Will Japanese Investors Buy More Equities?

Spread over 10-Year JGBs

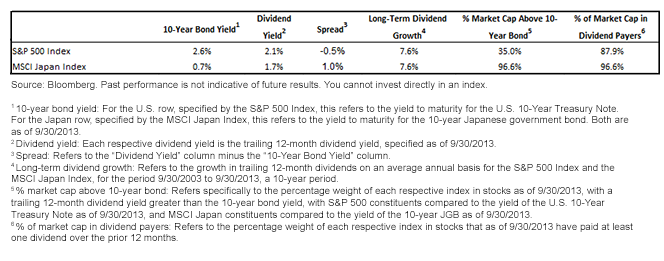

Those looking at the trailing 12-month dividend yield of the MSCI Japan Index will realize that it is approximately 1.0% higher than that of the 10-year JGB. What this ultimately means is that traditional avenues of fixed income investment in Japan are looking expensive compared to equities. Fixed income, by definition, offers a fixed payment of interest over time, whereas with equities, one has the potential to see dividends grow over time. Over the last 10 years, dividend growth in Japan has averaged about 7.6% per year.1

Dividend Growth

Those observing the dividend growth of the MSCI Japan Index will note that, over the past 10 years, the level has been fairly similar to that of the U.S., with U.S. equities represented by the S&P 500 Index. Interestingly, inflation has been much higher in the United States (as measured by the Consumer Price Index) than in Japan (as measured by the Japan Nationwide Consumer Price Index), so the dividend growth of Japanese equities has been much higher, when measured against Japan’s inflation, than has the dividend growth of U.S. equities (measured against U.S. inflation).2

Percentage of Market Cap Earning More Than Government Bonds

One statistic that has been cited in recent years is how many stocks in the United States had a dividend yield ahead of the U.S. Treasury Bond. Since the start of the year, as interest rates3 have risen almost 100 basis points, that percentage has declined, and currently the dividend yield of the S&P 500 Index is approximately 50 basis points less than the Treasury. However, given the 68 basis point 10-year JGB, the hurdle is much lower for Japan. The fact that more than 96% of the MSCI Japan Index’s market cap is in stocks with yields above that of the 10-year JGB is powerful—especially when combined with the fact that 96% of the market cap of this index actually pays dividends.4 Just as it was a motivator for many in the U.S. to buy dividend-paying stocks in a low-rate environment, this can become more important for the Japanese as well.

Conclusion

After so many years of hunkering down in cash and government bonds, Japanese households cannot be expected to shift into equities wholesale. Many remember the bubble period of the late 1980s and the long-term deflation they faced. However, as Prime Minister Abe’s economic revival plans begin to take hold and inflation returns to Japan, the current dividend yield spread for the MSCI Japan Index over JGBs and the potential for dividend growth can begin to attract more Japanese to equities. And the NISA account establishes some tax preferences that can also help contribute to slowly changing mindsets.

1“Dividend growth in Japan” refers specifically to the trailing 12-month dividend growth of the MSCI Japan Index from 9/30/2003 to 9/30/2013.

2Source: Bloomberg, with data through 8/31/2013. From 7/31/2009 to 8/31/2013, the Consumer Price Index was higher than the Japan Nationwide Consumer Price Index.

3Refers to the interest rate on the U.S. 10-Year Treasury Note, measured from 12/31/2012 to 9/30/2013.

4Source: Bloomberg; data as of 9/30/2013.

Spread over 10-Year JGBs

Those looking at the trailing 12-month dividend yield of the MSCI Japan Index will realize that it is approximately 1.0% higher than that of the 10-year JGB. What this ultimately means is that traditional avenues of fixed income investment in Japan are looking expensive compared to equities. Fixed income, by definition, offers a fixed payment of interest over time, whereas with equities, one has the potential to see dividends grow over time. Over the last 10 years, dividend growth in Japan has averaged about 7.6% per year.1

Dividend Growth

Those observing the dividend growth of the MSCI Japan Index will note that, over the past 10 years, the level has been fairly similar to that of the U.S., with U.S. equities represented by the S&P 500 Index. Interestingly, inflation has been much higher in the United States (as measured by the Consumer Price Index) than in Japan (as measured by the Japan Nationwide Consumer Price Index), so the dividend growth of Japanese equities has been much higher, when measured against Japan’s inflation, than has the dividend growth of U.S. equities (measured against U.S. inflation).2

Percentage of Market Cap Earning More Than Government Bonds

One statistic that has been cited in recent years is how many stocks in the United States had a dividend yield ahead of the U.S. Treasury Bond. Since the start of the year, as interest rates3 have risen almost 100 basis points, that percentage has declined, and currently the dividend yield of the S&P 500 Index is approximately 50 basis points less than the Treasury. However, given the 68 basis point 10-year JGB, the hurdle is much lower for Japan. The fact that more than 96% of the MSCI Japan Index’s market cap is in stocks with yields above that of the 10-year JGB is powerful—especially when combined with the fact that 96% of the market cap of this index actually pays dividends.4 Just as it was a motivator for many in the U.S. to buy dividend-paying stocks in a low-rate environment, this can become more important for the Japanese as well.

Conclusion

After so many years of hunkering down in cash and government bonds, Japanese households cannot be expected to shift into equities wholesale. Many remember the bubble period of the late 1980s and the long-term deflation they faced. However, as Prime Minister Abe’s economic revival plans begin to take hold and inflation returns to Japan, the current dividend yield spread for the MSCI Japan Index over JGBs and the potential for dividend growth can begin to attract more Japanese to equities. And the NISA account establishes some tax preferences that can also help contribute to slowly changing mindsets.

1“Dividend growth in Japan” refers specifically to the trailing 12-month dividend growth of the MSCI Japan Index from 9/30/2003 to 9/30/2013.

2Source: Bloomberg, with data through 8/31/2013. From 7/31/2009 to 8/31/2013, the Consumer Price Index was higher than the Japan Nationwide Consumer Price Index.

3Refers to the interest rate on the U.S. 10-Year Treasury Note, measured from 12/31/2012 to 9/30/2013.

4Source: Bloomberg; data as of 9/30/2013. Important Risks Related to this Article

Investments focusing on Japan increase the impact of events and developments in Japan, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investment risk and the effect of varied economic conditions. Neither WisdomTree Investments, Inc. nor its affiliates, nor ALPS Distributors, Inc., or its affiliates provide tax advice. Investors seeking tax advice should consult an independent tax advisor.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.