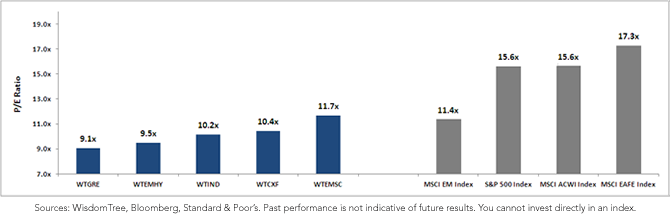

The Lowest Price to Earnings Ratio Markets Today

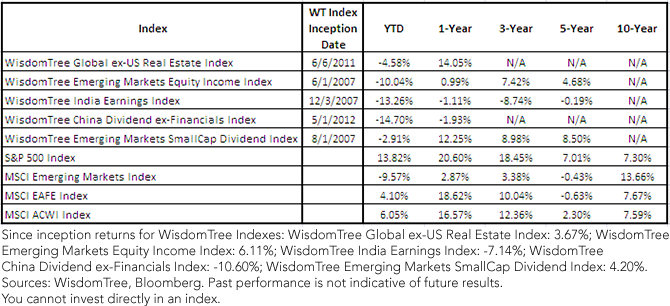

Average Annual Returns as of June 30, 2013

Average Annual Returns as of June 30, 2013

For definitions of indexes in the chart, please visit our glossary.

• Emerging Markets Theme: The WisdomTree Indexes shown above all have exposure to emerging markets. While the WisdomTree Global ex-US Real Estate Index had approximately 13% EM exposure as of July 11, 2013, the other four are 100% exposed to emerging markets. The emerging markets are currently one of the most out-of-favor investment areas. We believe this creates great opportunities for those who can take a longer-term view of this region and asset class.

• Negative Year-to-Date Performance: Each of the five shown WisdomTree Indexes with lowest P/E ratios has exhibited negative performance for the first half of 2013. The WisdomTree Emerging Markets SmallCap Dividend Index was the best performer, dropping less than 3%. The other 100% emerging market-exposed WisdomTree Indexes are all down more than 10%, and the MSCI Emerging Markets Index is down nearly 10%. China is one of the most out-of-favor markets—its approximately 15 percentage point decline is greater than that of the broader emerging markets. Much of the disappointing emerging market performance stems from concerns about a slowdown in Chinese economic growth rates.

Searching for a Catalyst

Historically, we have seen EM equity performance change quickly. Sometimes there is a clear catalyst to spark the inflection point, and at other times there is simply an unannounced shift in sentiment, the reason for which can be difficult to detect. While many investors might feel apprehensive about trying to catch the proverbial “falling knife” when considering emerging market equities today, we’d simply remind them that performance trends have a tendency to change over time and that, historically, considering equities with lower relative valuations has been a compelling theme. In our opinion, the valuation discount in many emerging market countries is unlikely to become a long-term characteristic of these markets.

For definitions of indexes in the chart, please visit our glossary.

• Emerging Markets Theme: The WisdomTree Indexes shown above all have exposure to emerging markets. While the WisdomTree Global ex-US Real Estate Index had approximately 13% EM exposure as of July 11, 2013, the other four are 100% exposed to emerging markets. The emerging markets are currently one of the most out-of-favor investment areas. We believe this creates great opportunities for those who can take a longer-term view of this region and asset class.

• Negative Year-to-Date Performance: Each of the five shown WisdomTree Indexes with lowest P/E ratios has exhibited negative performance for the first half of 2013. The WisdomTree Emerging Markets SmallCap Dividend Index was the best performer, dropping less than 3%. The other 100% emerging market-exposed WisdomTree Indexes are all down more than 10%, and the MSCI Emerging Markets Index is down nearly 10%. China is one of the most out-of-favor markets—its approximately 15 percentage point decline is greater than that of the broader emerging markets. Much of the disappointing emerging market performance stems from concerns about a slowdown in Chinese economic growth rates.

Searching for a Catalyst

Historically, we have seen EM equity performance change quickly. Sometimes there is a clear catalyst to spark the inflection point, and at other times there is simply an unannounced shift in sentiment, the reason for which can be difficult to detect. While many investors might feel apprehensive about trying to catch the proverbial “falling knife” when considering emerging market equities today, we’d simply remind them that performance trends have a tendency to change over time and that, historically, considering equities with lower relative valuations has been a compelling theme. In our opinion, the valuation discount in many emerging market countries is unlikely to become a long-term characteristic of these markets.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.