Looking Under the Hood of Smart Beta: A Focus on the Size Factor

For definitions of indexes in the chart, please visit our glossary.

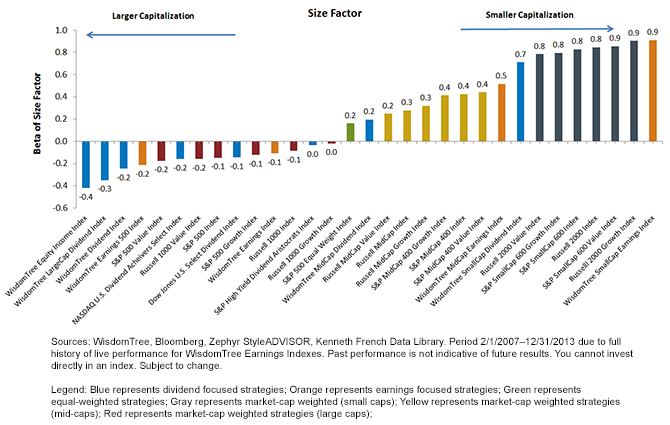

• Equal Weighting: We can start with the classic, intuitive example of equal-weighting the S&P 500 Index to illustrate how different weighting methodologies can influence the size factor of a particular index. We see that the S&P 500 Index registers a negative value (meaning that it’s tilting toward exposure to larger companies) whereas the S&P 500 Equal Weight Index registers a positive value (meaning that its size exposure is tilting toward smaller companies).

o It’s interesting that the S&P 500 Equal Weight Index has a very similar size factor to the WisdomTree MidCap Dividend Index (WTMDI).

• Size Factor Takeaways: The WisdomTree LargeCap Dividend Index (WTLDI) and Equity Income Index (WTHYE) indicated size factors more than twice that of the S&P 500 Index. When critics characterize smart beta as being a tilt to small caps, they are clearly not talking about WisdomTree’s large-cap dividend or earnings approaches, which are more large cap than the S&P 500. Part of this distinction is caused by the fact that WisdomTree selects stocks by market capitalization for its size-based segments, and then weights securities by dividends or Earnings Streams®. In our opinion, that selection rule results in purer size segmentations across the spectrum.

• Interestingly, the WisdomTree Dividend Index, which includes all dividend payers and has more than twice the number of securities of the S&P 500, still has a great large-cap bias and more loading to large caps than the S&P 500 (more negative size factor than the S&P 500 Index).

• Most Small-Cap Tilted: The WisdomTree SmallCap Earnings Index had the largest factor sensitivity to small caps of all the indexes included in the analysis.

What can be done with this factor information to impact strategic investment considerations?

Take 1: Targeting Allocations to Match the Size Exposure of the S&P 500 Index

One of the most widely followed equity indexes is the S&P 500. We mentioned that our Indexes have more of a large-cap bias than the S&P 500. A natural question is, what combination of indexes with our large-cap bias would produce a size exposure similar to the S&P 500?

We think it’s interesting to consider blending WTLDI with mid-cap options in order to bring the weighted average size exposure into alignment with that of the S&P 500 Index, and the two mid-caps we use are the WisdomTree MidCap Earnings Index (WTMEI) and the WisdomTree MidCap Dividend Index (WTMDI).

The conclusion:

• An allocation of 77% WTLDI / 23% WTMEI achieved the same size factor as the S&P 500.

• An allocation of 64% WTLDI / 36% WTMDI achieved the same size factor as the S&P 500. WTMDI had a bigger size factor than WTMEI and thus more was necessary to lower the overall size factor to the S&P 500’s.

The WisdomTree Earnings 500 Index (WTEPS) also has more of a large-cap bias than the S&P 500, and we analyzed what combinations targeted the S&P 500 size factor. They are:

• 91% WTEPS / 9% WTMEI

• 85% WTEPS / 15% WTMDI

As people consider ways in which to potentially outperform the S&P 500 on a risk-adjusted basis, we believe that these are examples of one approach that could be of interest. It also shows that as one looks to add in the WisdomTree large-cap options, there is a large-cap bias to construction relative to the S&P 500 that could impact desired allocations in other segments.

To read our full factor analysis on our smart beta approach, click here.

For definitions of indexes in the chart, please visit our glossary.

• Equal Weighting: We can start with the classic, intuitive example of equal-weighting the S&P 500 Index to illustrate how different weighting methodologies can influence the size factor of a particular index. We see that the S&P 500 Index registers a negative value (meaning that it’s tilting toward exposure to larger companies) whereas the S&P 500 Equal Weight Index registers a positive value (meaning that its size exposure is tilting toward smaller companies).

o It’s interesting that the S&P 500 Equal Weight Index has a very similar size factor to the WisdomTree MidCap Dividend Index (WTMDI).

• Size Factor Takeaways: The WisdomTree LargeCap Dividend Index (WTLDI) and Equity Income Index (WTHYE) indicated size factors more than twice that of the S&P 500 Index. When critics characterize smart beta as being a tilt to small caps, they are clearly not talking about WisdomTree’s large-cap dividend or earnings approaches, which are more large cap than the S&P 500. Part of this distinction is caused by the fact that WisdomTree selects stocks by market capitalization for its size-based segments, and then weights securities by dividends or Earnings Streams®. In our opinion, that selection rule results in purer size segmentations across the spectrum.

• Interestingly, the WisdomTree Dividend Index, which includes all dividend payers and has more than twice the number of securities of the S&P 500, still has a great large-cap bias and more loading to large caps than the S&P 500 (more negative size factor than the S&P 500 Index).

• Most Small-Cap Tilted: The WisdomTree SmallCap Earnings Index had the largest factor sensitivity to small caps of all the indexes included in the analysis.

What can be done with this factor information to impact strategic investment considerations?

Take 1: Targeting Allocations to Match the Size Exposure of the S&P 500 Index

One of the most widely followed equity indexes is the S&P 500. We mentioned that our Indexes have more of a large-cap bias than the S&P 500. A natural question is, what combination of indexes with our large-cap bias would produce a size exposure similar to the S&P 500?

We think it’s interesting to consider blending WTLDI with mid-cap options in order to bring the weighted average size exposure into alignment with that of the S&P 500 Index, and the two mid-caps we use are the WisdomTree MidCap Earnings Index (WTMEI) and the WisdomTree MidCap Dividend Index (WTMDI).

The conclusion:

• An allocation of 77% WTLDI / 23% WTMEI achieved the same size factor as the S&P 500.

• An allocation of 64% WTLDI / 36% WTMDI achieved the same size factor as the S&P 500. WTMDI had a bigger size factor than WTMEI and thus more was necessary to lower the overall size factor to the S&P 500’s.

The WisdomTree Earnings 500 Index (WTEPS) also has more of a large-cap bias than the S&P 500, and we analyzed what combinations targeted the S&P 500 size factor. They are:

• 91% WTEPS / 9% WTMEI

• 85% WTEPS / 15% WTMDI

As people consider ways in which to potentially outperform the S&P 500 on a risk-adjusted basis, we believe that these are examples of one approach that could be of interest. It also shows that as one looks to add in the WisdomTree large-cap options, there is a large-cap bias to construction relative to the S&P 500 that could impact desired allocations in other segments.

To read our full factor analysis on our smart beta approach, click here.

Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. The Dow Jones U.S. Select Dividend Index is calculated, distributed and marketed by Dow Jones Indexes, a licensed trademark of CME Group Index Services LLC, and has been licensed for use.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.