Managing Valuation Risk by Rebalancing

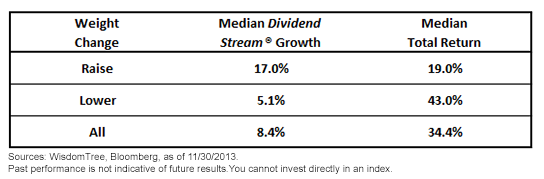

• Dividend Growers Saw Weight Increase: The companies that saw their weight increase at the rebalance had a median dividend growth of 17.0%, which was greater than the median dividend growth of all companies (at 8.4%). Companies that saw their weight lowered at the rebalance had a median dividend growth of just 5.1%.

• Underperformers Typically Saw Weight Increase: Performance is also a key driver of relative changes. The typical stock that saw its weight increase had a median total return that was over 15 percentage points lower than the median of all stocks.

• Outperformers Reduced at Rebalance: The typical stock that saw its weight lowered at the rebalance had a median total return 9 percentage points above all stocks. This is one of the keys to managing valuation risks.

A Detailed Look at the Individual Drivers

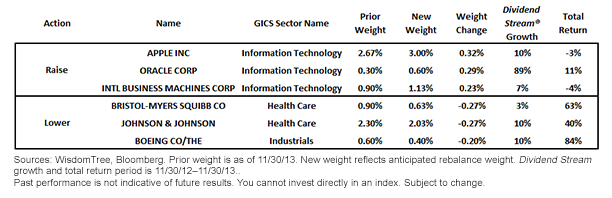

The above was a higher-level overview of the total Index, but in the chart below we highlight a few of the top weight increases and decreases to help further specify the contributors.

Figure 2: WisdomTree Dividend Index (WTDI) Details

• Dividend Growers Saw Weight Increase: The companies that saw their weight increase at the rebalance had a median dividend growth of 17.0%, which was greater than the median dividend growth of all companies (at 8.4%). Companies that saw their weight lowered at the rebalance had a median dividend growth of just 5.1%.

• Underperformers Typically Saw Weight Increase: Performance is also a key driver of relative changes. The typical stock that saw its weight increase had a median total return that was over 15 percentage points lower than the median of all stocks.

• Outperformers Reduced at Rebalance: The typical stock that saw its weight lowered at the rebalance had a median total return 9 percentage points above all stocks. This is one of the keys to managing valuation risks.

A Detailed Look at the Individual Drivers

The above was a higher-level overview of the total Index, but in the chart below we highlight a few of the top weight increases and decreases to help further specify the contributors.

Figure 2: WisdomTree Dividend Index (WTDI) Details

For current holdings of the WisdomTree Dividend Index, please click here.

• Information Technology Earned Largest Increase: The biggest increase in weight for any sector in WTDI occurred in Information Technology—an increase of 0.9%, which was driven primarily by its dividend growth. As noted above; Apple, Oracle and IBM all helped contribute to this increase in weight, having grown their dividends faster than their prices over the period and thus ultimately improving the fundamental relationship between price and dividends.

• Health Care Saw Weight Lowered: Over the period, the Industrial and Health Care sectors saw the largest reduction in weight within WTDI. Both sectors saw strong absolute returns over the period, which made it harder for their dividend growth to keep pace. The three examples above that saw a reduction in weight help illustrate this trend, with an average return of 62% over the period, but an average dividend growth below 8%.

Importance of Incorporating a Relative Rebalance

The WisdomTree annual rebalance is a key element of the added value of WisdomTree’s Index methodology and can help manage valuation risks. WisdomTree Indexes use dividend growth as a key factor in determining which companies get increased weight at a rebalance. We interpret another year of double-digit dividend growth as a very positive indicator of underlying market fundamentals and believe it helps provide a notable foundation for potential future gains.

For current holdings of the WisdomTree Dividend Index, please click here.

• Information Technology Earned Largest Increase: The biggest increase in weight for any sector in WTDI occurred in Information Technology—an increase of 0.9%, which was driven primarily by its dividend growth. As noted above; Apple, Oracle and IBM all helped contribute to this increase in weight, having grown their dividends faster than their prices over the period and thus ultimately improving the fundamental relationship between price and dividends.

• Health Care Saw Weight Lowered: Over the period, the Industrial and Health Care sectors saw the largest reduction in weight within WTDI. Both sectors saw strong absolute returns over the period, which made it harder for their dividend growth to keep pace. The three examples above that saw a reduction in weight help illustrate this trend, with an average return of 62% over the period, but an average dividend growth below 8%.

Importance of Incorporating a Relative Rebalance

The WisdomTree annual rebalance is a key element of the added value of WisdomTree’s Index methodology and can help manage valuation risks. WisdomTree Indexes use dividend growth as a key factor in determining which companies get increased weight at a rebalance. We interpret another year of double-digit dividend growth as a very positive indicator of underlying market fundamentals and believe it helps provide a notable foundation for potential future gains.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.