Deep Capacity Can Be a Benefit to Index Based Investing: The Case of European Small Caps

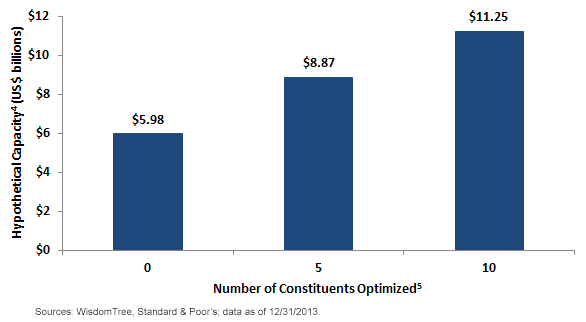

• Scalable Methodology: On December 31, 2013, the WisdomTree Europe SmallCap Dividend Index had 284 constituents. Almost $6 billion of hypothetical assets could track this Index prior to its holding 10% of the market capitalization of any underlying firms.

• Optimization Helps Further: Were one to optimize around the 5 or 10 most constraining firms, the level of hypothetical assets prior to reaching a 10% position in any underlying firm could jump from $6 billion to over $11 billion. To be fair, optimization such as this could lead to greater potential for tracking error. For reference, the 5 and 10 most constraining firms represented approximately 8% and 11%, respectively, of the Index’s weight as of December 31, 2013.

• A Benefit to Proprietary Indexing: One benefit to WisdomTree being the Index developer and ETF sponsor is WisdomTree maintains additional flexibility allowing us to increase the capacity of our Indexes and the ETFs that track their performance after costs, fees and expenses.

Innovative Methodology

The WisdomTree Europe SmallCap Dividend Index is designed to zero in on European small-cap companies that pay dividends. Weighting by cash Dividend Stream lends a degree of scalability to the Index in that it accounts for the number of shares outstanding.

There are few funds available today that provide exposure to European small caps, and the largest traditional mutual fund just closed to new investors recently. This blog post highlights the benefits of following an index-based approach to get exposure to this asset class, of which there are very few vehicles open to investors. For current holdings in the WisdomTree Europe SmallCap Dividend Index, click here.

1European small caps: Refers to constituents of the WisdomTree Europe SmallCap Dividend Index, which delivered nearly 50% returns for the 2013 calendar year. Source: Bloomberg.

2Source: Morningstar Direct.

3Source: Invesco.com.

4Refers to a hypothetical capacity level for assets tracking the performance of an Index, which denotes the level of assets where the Index would prescribe taking its first 10% position in an underlying constituent.

5These numbers refer to hypothetical optimizations in which every security in the Index is held (“0”), to omitting the 10 most constraining positions (“10”).

• Scalable Methodology: On December 31, 2013, the WisdomTree Europe SmallCap Dividend Index had 284 constituents. Almost $6 billion of hypothetical assets could track this Index prior to its holding 10% of the market capitalization of any underlying firms.

• Optimization Helps Further: Were one to optimize around the 5 or 10 most constraining firms, the level of hypothetical assets prior to reaching a 10% position in any underlying firm could jump from $6 billion to over $11 billion. To be fair, optimization such as this could lead to greater potential for tracking error. For reference, the 5 and 10 most constraining firms represented approximately 8% and 11%, respectively, of the Index’s weight as of December 31, 2013.

• A Benefit to Proprietary Indexing: One benefit to WisdomTree being the Index developer and ETF sponsor is WisdomTree maintains additional flexibility allowing us to increase the capacity of our Indexes and the ETFs that track their performance after costs, fees and expenses.

Innovative Methodology

The WisdomTree Europe SmallCap Dividend Index is designed to zero in on European small-cap companies that pay dividends. Weighting by cash Dividend Stream lends a degree of scalability to the Index in that it accounts for the number of shares outstanding.

There are few funds available today that provide exposure to European small caps, and the largest traditional mutual fund just closed to new investors recently. This blog post highlights the benefits of following an index-based approach to get exposure to this asset class, of which there are very few vehicles open to investors. For current holdings in the WisdomTree Europe SmallCap Dividend Index, click here.

1European small caps: Refers to constituents of the WisdomTree Europe SmallCap Dividend Index, which delivered nearly 50% returns for the 2013 calendar year. Source: Bloomberg.

2Source: Morningstar Direct.

3Source: Invesco.com.

4Refers to a hypothetical capacity level for assets tracking the performance of an Index, which denotes the level of assets where the Index would prescribe taking its first 10% position in an underlying constituent.

5These numbers refer to hypothetical optimizations in which every security in the Index is held (“0”), to omitting the 10 most constraining positions (“10”).Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. ETF shares are not sold or bought at their net asset value (NAV) the way mutual fund shares are. ETF shares’ market price may be at, above or below the fund’s NAV. The fund’s NAV will fluctuate with changes in the market value of its portfolio holdings, and the market price of an ETF’s shares will fluctuate with changes in the NAV and the supply and demand in the market for the shares. The market price of ETF shares may differ significantly from their NAV during periods of market volatility. ETF shares may only be redeemed directly with the fund at NAV by authorized participants in very large redemption/creation units.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.