Earlier we wrote about managing

valuation risks in the domestic

small-cap market by focusing on profitable companies and rebalancing back to

fundamentals.We thought it would be useful to expand on how screening and weighting by profitability can also help manage valuation risk in mid-caps.

WisdomTree feels that weighting by

market capitalization, which does not weight, consider or rebalance back to any

fundamental value, may not be the best approach. Instead, we believe a disciplined strategy of anchoring allocations back to a concept of

relative value, based on fundamentals such as

dividends or earnings, can add value over time.

The Fundamental Difference

The WisdomTree Earnings Indexes seek to provide exposure to the core, profitable market but do so while maintaining sensitivity to valuation. To help achieve this, WisdomTree weights companies in the Indexes by the profits they generate, rather than their market cap, and rebalances back to profitability on an annual basis.

WisdomTree’s Earnings Index rebalance process typically is driven by:

-Earnings Growth: Companies increasing profits see their weight increased

-Relative Performance:

-Underperformers typically see their weight increased

-Outperformers often see their weight decreased

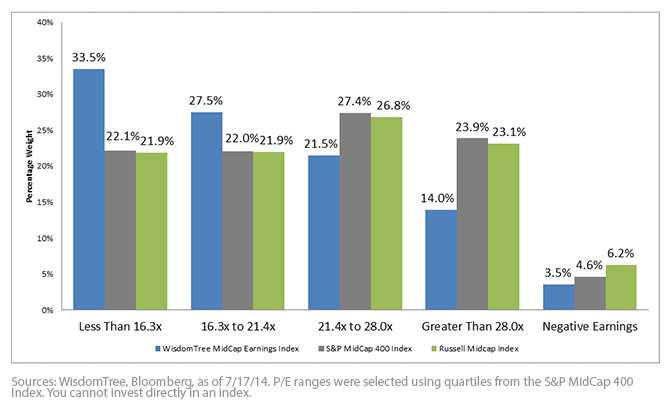

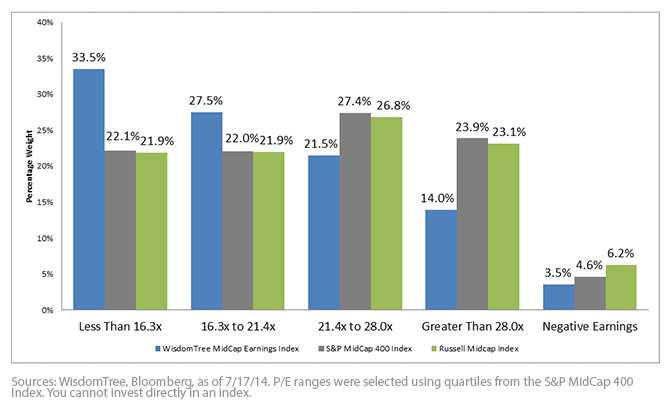

This process tends to shift weight to firms with lower

price-to-earnings (P/E) ratios, as illustrated in the chart below: it compares the distribution of stocks by their P/E ratios in the

WisdomTree MidCap Earnings Index to that of widely followed market cap-weighted indexes.

P/E Ratio and Weight Distribution

The P/E ratio for the

WisdomTree MidCap Earnings Index is approximately 16.4x, about 15% lower than the 19.4x P/E ratio of the

S&P MidCap400 Index and 16% lower than the 19.7x P/E ratio of the

Russell Midcap Index.

1 The chart below provides a look at how the weight is distributed, to give a sense for why this lower P/E ratio is seen at the aggregate index.

•

More Weight to Lower-Priced Stocks – The WisdomTree MidCap Earnings Index has over 60% of its weight in the two lowest-priced quartiles, which is over 16% more weight than the S&P MidCap 400 or the Russell Midcap. There is a natural tendency of earnings-weighted approaches to reduce weight to stocks whose prices have appreciated at a faster rate than their earnings, and concurrently to increase weight to stocks that have fallen in price despite exhibiting positive earnings growth.

•

Less Weight to Higher-Priced Stocks – WisdomTree’s 16% over-weight to lower-priced stocks comes from a 16% under-weight to the higher-priced segment of the mid-cap market. WisdomTree also has approximately 40% less weight to stocks that fall in the highest P/E ratio quartile than either of the market cap-weighted indexes.

•

Negative Earnings and Speculative Stocks – Although profitability may fluctuate throughout the year, at each annual rebalance WisdomTree requires companies to be profitable before inclusion. This requirement limits the weight to firms we feel tend to be more speculative and lower quality at zero. Neither of the market cap-weighted indexes above shares this requirement.

1Sources: WisdomTree, Bloomberg, as of 7/17/14.

Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development.

•More Weight to Lower-Priced Stocks – The WisdomTree MidCap Earnings Index has over 60% of its weight in the two lowest-priced quartiles, which is over 16% more weight than the S&P MidCap 400 or the Russell Midcap. There is a natural tendency of earnings-weighted approaches to reduce weight to stocks whose prices have appreciated at a faster rate than their earnings, and concurrently to increase weight to stocks that have fallen in price despite exhibiting positive earnings growth.

•Less Weight to Higher-Priced Stocks – WisdomTree’s 16% over-weight to lower-priced stocks comes from a 16% under-weight to the higher-priced segment of the mid-cap market. WisdomTree also has approximately 40% less weight to stocks that fall in the highest P/E ratio quartile than either of the market cap-weighted indexes.

•Negative Earnings and Speculative Stocks – Although profitability may fluctuate throughout the year, at each annual rebalance WisdomTree requires companies to be profitable before inclusion. This requirement limits the weight to firms we feel tend to be more speculative and lower quality at zero. Neither of the market cap-weighted indexes above shares this requirement.

1Sources: WisdomTree, Bloomberg, as of 7/17/14.

•More Weight to Lower-Priced Stocks – The WisdomTree MidCap Earnings Index has over 60% of its weight in the two lowest-priced quartiles, which is over 16% more weight than the S&P MidCap 400 or the Russell Midcap. There is a natural tendency of earnings-weighted approaches to reduce weight to stocks whose prices have appreciated at a faster rate than their earnings, and concurrently to increase weight to stocks that have fallen in price despite exhibiting positive earnings growth.

•Less Weight to Higher-Priced Stocks – WisdomTree’s 16% over-weight to lower-priced stocks comes from a 16% under-weight to the higher-priced segment of the mid-cap market. WisdomTree also has approximately 40% less weight to stocks that fall in the highest P/E ratio quartile than either of the market cap-weighted indexes.

•Negative Earnings and Speculative Stocks – Although profitability may fluctuate throughout the year, at each annual rebalance WisdomTree requires companies to be profitable before inclusion. This requirement limits the weight to firms we feel tend to be more speculative and lower quality at zero. Neither of the market cap-weighted indexes above shares this requirement.

1Sources: WisdomTree, Bloomberg, as of 7/17/14.