Look to Japan, Emerging Markets for Cheapest Valuations Among Global Small Caps

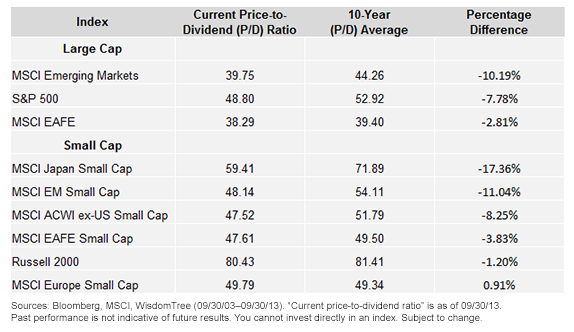

• Global Small Caps Show Similar Price-to-Dividend Ratios as the S&P 500 Index – Typically, one might expect small caps to trade at higher premiums than large caps as a result of their higher growth expectations. Of course, there are regional differences, but we find it interesting that the MSCI EM Small Cap, MSCI EAFE Small Cap and MSCI Europe Small Cap indexes are all showing similar price-to-dividend ratios as the S&P 500 Index.

• Highest Price-to-Dividend Ratio: Note that the Russell 2000 Index has a price-to-dividend ratio of over 80x, which is more than 60% higher than that of the S&P 500. All foreign small-cap indexes are significantly lower than the Russell 2000.

• Japan Small Caps Display Highest Discount to Historical Average – Looking at the differences in the indexes’ current price-to-dividend ratio compared to their 10-year average, Japan currently is selling at a discount of more than 17%. We feel this is important to note because the Japanese government has taken aggressive action to end deflation by adopting a bold monetary policy and has signaled it will follow up with fiscal and structural reforms. We believe these actions should continue to provide tailwind for Japanese large and especially small caps as the full effects are being felt by the local economy.

• Emerging Market Small Caps Appear Attractive – Most economists expect emerging markets to grow faster than developed markets over the next decade, so we find it interesting that, as a region, they are currently priced at a discount. Also, emerging markets have displayed the highest regional dividend growth over the past 10 years, with large-cap dividends growing over 12% and small caps at almost 15% on an average annual basis.1 I believe this has the potential to continue in the long term if emerging market growth expectations materialize.

Conclusion

Without question, we feel investors should benefit by including exposure to global small caps in a diversified portfolio over the long term. After such strong recent short-term performance, we believe a focus on a fundamental rebalancing process becomes necessary to potentially manage valuation risk.

While market capitalization-weighted indexes by their definition and investment process allocate the greatest weights to the firms with the largest market caps and the stocks that have appreciated the most, WisdomTree Indexes focus on fundamentals—either dividends or earnings—to determine their constituent weights. We believe this gives WisdomTree Indexes the potential to sell stocks that have become more expensive relative to their underlying fundamentals and buy stocks that have become less expensive relative to their underlying fundamentals.

The cheapest part of the global small-cap market, when looking at current ratios versus their 10-year averages, appears to be Japan, followed by the emerging markets. I see both of these as attractive areas if one wants to diversify one’s U.S. small-cap allocations.

1Sources: WisdomTree, MSCI (09/30/03–09/30/13).

• Global Small Caps Show Similar Price-to-Dividend Ratios as the S&P 500 Index – Typically, one might expect small caps to trade at higher premiums than large caps as a result of their higher growth expectations. Of course, there are regional differences, but we find it interesting that the MSCI EM Small Cap, MSCI EAFE Small Cap and MSCI Europe Small Cap indexes are all showing similar price-to-dividend ratios as the S&P 500 Index.

• Highest Price-to-Dividend Ratio: Note that the Russell 2000 Index has a price-to-dividend ratio of over 80x, which is more than 60% higher than that of the S&P 500. All foreign small-cap indexes are significantly lower than the Russell 2000.

• Japan Small Caps Display Highest Discount to Historical Average – Looking at the differences in the indexes’ current price-to-dividend ratio compared to their 10-year average, Japan currently is selling at a discount of more than 17%. We feel this is important to note because the Japanese government has taken aggressive action to end deflation by adopting a bold monetary policy and has signaled it will follow up with fiscal and structural reforms. We believe these actions should continue to provide tailwind for Japanese large and especially small caps as the full effects are being felt by the local economy.

• Emerging Market Small Caps Appear Attractive – Most economists expect emerging markets to grow faster than developed markets over the next decade, so we find it interesting that, as a region, they are currently priced at a discount. Also, emerging markets have displayed the highest regional dividend growth over the past 10 years, with large-cap dividends growing over 12% and small caps at almost 15% on an average annual basis.1 I believe this has the potential to continue in the long term if emerging market growth expectations materialize.

Conclusion

Without question, we feel investors should benefit by including exposure to global small caps in a diversified portfolio over the long term. After such strong recent short-term performance, we believe a focus on a fundamental rebalancing process becomes necessary to potentially manage valuation risk.

While market capitalization-weighted indexes by their definition and investment process allocate the greatest weights to the firms with the largest market caps and the stocks that have appreciated the most, WisdomTree Indexes focus on fundamentals—either dividends or earnings—to determine their constituent weights. We believe this gives WisdomTree Indexes the potential to sell stocks that have become more expensive relative to their underlying fundamentals and buy stocks that have become less expensive relative to their underlying fundamentals.

The cheapest part of the global small-cap market, when looking at current ratios versus their 10-year averages, appears to be Japan, followed by the emerging markets. I see both of these as attractive areas if one wants to diversify one’s U.S. small-cap allocations.

1Sources: WisdomTree, MSCI (09/30/03–09/30/13).Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Diversification does not eliminate the risk of experiencing investment losses. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.