It is widely recognized that emerging market equities are very susceptible to investor sentiment—a fact that can work toward generating both positive and negative performance at different points in time. Within emerging market economies, two of the data points that people get most attracted to are:

• Fast rates of economic growth compared to the developed world (fast growth rates)

• Very large populations (large numbers)

Fast growth rates and large numbers are two elements that have the potential to make investors forget some of the more basic elements of investing—such as

valuation—and simply get excited. Historically, we’ve seen that excitement at the exclusion of all else has typically been associated with disappointing subsequent returns.

Historically, Consumer Sectors (Staples and Discretionary) Have Tended to Be Expensive

Because investors are easily enamored with the theme of consumer growth in emerging markets, we believe that valuation risk is one of the single greatest risks to consumer-oriented stocks and sectors in the emerging markets today. Looking specifically at the

MSCI Emerging Markets Consumer Discretionary Index (Discretionary) and the

MSCI Emerging Markets Consumer Staples Index (Staples), we see:

•

Over the 10 Years Ending 8/31/2013: Discretionary traded at an average

price-to-earnings (P/E) ratio approximately 5% above that of the broader

MSCI Emerging Markets Index (MSCI EM Index), while Staples traded at an average P/E ratio of nearly 50% above this same benchmark over the same period.

•

As of 8/31/2013: Currently, Discretionary has a P/E ratio approximately 13.5% above that of the MSCI EM Index (almost three times above its 10-year average), and Staples has a P/E ratio about 100% above that of the broad market.

We want to bring this point to people’s attention to remind them that while a theme—such as that of the EM consumer—may look attractive, it cannot be considered in a vacuum. Valuation must remain an important question, and we took this as an important challenge to tackle as we developed our methodology for the

WisdomTree Emerging Markets Consumer Growth Index (WTEMCG).

A Double-Barreled Valuation Discipline—Selection and Weighting

When creating any methodology for an index, there are two broad concepts that must be considered. First is stock selection, in that there is always an initial universe of eligible companies from which a methodology must select constituents in order to emphasize certain types of attributes over others. Typically, the types of firms that your selection steers you away from are just as important as what your selection steers you toward. For WTEMCG, eligible companies are screened by their

earnings yield, a factor that comprises a one-third weight within the composite score that determines the ultimate constituent list. Firms with relatively lower earnings yields—and, therefore, more expensive valuations—may score low enough by this metric that, even if their other scores are favorable, they do not gain inclusion in the Index.

The second broad concept in Index construction regards weighting, a process that only begins after the final constituent list is set. As a general note, a big WisdomTree theme is weighting by

fundamentals, so a firm’s share price is not a primary determining factor in its weight. In the case of WTEMCG, constituents are weighted by their earnings. Let’s compare an

earnings-weighted methodology to a

market capitalization-weighted methodology for two firms with:

1. The same number of shares outstanding

2. The same level of earnings per share, and

3. Different share prices

In this hypothetical we can say that a market capitalization-weighted approach would give more weight to the firm with the higher price, as that firm would necessarily have the higher market capitalization. Since both firms also have the same earnings per share, this firm would also have the higher P/E ratio. On the other hand, an earnings-weighted approach would give an equal weight to both firms, which, in other words, means giving more weight to the firm with the lower P/E ratio relative to the market capitalization-weighted approach.

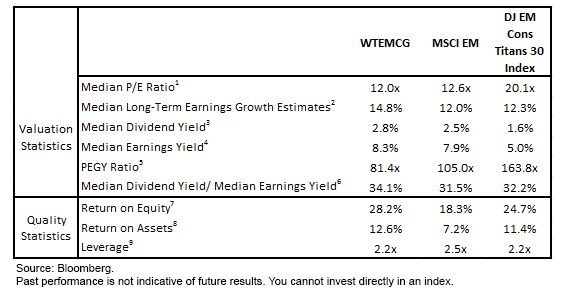

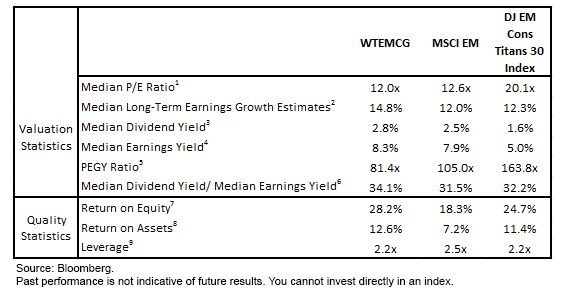

Result: WTEMCG Exhibited a Similar Valuation as MSCI EM (as of 8/31/2013)

For definitions of terms in the chart, please visit our Glossary.

For definitions of terms in the chart, please visit our Glossary.

•

Similar Median P/E ratio to MSCI EM: WTEMCG exhibited a similar median P/E ratio of approximately 12x as the MSCI EM as of 8/31/2013. The

Dow Jones Emerging Markets Consumer Titans 30 Index—an Index of 30 firms in the Consumer Discretionary and Consumer Staples sectors, weighted by market capitalization—exhibited a median P/E ratio of greater than 20x.

•

PEGY Ratio Appears Attractive: Of the three indexes shown, WTEMCG exhibited the lowest PEGY ratio—a ratio that specifically denotes the level of the median P/E ratio of the Index relative to its median long-term earnings growth estimates. It is approximately half that of the Dow Jones Emerging Markets Consumer Titans 30 Index, due to the fact that WTEMCG has both a lower median P/E ratio and a higher level of median long-term earnings growth estimates.

Conclusion

Regardless of WTEMCG’s current valuation, the biggest ongoing benefit of the methodology, we believe, comes from the ongoing disciplined rebalancing process. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be sensitive to valuation.

Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

For definitions of terms in the chart, please visit our Glossary.

• Similar Median P/E ratio to MSCI EM: WTEMCG exhibited a similar median P/E ratio of approximately 12x as the MSCI EM as of 8/31/2013. The Dow Jones Emerging Markets Consumer Titans 30 Index—an Index of 30 firms in the Consumer Discretionary and Consumer Staples sectors, weighted by market capitalization—exhibited a median P/E ratio of greater than 20x.

• PEGY Ratio Appears Attractive: Of the three indexes shown, WTEMCG exhibited the lowest PEGY ratio—a ratio that specifically denotes the level of the median P/E ratio of the Index relative to its median long-term earnings growth estimates. It is approximately half that of the Dow Jones Emerging Markets Consumer Titans 30 Index, due to the fact that WTEMCG has both a lower median P/E ratio and a higher level of median long-term earnings growth estimates.

Conclusion

Regardless of WTEMCG’s current valuation, the biggest ongoing benefit of the methodology, we believe, comes from the ongoing disciplined rebalancing process. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be sensitive to valuation.

For definitions of terms in the chart, please visit our Glossary.

• Similar Median P/E ratio to MSCI EM: WTEMCG exhibited a similar median P/E ratio of approximately 12x as the MSCI EM as of 8/31/2013. The Dow Jones Emerging Markets Consumer Titans 30 Index—an Index of 30 firms in the Consumer Discretionary and Consumer Staples sectors, weighted by market capitalization—exhibited a median P/E ratio of greater than 20x.

• PEGY Ratio Appears Attractive: Of the three indexes shown, WTEMCG exhibited the lowest PEGY ratio—a ratio that specifically denotes the level of the median P/E ratio of the Index relative to its median long-term earnings growth estimates. It is approximately half that of the Dow Jones Emerging Markets Consumer Titans 30 Index, due to the fact that WTEMCG has both a lower median P/E ratio and a higher level of median long-term earnings growth estimates.

Conclusion

Regardless of WTEMCG’s current valuation, the biggest ongoing benefit of the methodology, we believe, comes from the ongoing disciplined rebalancing process. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be sensitive to valuation.