real Estate is an important rebalancing methodology that brings constituent weights back toward a measure of relative value—something that is especially important after periods of strong performance. This occurs once per year and is based on a screening run on September 30.

U.S. Real Estate does not rebalance back toward a measure of relative value.

• Valuation Impacts of Rebalance: The rebalancing mechanism within Global ex-U.S. Real Estate focuses on dividends, so it isn’t surprising if the dividend yield of the Index increases—a fact that we observed this year, going from 4.3% to 4.5%. The price-to-earnings (P/E) ratio is not directly focused upon as part of the rebalance, but it did drop slightly, from 10.4x to 10.3x. Since it’s true that a P/E ratio may not be the best valuation ratio to use for real estate, we also note that the price-to-book ratio was unchanged, holding steady at 0.95x.2

• Important Country Impact of Rebalance: Generally speaking, the country exposures of Global ex-U.S. Real Estate did not shift to a great degree, but one shift in particular is worth noting. The rebalancing process ended up adding 1.6% to Japan. During 2014 leading up to September 30, real estate within Japan was a poor performer, so it makes sense that weight was added to an underperforming market. However, as of an October 31, 2014, announcement, we also know that the Bank of Japan has tripled its annual purchases of Japanese real estate investment trusts (REIT)s, pursuant to its quantitative and qualitative monetary easing policy.3 It’s possible that this could be a catalyst for better performance out of Japanese real estate, but only time will tell for sure.

• U.S. Real Estate vs. Global ex-U.S. Real Estate: The other part of the discussion is clearly the comparison between U.S. and non-U.S. real estate. Intuition tells us that, since U.S. Real Estate performed approximately three times as strongly, it is likely more expensive, but the critical question is, how much more? As of the September 30, 2014, index screening:4

- U.S. Real Estate had a dividend yield of 3.63%, nearly 1.0% below that of Global ex-U.S. Real Estate.

- U.S. Real Estate had a price-to-book ratio of 2.3x—more than twice that of Global ex-U.S. Real Estate.

The bottom line: While there is no way to be certain of future performance, we think that it could be beneficial to consider diversifying exposures to U.S. Real Estate—which has performed well—with Global ex-U.S. Real Estate.

1Source: Bloomberg, 12/31/13–11/10/14. Refers to performance of the S&P 500 Index for U.S., MSCI Emerging Markets Index for emerging markets and MSCI EAFE Index for developed international.

2Sources for bullet: Bloomberg, Standard & Poor’s, with data measured as of 9/30/14 index screening.

3Source: “Expansion of the Quantitative and Qualitative Monetary Easing,” Bank of Japan, 10/31/14.

4Source for sub-bullets: Bloomberg, as of 9/30/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.