Middle East Dividend Index Reaches New High

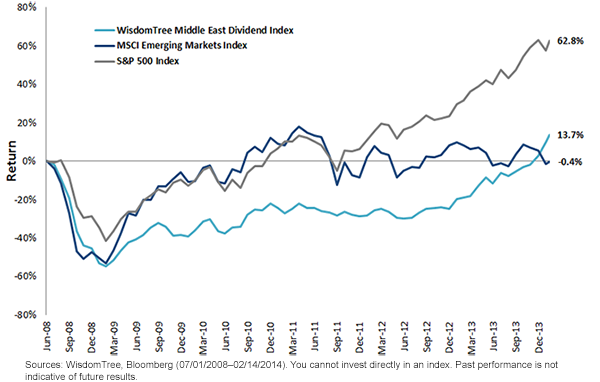

• WisdomTree Middle East Dividend Index Reaches New High – The Index finished the most recent calendar year with a gain of over 37%, putting it at an all-time high and pushing its cumulative return since inception into positive territory for the first time. Year-to-date, WTEMME continues to forge new highs, up close to 10.5%, outperforming both the S&P 500 and MSCI EM by over 10% and almost 16%, respectively.1

• WTEMME Continues to Diverge from MSCI EM – Since the start of last year, WTEMME has finally started to trend higher after a few years of sideways consolidation, and this improvement started only after it was announced by MSCI in June of 2013 that Qatar and the UAE would be upgraded to emerging market status in June 2014. It is impossible to know what the new country weights are going to be in the future, but we did know that market participants would need to add exposure to Qatar and the UAE. As a result, it was expected that these markets would converge upon the traditional emerging markets. But the Middle East countries did not stop there; they continued to move higher even as the emerging markets trended lower. I find this relative strength quite impressive, especially considering the year-to-date action, and I believe there is more to these countries than just the upgrade announcement.

• While the Middle East Dividend Index went down nearly 1 for 1 with the emerging markets during the 2008 crisis for drops over 50%, the traditional emerging markets rebounded strongly in 2009 – with gains of over 70%, while the Middle East Dividend Index languished. It is making its way back from the crisis, and real estate and banking in particular have been doing well in the UAE.

Further Reasons to Consider the Middle East

Although the region has recently reached new highs, I think it still remains relatively attractive from a valuation perspective. WTEMME had a dividend yield of over 5%, surpassing the S&P 500 and MSCI EM indexes by over 3.1% and 2.3%, respectively. From a price-to-earnings perspective, WTEMME traded at 11.5x expected earnings, a little above MSCI EM at 9.5x and below the S&P 500 Index at 15.6x.2

• Valuations Remain Attractive after Strong Performance – The weighted average performance of stocks within WTEMME domiciled in Qatar and the UAE were up over 29% and 99%, respectively. 3 Yet stocks within Qatar have a dividend yield of 4.36% and an estimated price-to-earnings ratio of 12.2x, while UAE stocks had a dividend yield of 2.8% and an estimated price-to-earnings ratio of 12.9x.4

• Dividend Growth Supports Valuations – Firms in the region have recently announced their proposed dividends for the 2013 calendar year, and some of the top weights in WTEMME had signaled for double-digit growth5:

o Qatar National Bank – 16.7% increase

o Industries Qatar – 29.4% increase

o First Gulf Bank – 20.0% increase

Potential Diversification Benefits

Exposure to these Middle East countries represents a different type of emerging market allocation. This can be illustrated through WTEMME’s historically low correlation with MSCI EM and S&P 500 Index.

• 3-Year Monthly Correlation6:

o MSCI EM vs. S&P 500 – 0.77

o WTEMME vs. S&P 500 – 0.56

o WTEMME vs. MSCI EM – 0.45

It is important to remember that regional returns can vary significantly year over year, and it is impossible to time the best-performing region. As a result, we think it is important to remain diversified across the different emerging or frontier countries and not focus just on the traditional countries. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

1Sources: WisdomTree, Bloomberg (12/31/2013–02/14/2014).

2Sources: WisdomTree, Bloomberg (02/14/2014).

3Sources: WisdomTree, Bloomberg (12/31/12–12/31/13).

4Sources: WisdomTree, Bloomberg (02/14/2014).

5WTEMME Index Weight (02/14/14): Qatar National Bank (7.21%), Industries Qatar (7.13%) and First Gulf Bank (6.69%).

6Sources: WisdomTree, Zephyr StyleADVISOR (12/31/10–12/31/13).

• WisdomTree Middle East Dividend Index Reaches New High – The Index finished the most recent calendar year with a gain of over 37%, putting it at an all-time high and pushing its cumulative return since inception into positive territory for the first time. Year-to-date, WTEMME continues to forge new highs, up close to 10.5%, outperforming both the S&P 500 and MSCI EM by over 10% and almost 16%, respectively.1

• WTEMME Continues to Diverge from MSCI EM – Since the start of last year, WTEMME has finally started to trend higher after a few years of sideways consolidation, and this improvement started only after it was announced by MSCI in June of 2013 that Qatar and the UAE would be upgraded to emerging market status in June 2014. It is impossible to know what the new country weights are going to be in the future, but we did know that market participants would need to add exposure to Qatar and the UAE. As a result, it was expected that these markets would converge upon the traditional emerging markets. But the Middle East countries did not stop there; they continued to move higher even as the emerging markets trended lower. I find this relative strength quite impressive, especially considering the year-to-date action, and I believe there is more to these countries than just the upgrade announcement.

• While the Middle East Dividend Index went down nearly 1 for 1 with the emerging markets during the 2008 crisis for drops over 50%, the traditional emerging markets rebounded strongly in 2009 – with gains of over 70%, while the Middle East Dividend Index languished. It is making its way back from the crisis, and real estate and banking in particular have been doing well in the UAE.

Further Reasons to Consider the Middle East

Although the region has recently reached new highs, I think it still remains relatively attractive from a valuation perspective. WTEMME had a dividend yield of over 5%, surpassing the S&P 500 and MSCI EM indexes by over 3.1% and 2.3%, respectively. From a price-to-earnings perspective, WTEMME traded at 11.5x expected earnings, a little above MSCI EM at 9.5x and below the S&P 500 Index at 15.6x.2

• Valuations Remain Attractive after Strong Performance – The weighted average performance of stocks within WTEMME domiciled in Qatar and the UAE were up over 29% and 99%, respectively. 3 Yet stocks within Qatar have a dividend yield of 4.36% and an estimated price-to-earnings ratio of 12.2x, while UAE stocks had a dividend yield of 2.8% and an estimated price-to-earnings ratio of 12.9x.4

• Dividend Growth Supports Valuations – Firms in the region have recently announced their proposed dividends for the 2013 calendar year, and some of the top weights in WTEMME had signaled for double-digit growth5:

o Qatar National Bank – 16.7% increase

o Industries Qatar – 29.4% increase

o First Gulf Bank – 20.0% increase

Potential Diversification Benefits

Exposure to these Middle East countries represents a different type of emerging market allocation. This can be illustrated through WTEMME’s historically low correlation with MSCI EM and S&P 500 Index.

• 3-Year Monthly Correlation6:

o MSCI EM vs. S&P 500 – 0.77

o WTEMME vs. S&P 500 – 0.56

o WTEMME vs. MSCI EM – 0.45

It is important to remember that regional returns can vary significantly year over year, and it is impossible to time the best-performing region. As a result, we think it is important to remain diversified across the different emerging or frontier countries and not focus just on the traditional countries. The WisdomTree Middle East Dividend Index tracks dividend-paying stocks in countries that tend to be under-weighted in many investors’ portfolios.

1Sources: WisdomTree, Bloomberg (12/31/2013–02/14/2014).

2Sources: WisdomTree, Bloomberg (02/14/2014).

3Sources: WisdomTree, Bloomberg (12/31/12–12/31/13).

4Sources: WisdomTree, Bloomberg (02/14/2014).

5WTEMME Index Weight (02/14/14): Qatar National Bank (7.21%), Industries Qatar (7.13%) and First Gulf Bank (6.69%).

6Sources: WisdomTree, Zephyr StyleADVISOR (12/31/10–12/31/13).Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in the Middle East increase the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Qatar or the United Arab Emirates are increasing the impact of events and developments associated with the region, which can adversely affect performance. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.