What Is the U.S. Dollar Actually Worth? Redux

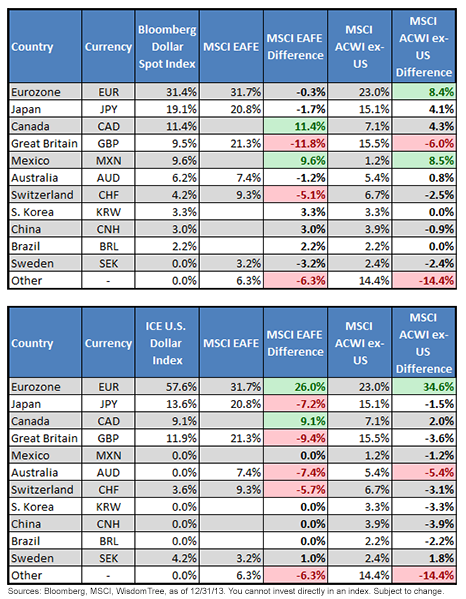

Interestingly enough, BBDXY currently has a remarkably similar weighting scheme to the currency exposures of MSCI EAFE and MSCI ACWI ex-US indexes. While we chose to establish our weighting scheme through global trade and liquidity measures, it is interesting to have our analysis in some ways validated by the relative size of each country’s equity markets and, by extension, their weight in these popular equity indexes. Additionally, BBDXY also avoids the large concentration risk to the euro found in DXY, while at the same time providing a broader approach (10 currencies compared to 6) that also includes exposure to emerging markets.

Real-World Applications

While this coincidence in some ways helps to potentially validate our thinking about the dollar, a perhaps more interesting application for investor portfolios would be to use the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) as a way to opportunistically mitigate exposure to foreign currencies as part of an overall portfolio allocation. As we have seen in recent history, the U.S. dollar tends to benefit during times of market stress. For investors with unhedged international equity exposure, taking short positions in foreign currencies against the U.S. dollar could potentially offset a portion of the losses embedded in their long equity positions. For broader-based portfolios, USDU could also provide a way to tactically express a view on the value of the U.S. dollar.

Interestingly enough, BBDXY currently has a remarkably similar weighting scheme to the currency exposures of MSCI EAFE and MSCI ACWI ex-US indexes. While we chose to establish our weighting scheme through global trade and liquidity measures, it is interesting to have our analysis in some ways validated by the relative size of each country’s equity markets and, by extension, their weight in these popular equity indexes. Additionally, BBDXY also avoids the large concentration risk to the euro found in DXY, while at the same time providing a broader approach (10 currencies compared to 6) that also includes exposure to emerging markets.

Real-World Applications

While this coincidence in some ways helps to potentially validate our thinking about the dollar, a perhaps more interesting application for investor portfolios would be to use the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) as a way to opportunistically mitigate exposure to foreign currencies as part of an overall portfolio allocation. As we have seen in recent history, the U.S. dollar tends to benefit during times of market stress. For investors with unhedged international equity exposure, taking short positions in foreign currencies against the U.S. dollar could potentially offset a portion of the losses embedded in their long equity positions. For broader-based portfolios, USDU could also provide a way to tactically express a view on the value of the U.S. dollar.

Important Risks Related to this Article

The USDU Fund is new and has a limited operating history. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in specific regions or countries, thereby increasing the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements and may decline prior to the expiration of the repurchase agreement term. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Although the Fund invests in very short-term, investment-grade instruments, the Fund is not a “money market” Fund, and it is not the objective of the Fund to maintain a constant share price. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Asset allocation cannot assure a profit nor protect against a loss. ALPS Distributors, Inc., is not affiliated with Bloomberg or MSCI.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.