By May 12, the world’s largest democracy will have headed to the polls over the course of several weeks to elect a new government. Indian equity markets are rising to all-time highs on the news that the Bharatiya Janata Party’s (BJP) Narendra Modi will be elected the next prime minister of India. Prices are rising on the hopes that he—seen as a pro-market, pro-reform agenda candidate—will be able to re-energize the Indian economy by reducing corruption and cutting red tape. With equity markets already rebounding on the news, we believe that increasing allocations to the rupee may be a prudent way to bet on renewed optimism in India.

Potential Flows into the Indian Economy Support the Rupee

We believe that the Indian rupee can continue to rise for several reasons:

• A stronger foundation provided by credible central bank policy

• Optimism that a BJP-led government will enact changes that remove obstacles to achieving India’s long-term potential

• Attractive levels of

carry offered by local money market rates

• Likelihood that these factors will continue to support foreign capital inflows

As we discussed in a

previous blog post, governor Raghuram Rajan’s efforts to restore the

inflation-fighting credibility of the Reserve Bank of India have created a more supportive backdrop for investment in India. Additionally, the finance ministry has taken steps to facilitate foreign investors’ access to rupee-denominated assets. As a result of greater access and conviction, an expanding consensus behind the pro-growth candidate has quickly led to strong inflows into local assets from foreign investors. Over the last month, more than $5.5 billion has moved into Indian equity and bond markets.

1

As emerging market investors are all too aware, investment flows can have a significant impact on the value of a currency. This is particularly true for the Indian rupee, which historically has a high level of sensitivity to portfolio flows. Money flowing out of markets—as it did last year—can weaken the currency, as foreign sellers seek to sell locally denominated assets and repatriate their U.S. dollars.

But this is also true in reverse. Positive flows back into Indian equity and bond markets cause the currency to rise as global demand for rupees—and rupee-denominated assets—increases. As we have seen over the last several weeks, the rupee has appreciated in value against the U.S. dollar by 3.2% in the lead-up to the elections.

2 Many investors may want to express a bullish view of the Indian economy but may be stuck deciding how to allocate between stocks and bonds. In our view, increasing demand for both asset classes will naturally support the value of the Indian rupee against the U.S. dollar.

Income Potential via Carry in Short-Term Rupee Exposures

While equity-only investors may be cheering the

SENSEX to new all-time highs, the rapid gains over the last few weeks could make some investors think that a pullback might be just around the corner. With most Indian stocks trading at around 17 times earnings—compared to the broader emerging market average of 12 times earnings—Indian stocks may appear like less of a bargain.

3 With efficient access to Indian bonds still limited for many investors, we believe that accessing the currency and local money market rates through exchange-traded funds (ETFs) provides an attractive means of participating in the optimistic outlook in India.

Historically, many investors have been interested in the rupee because it is trading at a significant discount to its long-term

purchasing power parity. In fact, the rupee is currently undervalued by 62%.

4 However, this discount will likely begin to fade in the long run. A more immediate reason why we are constructive on the rupee is that the short-term interest rates in India are currently at 8%.

5 Since the

WisdomTree Indian Rupee Strategy Fund (ICN) seeks to provide its exposure to the rupee through forward currency contracts, foreign investors are able to capture the higher interest rates available to Indian investors. In our view this 8% interest rate, the third-highest across all emerging markets,

6 can serve as a buffer to investor returns, should the Indian rupee decline in value. As we mentioned in an

earlier blog post, the cost of hedging the rupee can largely be attributed to this interest rate factor. As a result, investors who take a long position in the rupee are being compensated a large portion of this 8% interest rate differential.

7

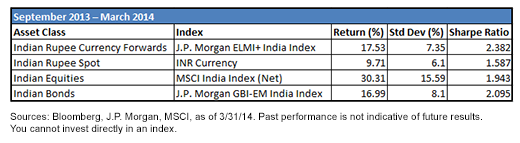

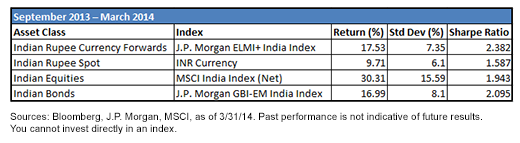

Indian Asset Class Risk vs. Return

For definition of terms in the chart, please visit our Glossary.

For definition of terms in the chart, please visit our Glossary.

As shown in the table above, Indian rupee

currency forwards have provided the best Sharpe ratios across nearly all Indian assets—including stocks and bonds—since the local markets bottomed out in August 2013.

8 In addition to its comparatively attractive risk-adjusted returns, this asset class allows investors to take a position on Indian markets with approximately half the

volatility of Indian equities, the most traditional means of accessing India markets for U.S.-based investors.

Conclusion

The Indian election entails a fair degree of uncertainty. While markets remain hopeful that a change in India’s political winds will ultimately lead to profit, we believe that the rupee represents the most attractive means of expressing a bullish view on the Indian economy.

1Source: EPFR Global, as of 4/9/14.

2Source: Bloomberg, 12/31/13–3/31/14.

3Based on the price/earnings ratio of the MSCI India and the MSCI Emerging Markets indices.

4Source: IMF, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14.

6Sources: Bloomberg, WisdomTree, as of 3/31/14.

7In order to provide investors with an idea of the income potential of investments in forward currency contracts, WisdomTree provides them with an

embedded income yield. The embedded income yield for ICN was 7.81% as of 3/31/14.

8The Indian rupee and MSCI India Index traded at their weakest levels in over 4 years on 8/28/13.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

For definition of terms in the chart, please visit our Glossary.

As shown in the table above, Indian rupee currency forwards have provided the best Sharpe ratios across nearly all Indian assets—including stocks and bonds—since the local markets bottomed out in August 2013.8 In addition to its comparatively attractive risk-adjusted returns, this asset class allows investors to take a position on Indian markets with approximately half the volatility of Indian equities, the most traditional means of accessing India markets for U.S.-based investors.

Conclusion

The Indian election entails a fair degree of uncertainty. While markets remain hopeful that a change in India’s political winds will ultimately lead to profit, we believe that the rupee represents the most attractive means of expressing a bullish view on the Indian economy.

1Source: EPFR Global, as of 4/9/14.

2Source: Bloomberg, 12/31/13–3/31/14.

3Based on the price/earnings ratio of the MSCI India and the MSCI Emerging Markets indices.

4Source: IMF, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14.

6Sources: Bloomberg, WisdomTree, as of 3/31/14.

7In order to provide investors with an idea of the income potential of investments in forward currency contracts, WisdomTree provides them with an embedded income yield. The embedded income yield for ICN was 7.81% as of 3/31/14.

8The Indian rupee and MSCI India Index traded at their weakest levels in over 4 years on 8/28/13.

For definition of terms in the chart, please visit our Glossary.

As shown in the table above, Indian rupee currency forwards have provided the best Sharpe ratios across nearly all Indian assets—including stocks and bonds—since the local markets bottomed out in August 2013.8 In addition to its comparatively attractive risk-adjusted returns, this asset class allows investors to take a position on Indian markets with approximately half the volatility of Indian equities, the most traditional means of accessing India markets for U.S.-based investors.

Conclusion

The Indian election entails a fair degree of uncertainty. While markets remain hopeful that a change in India’s political winds will ultimately lead to profit, we believe that the rupee represents the most attractive means of expressing a bullish view on the Indian economy.

1Source: EPFR Global, as of 4/9/14.

2Source: Bloomberg, 12/31/13–3/31/14.

3Based on the price/earnings ratio of the MSCI India and the MSCI Emerging Markets indices.

4Source: IMF, as of 3/31/14.

5Source: Bloomberg, as of 3/31/14.

6Sources: Bloomberg, WisdomTree, as of 3/31/14.

7In order to provide investors with an idea of the income potential of investments in forward currency contracts, WisdomTree provides them with an embedded income yield. The embedded income yield for ICN was 7.81% as of 3/31/14.

8The Indian rupee and MSCI India Index traded at their weakest levels in over 4 years on 8/28/13.