Where We See the Greatest Opportunities in Emerging Market Fixed Income: Part I

For definitions of terms and indexes in the chart, please visit our Glossary.

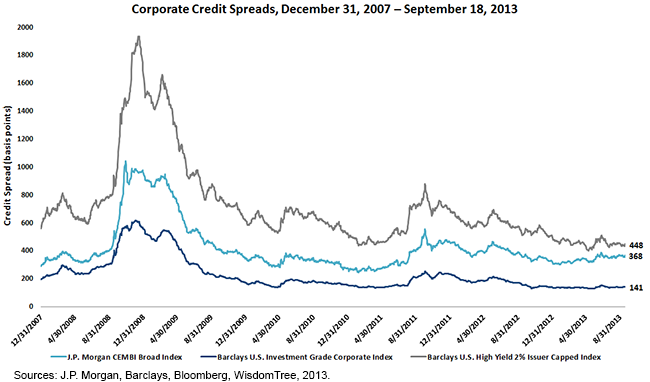

As shown in the chart above, credit spreads have generally trended lower over the last five years. With a recovering global economy and healthy corporate profits, companies posed less of a risk to lenders. After a momentary spike in September 2011 (caused by concerns in Europe), credit spreads continued to tighten through mid-2013. For much of this period, EM corporate spreads moved largely in concert with those of U.S. companies. However, due to a combination of moderating Chinese growth and better than expected U.S. data, yields in emerging market corporate bonds began to diverge. Even though spreads in U.S. credit continue to trade at or below their 12-month average, spreads in emerging markets have widened to 368 basis points, currently near their closest relative spread to U.S. high yield in history. Although emerging markets present an additional wrinkle for investors', the narrowing of the spread between EM corporates (an asset class that is currently rated 69% investment grade1) to an all high-yield portfolio should have EM popping up on more investors’ radars. In perhaps an even more interesting development, the so-called “EM premium” is currently trading at levels not seen since the bottoming of the global financial crisis in early 2009.

For definitions of terms and indexes in the chart, please visit our Glossary.

As shown in the chart above, credit spreads have generally trended lower over the last five years. With a recovering global economy and healthy corporate profits, companies posed less of a risk to lenders. After a momentary spike in September 2011 (caused by concerns in Europe), credit spreads continued to tighten through mid-2013. For much of this period, EM corporate spreads moved largely in concert with those of U.S. companies. However, due to a combination of moderating Chinese growth and better than expected U.S. data, yields in emerging market corporate bonds began to diverge. Even though spreads in U.S. credit continue to trade at or below their 12-month average, spreads in emerging markets have widened to 368 basis points, currently near their closest relative spread to U.S. high yield in history. Although emerging markets present an additional wrinkle for investors', the narrowing of the spread between EM corporates (an asset class that is currently rated 69% investment grade1) to an all high-yield portfolio should have EM popping up on more investors’ radars. In perhaps an even more interesting development, the so-called “EM premium” is currently trading at levels not seen since the bottoming of the global financial crisis in early 2009.

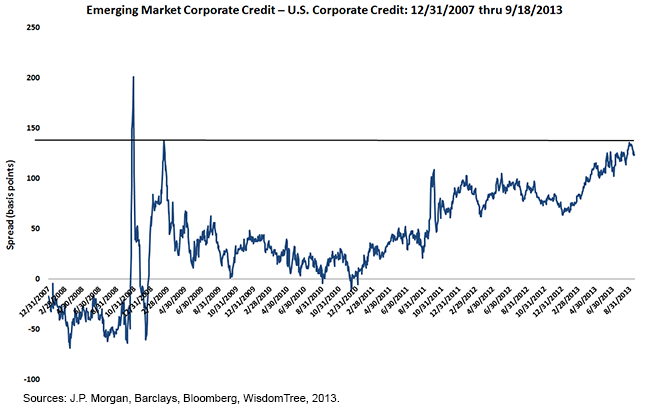

In the chart above, we compare a similarly rated composite of U.S. corporate bonds to the J.P. Morgan Corporate Emerging Markets Bond Index Broad. In the last week, the relative credit spread between emerging markets and the U.S. was trading at all-time wide levels. In our view this implies that either EM corporate bonds are undervalued or that U.S. credit is overvalued, at least when using credit ratings as a proxy for risk.

Overcoming the EM Stigma

Even though they understand the quantitative advantages of EM credit investing (higher yields for comparable credit quality businesses), the thought of lending to companies headquartered in a foreign country seems to cause some investors concern. However, just like equity investing, by limiting your investable universe to developed markets, you severely restrict your investment opportunity set (and the potential for declining correlations and excess returns). With EM lagging across virtually all asset classes this year, it might be trendy to decry the end of EM investing. But many of the companies represented in the EM corporate investable universe are multi-billion dollar, multinational corporations with significant track records and credit histories. The combination of solid fundamentals and above market interest rates due to their country of domicile could make for an attractive investment if investors can put their biases behind them.

While investor interest has been increasing in recent years, EM corporate credit comprises only 4% of the Barclays Global Aggregate Corporate Index.2 At current levels, EM corporate debt appears to be attractively priced compared to U.S. credit. Should investors believe in the long-term opportunity of emerging markets, EM credit may provide an attractive way to generate income in their portfolios while at the same time reducing volatility relative to traditional equity investments in these markets.

1Source: J.P. Morgan, August 31, 2013.

2Barclays, August 31, 2013

In the chart above, we compare a similarly rated composite of U.S. corporate bonds to the J.P. Morgan Corporate Emerging Markets Bond Index Broad. In the last week, the relative credit spread between emerging markets and the U.S. was trading at all-time wide levels. In our view this implies that either EM corporate bonds are undervalued or that U.S. credit is overvalued, at least when using credit ratings as a proxy for risk.

Overcoming the EM Stigma

Even though they understand the quantitative advantages of EM credit investing (higher yields for comparable credit quality businesses), the thought of lending to companies headquartered in a foreign country seems to cause some investors concern. However, just like equity investing, by limiting your investable universe to developed markets, you severely restrict your investment opportunity set (and the potential for declining correlations and excess returns). With EM lagging across virtually all asset classes this year, it might be trendy to decry the end of EM investing. But many of the companies represented in the EM corporate investable universe are multi-billion dollar, multinational corporations with significant track records and credit histories. The combination of solid fundamentals and above market interest rates due to their country of domicile could make for an attractive investment if investors can put their biases behind them.

While investor interest has been increasing in recent years, EM corporate credit comprises only 4% of the Barclays Global Aggregate Corporate Index.2 At current levels, EM corporate debt appears to be attractively priced compared to U.S. credit. Should investors believe in the long-term opportunity of emerging markets, EM credit may provide an attractive way to generate income in their portfolios while at the same time reducing volatility relative to traditional equity investments in these markets.

1Source: J.P. Morgan, August 31, 2013.

2Barclays, August 31, 2013Important Risks Related to this Article

You cannot invest directly in an index.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.