Concerned about U.S. Small Cap Valuations? Think Internationally!

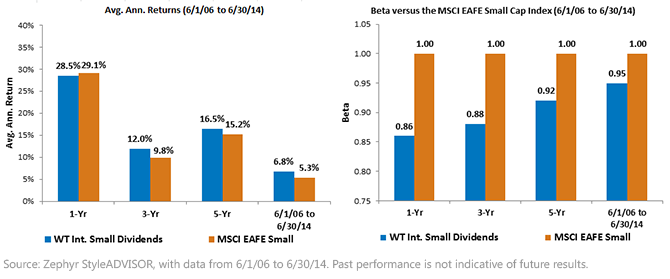

• Dividend Payers Outperform: Over the three-year, five-year and since-inception periods, WT Int. Small Dividends outperformed the MSCI EAFE Small Cap Index. In a strong market during the one-year time frame, the dividend payers definitely kept pace—a feat we believe impressive because dividend-focused strategies frequently do not capture the full upward moves of bull markets.

• Dividend Payers Lower Risk across All Periods: One way to consider risk is through the beta statistic, a measure of the relative volatility between two indexes. The MSCI EAFE Small Cap Index, serving as the benchmark in this case, will therefore have a beta of 1.00 in every period. Since WT Int. Small Dividends is less than 1.00 over every period shown, this indicates that risk was reduced over these periods.

o For those thinking in more absolute terms, WT Int. Small Dividends also had a lower standard deviation than MSCI EAFE Small Cap Index over each of the periods shown.3

While we believe the historical track record is impressive, past performance is just that—in the past. To really put these results in context, it’s important to understand that the single most important element of WT Int. Small Dividends is its annual rebalance. Simply put:

• Firms Rewarded with Greater Weight: Typically, these are firms where share-price performance has been lackluster, but dividends have remained stable or grown.

• Firms Punished with Lower Weight: Typically, these are firms where share-price performance has been very strong, but dividends—in other words, fundamentals—have not appreciated commensurately.

The fact is that the top-performing stocks of today may not be poised to become the key drivers of performance tomorrow—especially after the strong year that we’ve just seen. Historically, WT Int. Small Dividends has undergone eight rebalances.4

• Dividend Yield Has Tended to Increase: On average, the Index dividend yield has increased nearly 23%. In essence, this is a natural consequence of the dividend-focused methodology.

• Price-to-Earnings (P/E) Ratio Has Tended to Decrease: On average, the Index P/E ratio has tended to decrease by about 12%.

1Sources for the three bullets: WisdomTree, Bloomberg, Standard & Poor’s, with data as of 7/25/14.

2Source: Bloomberg, as of 7/25/14.

3Source: Zephyr StyleADVISOR, with standard deviation measured over the one-year, three-year, five-year and 6/1/06–6/30/14 periods, as of 6/30/14.

4Each rebalance has coincided with an annual Index screening occurring on May 31, the earliest being 5/31/07 and the latest being 5/31/14.

• Dividend Payers Outperform: Over the three-year, five-year and since-inception periods, WT Int. Small Dividends outperformed the MSCI EAFE Small Cap Index. In a strong market during the one-year time frame, the dividend payers definitely kept pace—a feat we believe impressive because dividend-focused strategies frequently do not capture the full upward moves of bull markets.

• Dividend Payers Lower Risk across All Periods: One way to consider risk is through the beta statistic, a measure of the relative volatility between two indexes. The MSCI EAFE Small Cap Index, serving as the benchmark in this case, will therefore have a beta of 1.00 in every period. Since WT Int. Small Dividends is less than 1.00 over every period shown, this indicates that risk was reduced over these periods.

o For those thinking in more absolute terms, WT Int. Small Dividends also had a lower standard deviation than MSCI EAFE Small Cap Index over each of the periods shown.3

While we believe the historical track record is impressive, past performance is just that—in the past. To really put these results in context, it’s important to understand that the single most important element of WT Int. Small Dividends is its annual rebalance. Simply put:

• Firms Rewarded with Greater Weight: Typically, these are firms where share-price performance has been lackluster, but dividends have remained stable or grown.

• Firms Punished with Lower Weight: Typically, these are firms where share-price performance has been very strong, but dividends—in other words, fundamentals—have not appreciated commensurately.

The fact is that the top-performing stocks of today may not be poised to become the key drivers of performance tomorrow—especially after the strong year that we’ve just seen. Historically, WT Int. Small Dividends has undergone eight rebalances.4

• Dividend Yield Has Tended to Increase: On average, the Index dividend yield has increased nearly 23%. In essence, this is a natural consequence of the dividend-focused methodology.

• Price-to-Earnings (P/E) Ratio Has Tended to Decrease: On average, the Index P/E ratio has tended to decrease by about 12%.

1Sources for the three bullets: WisdomTree, Bloomberg, Standard & Poor’s, with data as of 7/25/14.

2Source: Bloomberg, as of 7/25/14.

3Source: Zephyr StyleADVISOR, with standard deviation measured over the one-year, three-year, five-year and 6/1/06–6/30/14 periods, as of 6/30/14.

4Each rebalance has coincided with an annual Index screening occurring on May 31, the earliest being 5/31/07 and the latest being 5/31/14.

Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Diversification does not eliminate the risk of experiencing investment losses. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.