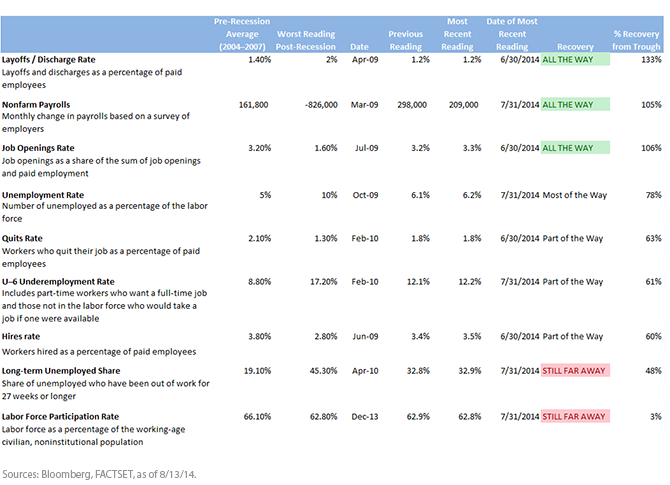

A Peek at Yellen’s Labor Market Dashboard Highlights Fed Concerns

In addition to a tick up in wages, anecdotal evidence and economic releases pointing to stabilization in labor force participation rates or a fall in the underemployment rate could improve the Fed’s assessment of labor conditions. Monitoring these factors in upcoming Fed speeches, including the meeting in Jackson Hole August 21–23, could provide clearer insight into the path for future short-term rates in the United States. We believe that economic releases in the near future will provide the Fed with greater confidence in the domestic case for beginning to adjust monetary policy. As a result, interest rates will likely rise in anticipation of the Fed increasing short-term interest rates next year.

As a result, we believe investors would be well served to reduce interest rate risk in their bond portfolios. As we have mentioned previously, we believe that the current risk/reward profile favors positions that will benefit from a rise in rates. With yields in most fixed income sectors near one-year lows, we believe that now may be a prudent time to reduce risk.

1Board of Governors of the Federal Reserve System, Federal Open Market Committee. 7/30/14.http://www.federalreserve.gov/newsevents/press/monetary/20140730a.htm

2Rich Miller and Michelle Jamrisko, “Yellen Jobs Dashboard Shows Rate Rise Far on Horizon: Economy,” Bloomberg, 4/2/14.

In addition to a tick up in wages, anecdotal evidence and economic releases pointing to stabilization in labor force participation rates or a fall in the underemployment rate could improve the Fed’s assessment of labor conditions. Monitoring these factors in upcoming Fed speeches, including the meeting in Jackson Hole August 21–23, could provide clearer insight into the path for future short-term rates in the United States. We believe that economic releases in the near future will provide the Fed with greater confidence in the domestic case for beginning to adjust monetary policy. As a result, interest rates will likely rise in anticipation of the Fed increasing short-term interest rates next year.

As a result, we believe investors would be well served to reduce interest rate risk in their bond portfolios. As we have mentioned previously, we believe that the current risk/reward profile favors positions that will benefit from a rise in rates. With yields in most fixed income sectors near one-year lows, we believe that now may be a prudent time to reduce risk.

1Board of Governors of the Federal Reserve System, Federal Open Market Committee. 7/30/14.http://www.federalreserve.gov/newsevents/press/monetary/20140730a.htm

2Rich Miller and Michelle Jamrisko, “Yellen Jobs Dashboard Shows Rate Rise Far on Horizon: Economy,” Bloomberg, 4/2/14. Important Risks Related to this Article

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition when interest rates fall income may decline.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.