Japanese Large Caps Diverge from Small Caps

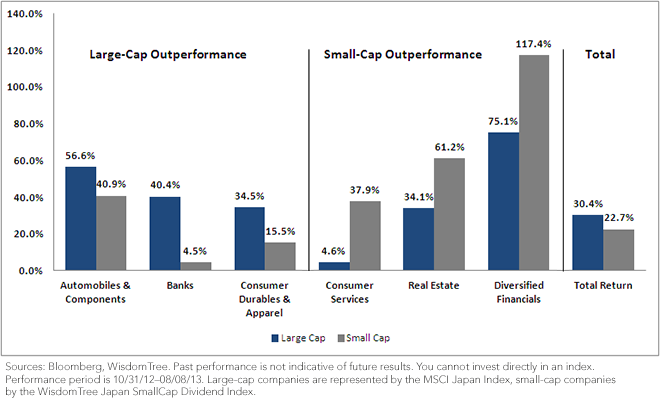

• Large-Cap Banks Outperform – The largest-cap banks, such as Mitsubishi UFJ Financial Group, Mizuho Financial Group and Mitsui Financial Group, are all up over 40% during the period. These three banks have profited more from a weaker yen and a rising equity market than some of their smaller counterparts. They have benefited from increased capital market activity, investment trust sales and brokerage fee income, all of which continues to grow with the stock market recovery.

• Small-Cap Real Estate and Diversified Financials Outperform on Domestic Trends – Real estate companies and real estate investment trusts (REITs) have been among the strongest performers. The Bank of Japan has been buying REITs, which has provided a tailwind for the industry.

• Automobiles and Consumer Durables Increase on Yen Weakness – Large automakers such as Nissan, Honda, Mazda and Toyota have all benefited from a weakening yen due to their export-oriented business models. Yen weakness has accounted for a majority of the automakers’ recent profitability, and Toyota just announced that ¥260 billion of their approximately ¥270 billion profit could be attributed to yen weakness.1 Consumer durables companies such as Sony and Panasonic have also benefited from a weakening yen, essentially making their products more attractive to overseas customers and boosting foreign profits through a lower, more advantageous exchange rate.

• Consumer Services Tied to Local Economy – The large performance difference in the consumer services industry is mainly a result of the industry group composition. A majority of these firms are tied to the local economy. As consumer confidence continues to increase, I expect this industry group to continue to benefit.

Potentially Focus on Smaller Companies for Future Domestic Growth

I believe the relationship between the Japanese large- and small-cap equity performance has been influenced by the yen’s substantial movements. Although some small-cap industries have already begun to benefit from Abe’s policies (e.g., real estate and diversified financials), I think the majority of the smaller-cap stocks have yet to fully benefit. Small-cap stocks typically export less and are more sensitive to the domestic economy than large-cap stocks. As I mentioned earlier, the structural reforms should help stimulate consumer demand, eventually benefiting smaller-cap companies.

WisdomTree Japan Small-Cap Indexes

WisdomTree has two different small-cap Indexes that track dividend-paying stocks in Japan. Although each Index provides exposure to companies that we believe are more geared toward local Japanese revenue and consumption, they have opposite exposure to currency risk.

• WisdomTree Japan SmallCap Dividend Index – includes exposure to the yen

• WisdomTree Japan Hedged SmallCap Equity Index – hedges out the currency risk

Conclusion

I don’t believe Abenomics will fade quickly on the monetary side—it has only just begun its fiscal and structural reforms. Promises have been made to focus on long-term results and to release Japanese citizens from the deflationary cycle. Although Japan’s global exporters are in favor, the focus could shift toward the more domestically sensitive firms that we see in small caps. With new options for the currency-hedged side of small caps, one can now decide on the optimal allocations—do I want the currency exposure or do I want to hedge it? I believe a number of investors may pair currency-hedged options with non-currency-hedged options to diversify their approach.

1Source: Toyota FY2014 1Q Financial Results : Earnings Release Presentation (08/02/2013)

• Large-Cap Banks Outperform – The largest-cap banks, such as Mitsubishi UFJ Financial Group, Mizuho Financial Group and Mitsui Financial Group, are all up over 40% during the period. These three banks have profited more from a weaker yen and a rising equity market than some of their smaller counterparts. They have benefited from increased capital market activity, investment trust sales and brokerage fee income, all of which continues to grow with the stock market recovery.

• Small-Cap Real Estate and Diversified Financials Outperform on Domestic Trends – Real estate companies and real estate investment trusts (REITs) have been among the strongest performers. The Bank of Japan has been buying REITs, which has provided a tailwind for the industry.

• Automobiles and Consumer Durables Increase on Yen Weakness – Large automakers such as Nissan, Honda, Mazda and Toyota have all benefited from a weakening yen due to their export-oriented business models. Yen weakness has accounted for a majority of the automakers’ recent profitability, and Toyota just announced that ¥260 billion of their approximately ¥270 billion profit could be attributed to yen weakness.1 Consumer durables companies such as Sony and Panasonic have also benefited from a weakening yen, essentially making their products more attractive to overseas customers and boosting foreign profits through a lower, more advantageous exchange rate.

• Consumer Services Tied to Local Economy – The large performance difference in the consumer services industry is mainly a result of the industry group composition. A majority of these firms are tied to the local economy. As consumer confidence continues to increase, I expect this industry group to continue to benefit.

Potentially Focus on Smaller Companies for Future Domestic Growth

I believe the relationship between the Japanese large- and small-cap equity performance has been influenced by the yen’s substantial movements. Although some small-cap industries have already begun to benefit from Abe’s policies (e.g., real estate and diversified financials), I think the majority of the smaller-cap stocks have yet to fully benefit. Small-cap stocks typically export less and are more sensitive to the domestic economy than large-cap stocks. As I mentioned earlier, the structural reforms should help stimulate consumer demand, eventually benefiting smaller-cap companies.

WisdomTree Japan Small-Cap Indexes

WisdomTree has two different small-cap Indexes that track dividend-paying stocks in Japan. Although each Index provides exposure to companies that we believe are more geared toward local Japanese revenue and consumption, they have opposite exposure to currency risk.

• WisdomTree Japan SmallCap Dividend Index – includes exposure to the yen

• WisdomTree Japan Hedged SmallCap Equity Index – hedges out the currency risk

Conclusion

I don’t believe Abenomics will fade quickly on the monetary side—it has only just begun its fiscal and structural reforms. Promises have been made to focus on long-term results and to release Japanese citizens from the deflationary cycle. Although Japan’s global exporters are in favor, the focus could shift toward the more domestically sensitive firms that we see in small caps. With new options for the currency-hedged side of small caps, one can now decide on the optimal allocations—do I want the currency exposure or do I want to hedge it? I believe a number of investors may pair currency-hedged options with non-currency-hedged options to diversify their approach.

1Source: Toyota FY2014 1Q Financial Results : Earnings Release Presentation (08/02/2013)Important Risks Related to this Article

Investments focusing in Japan thereby increase the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investment risk and the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.