Our Best and Worst Performing Equity Funds This Year

Top 5 & Bottom 5 of 2014: Equity ETFs

Top 5 & Bottom 5 of 2014: Equity ETFs

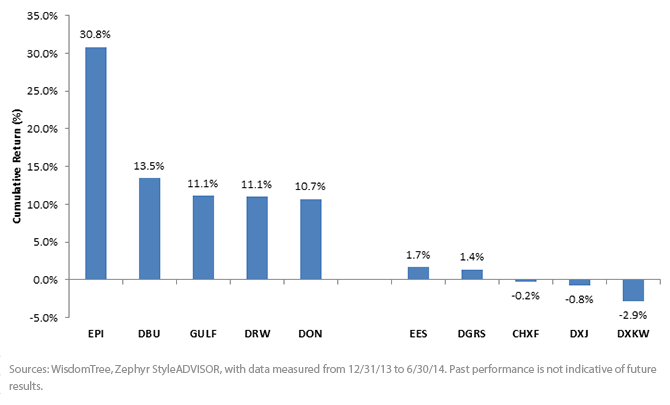

Top 5 Performers

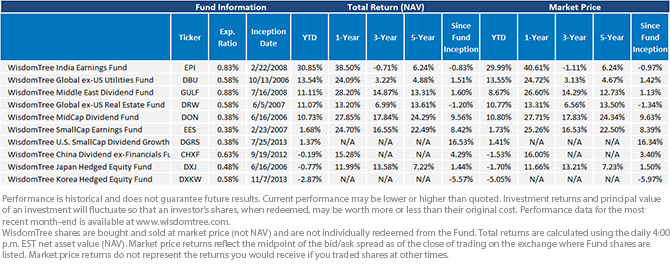

• India as the Top Performer: WisdomTree’s India Earnings Fund (EPI) was far and away the top performer of the group. Initially, this was due to excitement over the prospects for a change in government leadership, leading up to the announcement on May 16, 2014, of the Bharatiya Janata Party (BJP)1 and Prime Minister Modi’s electoral victory. Performance has been positive since then as it is perceived that India’s very necessary reform effort is moving in a positive direction.

• Utilities for Yield-Hungry Investors: Interest rates in developed markets have been trending downward2, but investors have been hungry for income-producing options. Utilities are one such place they have looked. The WisdomTree Global ex-U.S. Utilities Fund (DBU) tracks, after costs, fees and expenses, the performance of an Index3 that focuses on the Utilities sector outside of the U.S. Performance of greater than 20% over the period was seen in such markets as Poland, Portugal, Spain, Finland and Indonesia.4 It’s important to note that the S&P 500 Utilities Index was up 18.7% for the period5, so the “ex-US” missed a very strong U.S. Utilities market over the period.

• The Middle East Upgrades: In June 2014 MSCI officially upgraded the United Arab Emirates and Qatar to emerging market status.6 Since then, however, the situation in the Middle East region has become volatile, so much of the positive performance from the WisdomTree Middle East Dividend Fund (GULF) occurred closer to the beginning of 2014 than to the midpoint.

• Real Estate: While the WisdomTree Global ex-U.S. Real Estate Fund (DRW) has broken into double digits with its performance, it’s important to note that U.S. real estate Indexes have outperformed it over this period7. It is another sector that, like Utilities, has the potential for helping to solve a need for income. The ultralow interest rates around the world and further support from the European and Japanese central banks are supporting real estate and income investment strategies around the world.

• U.S. Mid-Caps: The WisdomTree MidCap Dividend Fund (DON) rounds out the top five performing ETFs over this period.

Bottom 5 Performers

• Valuation Concerns in U.S. Small Caps: Both EES and DGRS represent U.S. small-cap options, and this market was very strong in 2013. Both of these funds track the performance of Indexes8 that are exposed to less-speculative and less-leveraged parts of the U.S. small-cap market, making them particularly suited for a potential rising-rate environment.

• Japan Has Been Volatile: After the breakout performance year of 2013, equities within Japan have been challenged. Abenomics is now less about making big announcements and more about following through on the proposed incremental reforms. The road to success will not be traveled in the short term, but it’s worth noting that since May 21 DXJ is up more than 8.5%.9

• WisdomTree’s Worst-Performing Equity Fund Thus Far in 2014: At times, investment strategies are created to focus on the worst performers of a particular period, and for those searching for that option at WisdomTree, the answer is DXKW. Korean firms have been hit hard by the depreciating yen, in that many Korean firms produce products that are very similar to their Japanese counterparts, and the Japanese products have become less expensive within their export markets. With the possibility of intervention by the Bank of Korea to try to weaken the won, Korea’s currency, we wrote about the potential opportunity that we see in this market in a prior blog post.

Looking Forward to the Second Half

As we write this piece on July 18, 2014, we’ve already seen transpiring major geopolitical events that will have the potential to impact equity markets around the globe in the second half of 2014. For momentum-oriented investors who look to continue to ride the performance wave, these five top-performing funds are worth watching, while the contrarian and value-seeking investors should find value in these bottom-performing segments.

1Bharatiya Janata Party (BJP): A political party in India.

2Source: Bloomberg. 10-year government bond interest rates in the United States, Japan, the United Kingdom, Germany, Spain and Australia were all lower on 7/15/14 than on 12/31/13.

3Refers to the WisdomTree Global ex- U.S. Utilities Index.

4Source: Bloomberg, with performance measured for constituents of the WisdomTree Global ex-US Utilities Index within these markets for the period 12/31/13 to 6/30/14.

5Source: Bloomberg, with performance measured from 12/31/13 to 6/30/14.

6Source: “MSCI Market Classification & Implementation Q&A,” MSCI, December 2013.

7Source: Bloomberg. MSCI US REIT Index & Dow Jones US Real Estate Index performed 17.7% and 16.4%, respectively, for the 12/31/13 to 6/30/14 period.

8EES tracks the WisdomTree SmallCap Earnings Index, and DGRS tracks the WisdomTree U.S. SmallCap Dividend Growth Index.

9Refers to performance of DXJ at NAV from 5/21/14 to 6/30/14.

Top 5 Performers

• India as the Top Performer: WisdomTree’s India Earnings Fund (EPI) was far and away the top performer of the group. Initially, this was due to excitement over the prospects for a change in government leadership, leading up to the announcement on May 16, 2014, of the Bharatiya Janata Party (BJP)1 and Prime Minister Modi’s electoral victory. Performance has been positive since then as it is perceived that India’s very necessary reform effort is moving in a positive direction.

• Utilities for Yield-Hungry Investors: Interest rates in developed markets have been trending downward2, but investors have been hungry for income-producing options. Utilities are one such place they have looked. The WisdomTree Global ex-U.S. Utilities Fund (DBU) tracks, after costs, fees and expenses, the performance of an Index3 that focuses on the Utilities sector outside of the U.S. Performance of greater than 20% over the period was seen in such markets as Poland, Portugal, Spain, Finland and Indonesia.4 It’s important to note that the S&P 500 Utilities Index was up 18.7% for the period5, so the “ex-US” missed a very strong U.S. Utilities market over the period.

• The Middle East Upgrades: In June 2014 MSCI officially upgraded the United Arab Emirates and Qatar to emerging market status.6 Since then, however, the situation in the Middle East region has become volatile, so much of the positive performance from the WisdomTree Middle East Dividend Fund (GULF) occurred closer to the beginning of 2014 than to the midpoint.

• Real Estate: While the WisdomTree Global ex-U.S. Real Estate Fund (DRW) has broken into double digits with its performance, it’s important to note that U.S. real estate Indexes have outperformed it over this period7. It is another sector that, like Utilities, has the potential for helping to solve a need for income. The ultralow interest rates around the world and further support from the European and Japanese central banks are supporting real estate and income investment strategies around the world.

• U.S. Mid-Caps: The WisdomTree MidCap Dividend Fund (DON) rounds out the top five performing ETFs over this period.

Bottom 5 Performers

• Valuation Concerns in U.S. Small Caps: Both EES and DGRS represent U.S. small-cap options, and this market was very strong in 2013. Both of these funds track the performance of Indexes8 that are exposed to less-speculative and less-leveraged parts of the U.S. small-cap market, making them particularly suited for a potential rising-rate environment.

• Japan Has Been Volatile: After the breakout performance year of 2013, equities within Japan have been challenged. Abenomics is now less about making big announcements and more about following through on the proposed incremental reforms. The road to success will not be traveled in the short term, but it’s worth noting that since May 21 DXJ is up more than 8.5%.9

• WisdomTree’s Worst-Performing Equity Fund Thus Far in 2014: At times, investment strategies are created to focus on the worst performers of a particular period, and for those searching for that option at WisdomTree, the answer is DXKW. Korean firms have been hit hard by the depreciating yen, in that many Korean firms produce products that are very similar to their Japanese counterparts, and the Japanese products have become less expensive within their export markets. With the possibility of intervention by the Bank of Korea to try to weaken the won, Korea’s currency, we wrote about the potential opportunity that we see in this market in a prior blog post.

Looking Forward to the Second Half

As we write this piece on July 18, 2014, we’ve already seen transpiring major geopolitical events that will have the potential to impact equity markets around the globe in the second half of 2014. For momentum-oriented investors who look to continue to ride the performance wave, these five top-performing funds are worth watching, while the contrarian and value-seeking investors should find value in these bottom-performing segments.

1Bharatiya Janata Party (BJP): A political party in India.

2Source: Bloomberg. 10-year government bond interest rates in the United States, Japan, the United Kingdom, Germany, Spain and Australia were all lower on 7/15/14 than on 12/31/13.

3Refers to the WisdomTree Global ex- U.S. Utilities Index.

4Source: Bloomberg, with performance measured for constituents of the WisdomTree Global ex-US Utilities Index within these markets for the period 12/31/13 to 6/30/14.

5Source: Bloomberg, with performance measured from 12/31/13 to 6/30/14.

6Source: “MSCI Market Classification & Implementation Q&A,” MSCI, December 2013.

7Source: Bloomberg. MSCI US REIT Index & Dow Jones US Real Estate Index performed 17.7% and 16.4%, respectively, for the 12/31/13 to 6/30/14 period.

8EES tracks the WisdomTree SmallCap Earnings Index, and DGRS tracks the WisdomTree U.S. SmallCap Dividend Growth Index.

9Refers to performance of DXJ at NAV from 5/21/14 to 6/30/14.Important Risks Related to this Article

High double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were achieved primarily during favorable market conditions. A Fund’s performance, especially for very short periods, should not be the sole factor in making an investment decision. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments in certain countries or regions, such as India, China, the Middle East, Japan and Korea, may be impacted by events and developments associated with the country or region, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. In addition, when interest rates fall, income may decline. As these Funds have a high concentration in some sectors, the Funds can be adversely affected by changes in those sectors. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding each Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.