How Vulnerable Is Short Duration Fixed Income to Fed Tightening?

For definitions of terms and Indexes in the chart, visit our glossary.

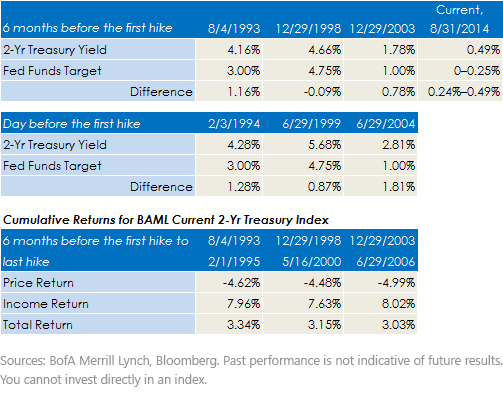

While today’s path to tightening is in many ways unprecedented, we believe looking at past tightening periods can provide valuable insight into the possible future path of rates. The most significant difference between today’s markets and past periods is the initial level of interest rates. In each of the three previous tightening periods, much higher yields provided a sizable cushion to offset losses related to lower bond prices as interest rates rose. For example, two-year Treasury yields rose by 103 basis points (bps) in the six months preceding the first Fed rate hike in 2003. In 1998, rates rose by 102 basis points.4 However, in both instances, total returns remained positive given the higher starting levels of yields. While it is noteworthy that rates rose by approximately the same amount in the six months preceding the first rate hike during the previous two cycles, we do not believe this will necessarily occur in 2015. This view is primarily driven by our outlook not only for the timing of the first rate hike, but the pace of subsequent hikes and the ultimate “neutral” policy rate.

The other interesting element of the table above relates to the total returns for the two years over each of the previous tightening cycles. While the duration and starting yield levels of each tightening period differ greatly, the total returns from each period are remarkably similar at approximately 3%. In higher-rate environments, the duration of the tightening cycle has historically been shorter. In the most recent tightening cycle, from 2003 through 2006, the longer period of tightening allowed bond investors to recoup losses through higher levels of income.

While we don’t anticipate that the pace of Fed tightening will be as aggressive as the periods seen in recent history, we do believe that in each previous period, the market underestimated the timing of a shift in policy. However, during previous periods, starting yields were significantly higher, thus increasing bond investors’ margin of error. In our view, given the current low levels of income potential, the prospect of negative returns from short-duration fixed income remains at much higher levels than in past tightening cycles.

To learn more about our interest rate strategies, click here.

1Source: Jens H.E. Christensen and Simon Kwan, “Assessing Expectations of Monetary Policy,” Federal Reserve Bank of San Francisco, 9/8/14.

2Source: Bloomberg, as of 8/31/14.

3Source: Morgan Stanley, 6/9/14.

4Sources: Bloomberg, WisdomTree.

For definitions of terms and Indexes in the chart, visit our glossary.

While today’s path to tightening is in many ways unprecedented, we believe looking at past tightening periods can provide valuable insight into the possible future path of rates. The most significant difference between today’s markets and past periods is the initial level of interest rates. In each of the three previous tightening periods, much higher yields provided a sizable cushion to offset losses related to lower bond prices as interest rates rose. For example, two-year Treasury yields rose by 103 basis points (bps) in the six months preceding the first Fed rate hike in 2003. In 1998, rates rose by 102 basis points.4 However, in both instances, total returns remained positive given the higher starting levels of yields. While it is noteworthy that rates rose by approximately the same amount in the six months preceding the first rate hike during the previous two cycles, we do not believe this will necessarily occur in 2015. This view is primarily driven by our outlook not only for the timing of the first rate hike, but the pace of subsequent hikes and the ultimate “neutral” policy rate.

The other interesting element of the table above relates to the total returns for the two years over each of the previous tightening cycles. While the duration and starting yield levels of each tightening period differ greatly, the total returns from each period are remarkably similar at approximately 3%. In higher-rate environments, the duration of the tightening cycle has historically been shorter. In the most recent tightening cycle, from 2003 through 2006, the longer period of tightening allowed bond investors to recoup losses through higher levels of income.

While we don’t anticipate that the pace of Fed tightening will be as aggressive as the periods seen in recent history, we do believe that in each previous period, the market underestimated the timing of a shift in policy. However, during previous periods, starting yields were significantly higher, thus increasing bond investors’ margin of error. In our view, given the current low levels of income potential, the prospect of negative returns from short-duration fixed income remains at much higher levels than in past tightening cycles.

To learn more about our interest rate strategies, click here.

1Source: Jens H.E. Christensen and Simon Kwan, “Assessing Expectations of Monetary Policy,” Federal Reserve Bank of San Francisco, 9/8/14.

2Source: Bloomberg, as of 8/31/14.

3Source: Morgan Stanley, 6/9/14.

4Sources: Bloomberg, WisdomTree.Important Risks Related to this Article

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.