When investors allocate to foreign stocks, they typically assume a secondary currency exposure on top of their local equity market returns. This secondary currency exposure—or “currency bet”—can increase returns during periods when the euro, yen, British pound and other foreign currencies are rising versus the dollar. But it can also decrease returns when those foreign currencies are falling in value. If investors do not have strong conviction in the potential direction of the euro, yen or British pound, WisdomTree argues they should

hedge at least a portion of their exposure to these currencies.

Moreover, WisdomTree believes we may be entering a period when the U.S. dollar increases in value in a secular trend. This view is based on changes unfolding in central bank policies, as well as likely changes in interest rate policies developing between Europe, Japan and the United States. This does not mean one should allocate less to foreign stocks if the dollar is rising—in fact this could have the potential to be the best time to own foreign stocks, as illustrated in Japan in 2013.

WisdomTree pioneered developing currency-hedged Indexes for use within the exchange-traded fund (ETF) structure as the first ETF firm to launch a

currency-hedged ETF.

1 WisdomTree continues to innovate along this theme with the introduction of the

WisdomTree International Hedged Dividend Growth Fund (IHDG), which tracks the performance of the

WisdomTree International Hedged Dividend Growth Index after costs, fees and expenses. Before describing the characteristics of this new Index that IHDG is designed to track, it is important to establish why WisdomTree thinks currency hedging is increasingly critical to obtaining international investments exposure, particularly in the developed world.

Central Banks and Interest Rates Impact Currencies

If the U.S. Federal Reserve increases

interest rates2 before the European Central Bank (ECB) or the Bank of Japan (BOJ), there could potentially be a time in the next two years when U.S. investors are paid the relative interest rate differentials

to hedge foreign currencies. Currency hedging contracts are priced based on relative interest rates. If the U.S. has higher interest rates than foreign markets, then U.S. investors would likely be paid to hedge the currency risk of those respective markets.

For instance, if the

Federal Funds Rate increases to 2% and the ECB and the BOJ both keep rates pegged near 0%, the U.S. investor could receive approximately 2% income to hedge the euro and yen risk. If this scenario materializes, it could have the potential to be a game-shifting catalyst for investors to transition to currency-hedged ETFs for their developed world exposures. In this scenario, one can argue it would be expensive to have euro and yen exposures like traditional foreign equity ETFs that do not hedge the currency risk—missing out on a potential 2% income or differential in interest rates from hedging the currency as well as the removal of a potential source of additional

risk.

Myth Busting: Currency-Hedged Edition

WisdomTree believes there are common myths about hedging foreign currencies and I plan to address the three main misconceptions in a series of three blog posts. The first myth is that it is expensive to hedge foreign currencies, followed by the myth that the euro and yen can be beneficial for the purchasing power of the U.S. dollar, and finally the myth that currencies are a wash in the long run, so one should default to taking the currency risk.

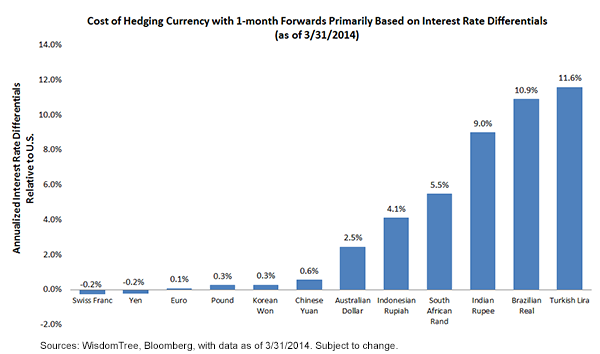

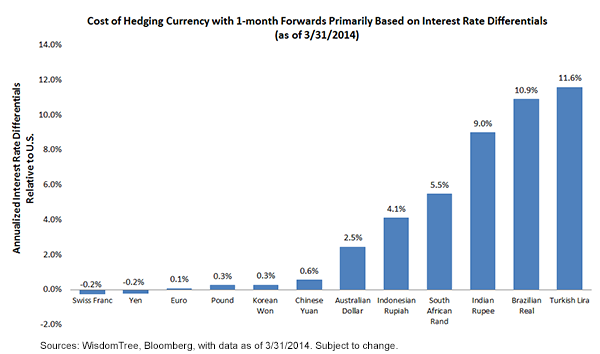

Myth #1: It Is Expensive to Hedge Foreign Currencies

Typically, it is only expensive for U.S. investors to hedge certain foreign currencies—those that have much higher short-term interest rates than the United States. Two current examples are Brazil and India. Both countries’ central banks have increased interest rates to help fend off declines in their currencies. By hiking interest rates, these central banks make it more costly for

speculators to

short the currencies and for

hedgers to hedge the currencies. The interest rate hikes can also make it more attractive for foreign investors to hold assets in reais and rupees to collect higher short-term interest rates compared to the rates in, for example, the United States.

The Brazilian Central Bank hiked rates to 11%,

3 while India hiked its repurchase rate three times since its new central bank governor, Raghuram Rajan, took office on September 4, 2013. The repurchase rate in India is at 8% as of March 31, 2014.

4 These are high hurdle rates for the currencies to depreciate against the U.S. dollar before a hedging investor has the potential to break even from the cost of the hedge.

However, the euro, yen and British pound—which combine to represent almost three-quarters of the weight of the

MSCI EAFE Index (a widely followed developed country international equity market benchmark)—each have a cost to hedge that is very low.

5 Specifically, this cost is approximately zero in the case of the euro and yen, and approximately 30

basis points for the British pound.

6

This is one reason why WisdomTree believes one may want to have a high conviction in the euro, yen and British pound’s direction to fully take on this currency risk in a traditional ETF that does not hedge the currency.

Illustrating the Difference Between High- and Low-Cost Currency Hedging

Conclusion

Conclusion

The bottom line is that WisdomTree ultimately believes currency hedging is gaining prominence and importance—as was particularly evident with Japan in 2013. But Japan is not a unique application. WisdomTree believes that currency-hedged strategies should have broad appeal, in Europe today based on monetary policy directions of the ECB, but also more strategically from a long-term standpoint in broader-based developed world exposures.

1WisdomTree launched the

WisdomTree Europe Hedged Equity Fund on 12/31/09, the first U.S.-listed currency-hedged equity ETF.

2Refers to the Federal Funds Rate.

3Source: Bloomberg, as of 3/31/14. Refers specifically to the SELIC rate, which was the rate used to implement this policy action.

4Source: Bloomberg, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14. For both currency weights within the MSCI EAFE Index and the cost to hedge the respective currencies.

6Source: Bloomberg, as of 3/31/14.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in specific regions or countries, thereby increasing the impact of events and developments associated with the region or country, which can adversely affect performance. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please see the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Conclusion

The bottom line is that WisdomTree ultimately believes currency hedging is gaining prominence and importance—as was particularly evident with Japan in 2013. But Japan is not a unique application. WisdomTree believes that currency-hedged strategies should have broad appeal, in Europe today based on monetary policy directions of the ECB, but also more strategically from a long-term standpoint in broader-based developed world exposures.

1WisdomTree launched the WisdomTree Europe Hedged Equity Fund on 12/31/09, the first U.S.-listed currency-hedged equity ETF.

2Refers to the Federal Funds Rate.

3Source: Bloomberg, as of 3/31/14. Refers specifically to the SELIC rate, which was the rate used to implement this policy action.

4Source: Bloomberg, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14. For both currency weights within the MSCI EAFE Index and the cost to hedge the respective currencies.

6Source: Bloomberg, as of 3/31/14.

Conclusion

The bottom line is that WisdomTree ultimately believes currency hedging is gaining prominence and importance—as was particularly evident with Japan in 2013. But Japan is not a unique application. WisdomTree believes that currency-hedged strategies should have broad appeal, in Europe today based on monetary policy directions of the ECB, but also more strategically from a long-term standpoint in broader-based developed world exposures.

1WisdomTree launched the WisdomTree Europe Hedged Equity Fund on 12/31/09, the first U.S.-listed currency-hedged equity ETF.

2Refers to the Federal Funds Rate.

3Source: Bloomberg, as of 3/31/14. Refers specifically to the SELIC rate, which was the rate used to implement this policy action.

4Source: Bloomberg, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14. For both currency weights within the MSCI EAFE Index and the cost to hedge the respective currencies.

6Source: Bloomberg, as of 3/31/14.