The Active vs. Passive Debate in Mid Cap Equities

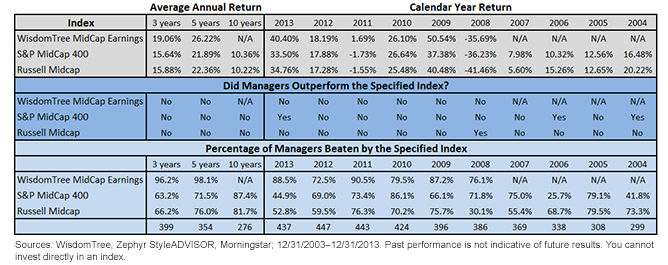

• Majority of Active Managers Underperform – Over the most recent 10-year period the Russell Midcap Index and the S&P MidCap 400 Index outperformed 81.7% and 87.4%, respectively, of funds in the Morningstar Mid-Cap Blend category. The Russell Midcap also outperformed more than 50% of the Morningstar category in 9 out of the past 10 calendar years, and the S&P MidCap 400 outperformed more than 50% of the category in 7 out of the past 10 calendar years.

• WisdomTree MidCap Earnings Index – WTMEI has outperformed close to 99% of the Morningstar category since its inception.1 I find it impressive that the Index was able to outperform over 75% of the category during the worst calendar year for the category (2008) as well as during the best one (2009).

Why Indexes?

Like all investors, active managers are susceptible to behavioral biases that can negatively affect their investment decisions. This is illustrated through the table above, which shows that the majority of active managers actually underperformed their respective benchmarks over the most recent 10-year period and over the majority of calendar years.

For believers of active management, I think these results are even more alarming given the fact that the Russell and S&P indexes are market cap-weighted. Market cap-weighted indexes typically give the greatest weight to the stocks with the highest prices, without regard to any measure of fundamental value. As a result, the market capitalization-weighted index may tend to over-weight more expensive equities and under-weight those that may be relatively less expensive.

Why Smart Beta?

Although I do not feel active management is necessary to provide compelling long-term returns, I do think it is important to invest with a disciplined focus on valuations. WisdomTree uses a rules-based methodology to weight the companies in its Indexes by their underlying fundamentals, such as dividends or earnings, because at WisdomTree we believe that stock markets are not always efficient. Furthermore, WisdomTree rebalances its Indexes annually to adjust for relative value.

As I referenced above, although dispersion levels can’t predict active manager performance, the current low dispersion levels imply that there are potentially fewer opportunities for active managers than usual. Given this reading and the historical underperformance of active managers against traditional indexes, I do not think it is time for active management in mid-cap equities.

1Sources: Zephyr StyleADVISOR, Morningstar; Index inception: 02/01/2007.

• Majority of Active Managers Underperform – Over the most recent 10-year period the Russell Midcap Index and the S&P MidCap 400 Index outperformed 81.7% and 87.4%, respectively, of funds in the Morningstar Mid-Cap Blend category. The Russell Midcap also outperformed more than 50% of the Morningstar category in 9 out of the past 10 calendar years, and the S&P MidCap 400 outperformed more than 50% of the category in 7 out of the past 10 calendar years.

• WisdomTree MidCap Earnings Index – WTMEI has outperformed close to 99% of the Morningstar category since its inception.1 I find it impressive that the Index was able to outperform over 75% of the category during the worst calendar year for the category (2008) as well as during the best one (2009).

Why Indexes?

Like all investors, active managers are susceptible to behavioral biases that can negatively affect their investment decisions. This is illustrated through the table above, which shows that the majority of active managers actually underperformed their respective benchmarks over the most recent 10-year period and over the majority of calendar years.

For believers of active management, I think these results are even more alarming given the fact that the Russell and S&P indexes are market cap-weighted. Market cap-weighted indexes typically give the greatest weight to the stocks with the highest prices, without regard to any measure of fundamental value. As a result, the market capitalization-weighted index may tend to over-weight more expensive equities and under-weight those that may be relatively less expensive.

Why Smart Beta?

Although I do not feel active management is necessary to provide compelling long-term returns, I do think it is important to invest with a disciplined focus on valuations. WisdomTree uses a rules-based methodology to weight the companies in its Indexes by their underlying fundamentals, such as dividends or earnings, because at WisdomTree we believe that stock markets are not always efficient. Furthermore, WisdomTree rebalances its Indexes annually to adjust for relative value.

As I referenced above, although dispersion levels can’t predict active manager performance, the current low dispersion levels imply that there are potentially fewer opportunities for active managers than usual. Given this reading and the historical underperformance of active managers against traditional indexes, I do not think it is time for active management in mid-cap equities.

1Sources: Zephyr StyleADVISOR, Morningstar; Index inception: 02/01/2007.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. This material contains the current research and opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy or deemed to be an offer or sale of any investment product, and it should not be relied on as such. The user of this information assumes the entire risk of any use made of the information provided herein. Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.