Flows Potential: Fund Managers Remain Under Weight Japan

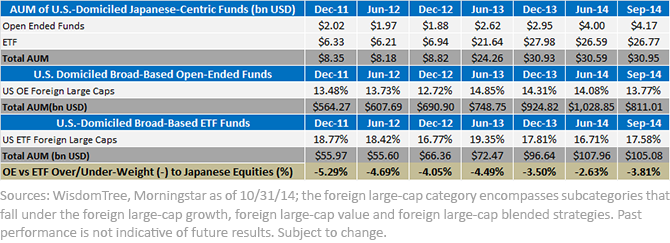

• Total Assets under Management in Dedicated Japanese Equities grew 270%. Since December 2011, total assets in Japanese dedicated equity funds in the ETF and open-ended space grew from $8.35 billion to $30.95 billion in September 2014.

- Japan Dedicated ETFs Expanding AUM Market Share: In December 2011, Japan-focused ETFs had 3x the AUM of Japan-focused open-ended funds for total AUM of $8.35 billion. By September 2014, mutual fund assets doubled, but ETF assets quadrupled, so the ratio of Japan dedicated ETF AUM was 6.4x the Japan dedicated open-ended fund AUM. According to the data above, this is one illustration of how ETFs have become preferred access vehicles for country exposures.

• Broad Open-Ended Funds Appear Under-Weight Japanese Equities: When compared to the ETF Funds in the same Morningstar category, foreign large caps, active managers have allocated 13.77% to Japanese stocks, while passively managed ETF strategies have a 17.58% allocation to Japanese equities. This reflects 3.81% under-weight allocation to equities in Japan. If active managers were to close this under-weight position, it could lead to more inflows to Japanese equities.

- Potential for Flows: If the managers we tracked removed their under-weight position, this would imply additional inflow of approximately $31 billion to Japanese equities. To put this in perspective, this is approximately one-third the total assets in the ETF foreign large-cap category within the U.S.

- Important Note: This context of potential flows is only from a subset of the broad market universe of funds where country allocation data is available. We identified $811 billion of fund assets where Japan country exposure is reported, but the total size of the foreign large blend category is approximately $1.1 trillion. If other funds that do not report Japan exposures show similar patterns of being under-weight Japanese equities, the amount of flows to Japan from just U.S. diversified mutual funds could thus be closer to $42 billion.

Since the inception of "Abenomics," TOPIX returned 77.64% cumulatively.1 Interestingly, the yen decreased significantly over this period, which neutralized some of the equity price rise and lowered the relative exposure in market cap benchmarks. In the ETF space, flows have gone toward currency-hedged ETFs over the last two years, which help neutralize this effect.

Global investors may slowly be convinced to stow away their two-decade-long perception of poor Japanese equity market performance. Japanese Prime Minister Shinzo Abe’s team is showing a strong commitment to breaking the deflation cycle. After two lost decades of poor performance for Japanese equities, money managers may have to re-evaluate their habitual under-weighted Japan position on the back of a weakening yen, improving earnings outlook and still very reasonable market valuation multiples.

Unless otherwise stated, data source is Morningstar, as of 10/31/14.

1Total returns between 11/30/12 and 10/31/14.

• Total Assets under Management in Dedicated Japanese Equities grew 270%. Since December 2011, total assets in Japanese dedicated equity funds in the ETF and open-ended space grew from $8.35 billion to $30.95 billion in September 2014.

- Japan Dedicated ETFs Expanding AUM Market Share: In December 2011, Japan-focused ETFs had 3x the AUM of Japan-focused open-ended funds for total AUM of $8.35 billion. By September 2014, mutual fund assets doubled, but ETF assets quadrupled, so the ratio of Japan dedicated ETF AUM was 6.4x the Japan dedicated open-ended fund AUM. According to the data above, this is one illustration of how ETFs have become preferred access vehicles for country exposures.

• Broad Open-Ended Funds Appear Under-Weight Japanese Equities: When compared to the ETF Funds in the same Morningstar category, foreign large caps, active managers have allocated 13.77% to Japanese stocks, while passively managed ETF strategies have a 17.58% allocation to Japanese equities. This reflects 3.81% under-weight allocation to equities in Japan. If active managers were to close this under-weight position, it could lead to more inflows to Japanese equities.

- Potential for Flows: If the managers we tracked removed their under-weight position, this would imply additional inflow of approximately $31 billion to Japanese equities. To put this in perspective, this is approximately one-third the total assets in the ETF foreign large-cap category within the U.S.

- Important Note: This context of potential flows is only from a subset of the broad market universe of funds where country allocation data is available. We identified $811 billion of fund assets where Japan country exposure is reported, but the total size of the foreign large blend category is approximately $1.1 trillion. If other funds that do not report Japan exposures show similar patterns of being under-weight Japanese equities, the amount of flows to Japan from just U.S. diversified mutual funds could thus be closer to $42 billion.

Since the inception of "Abenomics," TOPIX returned 77.64% cumulatively.1 Interestingly, the yen decreased significantly over this period, which neutralized some of the equity price rise and lowered the relative exposure in market cap benchmarks. In the ETF space, flows have gone toward currency-hedged ETFs over the last two years, which help neutralize this effect.

Global investors may slowly be convinced to stow away their two-decade-long perception of poor Japanese equity market performance. Japanese Prime Minister Shinzo Abe’s team is showing a strong commitment to breaking the deflation cycle. After two lost decades of poor performance for Japanese equities, money managers may have to re-evaluate their habitual under-weighted Japan position on the back of a weakening yen, improving earnings outlook and still very reasonable market valuation multiples.

Unless otherwise stated, data source is Morningstar, as of 10/31/14.

1Total returns between 11/30/12 and 10/31/14.Important Risks Related to this Article

Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.