Fast and Furious Dividend Growth to Start 2014

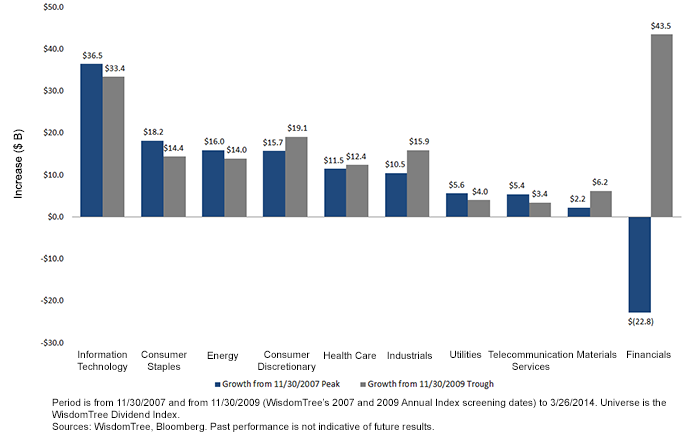

• Information Technology: This sector accounts for almost 37% of the increase in dividends from November 30, 2007, to March 26, 2014, with $36.5 billion of the $98.7 billion total increase in dividends. Technology firms are generally recent initiators, with lots of cash on their balance sheets and potential for further dividend growth. This sector accounted for about 20% of the increase from the November 30, 2009, low.

• Financials: At the November 30, 2007, screening date, financials comprised approximately one-third of the total Dividend Stream, but today they account for only 18%. Recent growth has been strong—with over $43 billion from the bottom in 2009 after the cuts through today. The latest increase came after the Fed’s approval of their stress test results. On the other hand, financials are still over $22 billion short of their November 30, 2007, high—the only sector that is still below its pre-financial crisis highs.

• Broad Growth: It is remarkable to us that 9 out of 10 sectors have grown from the November 30, 2007, level and all 10 are higher than they were on November 30, 2009.

Positioning to Capture the Market’s Dividend Growth

We continue to believe it is important to be broadly diversified in the market to capture the dividend growth. Financial firms, though still on the comeback trail, are widely expected to continue growing their dividends, pending approval from the U.S. government. Information technology firms have large amounts of cash, so we may see more dividend initiations as well as dividend growth from that sector.

Ultimately, strategies focused on looking backward and on regular cycles of 5, 10 or 20 years of consecutive dividend growth are likely to miss out on the new up-and-coming dividend payers (or those that cut dividends during the crisis, such as the aforementioned Bank of America, Wells Fargo and J.P. Morgan).

With WisdomTree’s U.S. dividend family, once a firm indicates a regular dividend and meets other market capitalization and liquidity screens, it becomes eligible for inclusion, allowing these strategies to move quickly to capture the U.S. Dividend Stream as it evolves.

Unless otherwise noted, sources are WisdomTree and Bloomberg.

• Information Technology: This sector accounts for almost 37% of the increase in dividends from November 30, 2007, to March 26, 2014, with $36.5 billion of the $98.7 billion total increase in dividends. Technology firms are generally recent initiators, with lots of cash on their balance sheets and potential for further dividend growth. This sector accounted for about 20% of the increase from the November 30, 2009, low.

• Financials: At the November 30, 2007, screening date, financials comprised approximately one-third of the total Dividend Stream, but today they account for only 18%. Recent growth has been strong—with over $43 billion from the bottom in 2009 after the cuts through today. The latest increase came after the Fed’s approval of their stress test results. On the other hand, financials are still over $22 billion short of their November 30, 2007, high—the only sector that is still below its pre-financial crisis highs.

• Broad Growth: It is remarkable to us that 9 out of 10 sectors have grown from the November 30, 2007, level and all 10 are higher than they were on November 30, 2009.

Positioning to Capture the Market’s Dividend Growth

We continue to believe it is important to be broadly diversified in the market to capture the dividend growth. Financial firms, though still on the comeback trail, are widely expected to continue growing their dividends, pending approval from the U.S. government. Information technology firms have large amounts of cash, so we may see more dividend initiations as well as dividend growth from that sector.

Ultimately, strategies focused on looking backward and on regular cycles of 5, 10 or 20 years of consecutive dividend growth are likely to miss out on the new up-and-coming dividend payers (or those that cut dividends during the crisis, such as the aforementioned Bank of America, Wells Fargo and J.P. Morgan).

With WisdomTree’s U.S. dividend family, once a firm indicates a regular dividend and meets other market capitalization and liquidity screens, it becomes eligible for inclusion, allowing these strategies to move quickly to capture the U.S. Dividend Stream as it evolves.

Unless otherwise noted, sources are WisdomTree and Bloomberg.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. ALPS Distributors, Inc. is not affiliated with Bank of America, Wells Fargo, J.P. Morgan, PepsiCo or Cisco Systems.