Interest Rate Differentials Imply the British Pound May Weaken

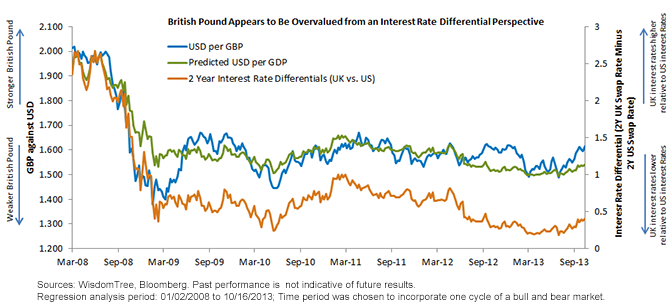

• The two-year interest rate differentials are a significant factor explaining currency changes with a positive relationship—i.e., that when two-year rates rise in the UK compared to the U.S., the British pound tends to strengthen against the USD. The two-year interest rate differentials (orange line) have been on a downward trend, implying that two-year rates in the UK, while higher than those of the U.S., have been on a decline since 2011.

• This model implies that the warranted rate of the GBP against the USD based on changes in interest rate differentials would be 1.539. This suggests that the current level of the pound—of 1.617—may be approximately 4.8% too high, given the changes in interest rates we have seen.

• What is most interesting about this regression analysis is that the current (10/16/2013) predicted value of the GBP vs. the USD (green line) deviates significantly from the actual value of the GBP vs. the USD (blue line). This 4.8% deviation is rare by historical standards and has occurred less than 10% of the time since 2008.

• One measure for how accurate these statistical models are is “goodness of fit,” as measured by the R-squared of the analysis. An R-squared of 0% suggests that the model is unable to explain the variability of the British pound based on the two-year interest rate differentials. An R-squared of 100%, on the other hand, suggests that the model is able to explain all of the variability of the British pound based on the two-year interest rate differentials. This particular model had an R-squared of 76.8%. For statistical analysis, this is a fairly high percentage.

In conclusion, economic theory and empirical evidence suggest that the British pound has room to depreciate against the U.S. dollar. While good economic data out of the UK has buoyed sentiment around the currency, disappointing economic data could trigger a sell-off, causing the currency to trade more in line with its interest rate differentials. For those who are allocating to United Kingdom equities, currency-hedged strategies can be an important tool.

1The interest rate differentials used were based on interest rate swaps. These are a highly liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount, from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. An alternate measure of interest rate differentials are the respective government bond differentials, but they tend to have distant maturities and are subject mostly to sovereign related stresses.

• The two-year interest rate differentials are a significant factor explaining currency changes with a positive relationship—i.e., that when two-year rates rise in the UK compared to the U.S., the British pound tends to strengthen against the USD. The two-year interest rate differentials (orange line) have been on a downward trend, implying that two-year rates in the UK, while higher than those of the U.S., have been on a decline since 2011.

• This model implies that the warranted rate of the GBP against the USD based on changes in interest rate differentials would be 1.539. This suggests that the current level of the pound—of 1.617—may be approximately 4.8% too high, given the changes in interest rates we have seen.

• What is most interesting about this regression analysis is that the current (10/16/2013) predicted value of the GBP vs. the USD (green line) deviates significantly from the actual value of the GBP vs. the USD (blue line). This 4.8% deviation is rare by historical standards and has occurred less than 10% of the time since 2008.

• One measure for how accurate these statistical models are is “goodness of fit,” as measured by the R-squared of the analysis. An R-squared of 0% suggests that the model is unable to explain the variability of the British pound based on the two-year interest rate differentials. An R-squared of 100%, on the other hand, suggests that the model is able to explain all of the variability of the British pound based on the two-year interest rate differentials. This particular model had an R-squared of 76.8%. For statistical analysis, this is a fairly high percentage.

In conclusion, economic theory and empirical evidence suggest that the British pound has room to depreciate against the U.S. dollar. While good economic data out of the UK has buoyed sentiment around the currency, disappointing economic data could trigger a sell-off, causing the currency to trade more in line with its interest rate differentials. For those who are allocating to United Kingdom equities, currency-hedged strategies can be an important tool.

1The interest rate differentials used were based on interest rate swaps. These are a highly liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount, from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. An alternate measure of interest rate differentials are the respective government bond differentials, but they tend to have distant maturities and are subject mostly to sovereign related stresses.Important Risks Related to this Article

Investments focused in the United Kingdom are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.