Federal Reserve Tapering Part I: Emerging Market Currency Performance

Regional Focus

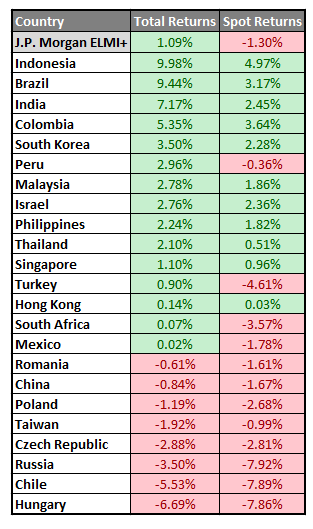

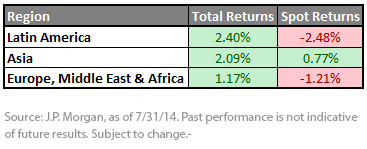

Continuing on the theme of income, when investors look at the currency returns by regional breakdown, the concept of carry is even more clearly illustrated. In fact, the region with the most negative spot returns actually ended up with the greatest total returns over the last seven months. Brazil, whose performance we have noted in previous blog posts, has been not only one of the strongest spot currency performers, but also boasts some of the highest interest rates in the emerging world. Shifting the focus to Asia, we note that while spot currency performance was the best across regions, lower interest rates yielded lower opportunities for carry compared to other parts of the world. Finally, given the continued uncertainty in Russia, Europe, the Middle East and Africa countries lagged Latin America and Asia with respect to total returns. Also, through a series of interest rate cuts, Hungary has continued to lag other markets in both opportunities for carry and currency performance.

In closing, while emerging market currencies have delivered positive total returns since the Fed began tapering in 2013, these returns have largely been attributable to the carry advantage most of these countries have over the U.S. While emerging markets may be susceptible to a pullback once we have greater clarity about the pace of future Fed interest rate increases, we believe these markets still may enjoy some upside as the drivers of returns shift from higher carry to spot currency appreciation. Additionally, the long-term story for EM currency appreciation remains intact. Faster economic growth and higher levels of economic productivity will continue to support EM currencies against developed market alternatives in the long run.

1Source: J.P. Morgan, 7/9/14.

2Sources: J.P. Morgan, Bloomberg, WisdomTree, as of 7/31/14.

Regional Focus

Continuing on the theme of income, when investors look at the currency returns by regional breakdown, the concept of carry is even more clearly illustrated. In fact, the region with the most negative spot returns actually ended up with the greatest total returns over the last seven months. Brazil, whose performance we have noted in previous blog posts, has been not only one of the strongest spot currency performers, but also boasts some of the highest interest rates in the emerging world. Shifting the focus to Asia, we note that while spot currency performance was the best across regions, lower interest rates yielded lower opportunities for carry compared to other parts of the world. Finally, given the continued uncertainty in Russia, Europe, the Middle East and Africa countries lagged Latin America and Asia with respect to total returns. Also, through a series of interest rate cuts, Hungary has continued to lag other markets in both opportunities for carry and currency performance.

In closing, while emerging market currencies have delivered positive total returns since the Fed began tapering in 2013, these returns have largely been attributable to the carry advantage most of these countries have over the U.S. While emerging markets may be susceptible to a pullback once we have greater clarity about the pace of future Fed interest rate increases, we believe these markets still may enjoy some upside as the drivers of returns shift from higher carry to spot currency appreciation. Additionally, the long-term story for EM currency appreciation remains intact. Faster economic growth and higher levels of economic productivity will continue to support EM currencies against developed market alternatives in the long run.

1Source: J.P. Morgan, 7/9/14.

2Sources: J.P. Morgan, Bloomberg, WisdomTree, as of 7/31/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.