Is Your Active Manager Beating the Benchmark Index?

For definitions of indexes in the chart, please visit our glossary.

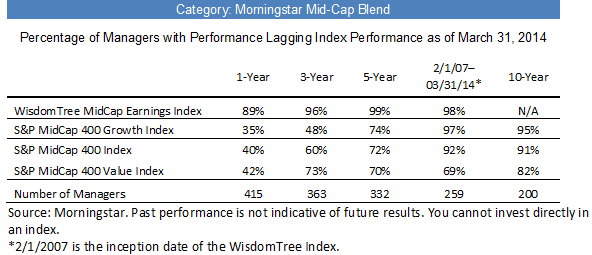

Like the WisdomTree SmallCap Earnings Index does for its category, the WisdomTree MidCap Earnings Index includes essentially all the profitable publicly traded mid-cap companies in America and weights them annually based on the aggregate earnings each company has generated over the prior year. By including more than 600 stocks with an aggregate market capitalization of more than $2.2 trillion, the WisdomTree MidCap Earnings Index is actually a broader and more representative barometer of the U.S. mid-cap asset class than the S&P MidCap 400 Index, whose 400 components have a combined market cap of just $1.65 trillion.2 Because WisdomTree’s fundamentally weighted approach to the U.S. mid-cap market is both representative of the mid-cap asset class and blessed with ample investment capacity, it could serve as the cornerstone for investors seeking core "smart beta" exposure for U.S. mid-caps stocks.

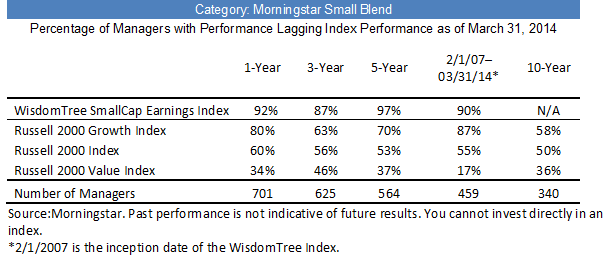

Similarly, if you screen for small-cap managers and fail to include ETFs or index-based strategies, you may be unaware of the WisdomTree SmallCap Earnings Index, which beat 97% of its peer group over the past five years, according to Morningstar.

For definitions of indexes in the chart, please visit our glossary.

Like the WisdomTree SmallCap Earnings Index does for its category, the WisdomTree MidCap Earnings Index includes essentially all the profitable publicly traded mid-cap companies in America and weights them annually based on the aggregate earnings each company has generated over the prior year. By including more than 600 stocks with an aggregate market capitalization of more than $2.2 trillion, the WisdomTree MidCap Earnings Index is actually a broader and more representative barometer of the U.S. mid-cap asset class than the S&P MidCap 400 Index, whose 400 components have a combined market cap of just $1.65 trillion.2 Because WisdomTree’s fundamentally weighted approach to the U.S. mid-cap market is both representative of the mid-cap asset class and blessed with ample investment capacity, it could serve as the cornerstone for investors seeking core "smart beta" exposure for U.S. mid-caps stocks.

Similarly, if you screen for small-cap managers and fail to include ETFs or index-based strategies, you may be unaware of the WisdomTree SmallCap Earnings Index, which beat 97% of its peer group over the past five years, according to Morningstar.

For definitions of indexes in the chart, please visit our glossary.

In the next part of this series, we’ll touch on one of the reasons why these excess returns may be occurring in the small- and mid-cap parts of the market, and what the ETF industry may not yet know about smart beta approaches to indexing.

To learn more about smart beta, click here to read Luciano’s recent Journal of Indexes article, “Considering Smart Beta.”

1Source: Morningstar.

2Market capitalization data as of 3/31/2014.

For definitions of indexes in the chart, please visit our glossary.

In the next part of this series, we’ll touch on one of the reasons why these excess returns may be occurring in the small- and mid-cap parts of the market, and what the ETF industry may not yet know about smart beta approaches to indexing.

To learn more about smart beta, click here to read Luciano’s recent Journal of Indexes article, “Considering Smart Beta.”

1Source: Morningstar.

2Market capitalization data as of 3/31/2014.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. 2014 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance, rankings and ratings are no guarantee of future results.