Equity Prices Are More Volatile Than Their Fundamentals

Yet Emerging Market Dividends Are Volatile

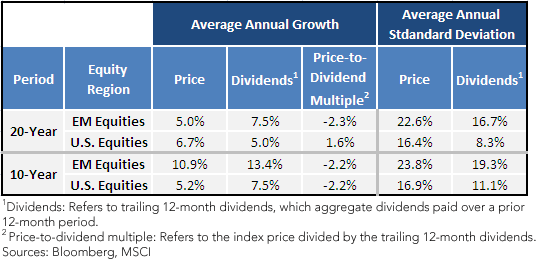

Yet emerging market dividends behave differently than dividends from those in the United States. The dividend volatility over 20 years was twice as high for EM Equities as it was for U.S. Equities2. There is a different mentality in the United States than in the emerging markets when it comes to dividend policies. U.S. companies do not like to raise and lower their dividends; they often manage cash to maintain a certain dividend per share every quarter. By contrast, emerging market dividend growth often mirrors the behavior of earnings.

We think the volatility of these dividends in EM Equities helps motivate our new dividend growth Index to focus on stocks that rank highly on our proprietary quality and growth selection factors. We believe that our stock selection factors can potentially help manage the volatility that we see in emerging market Dividend Streams®.

The Link between Dividend Growth and Return: Valuation

While their dividend growth has disappointed recently, the emerging markets still possess some of the best prospects for economic growth over the long term. When investors get overly enthused about growth prospects, there is a tendency to overpay for this potential growth.

From this perspective, it is interesting to contrast how the price-to-dividend multiple has changed with respect to U.S. Equities and EM Equities over the last 10 and 20 years3.

Over the last 20 years U.S. Equities have seen trailing 12-month dividend growth of 5.0% and price appreciation of 6.7% per year4. This increase in price level was fueled by an expansion of 1.6% per year in the price-to-dividend ratio—or a valuation multiple of the market that measures the relationship between the index price level and the index’s trailing 12-month dividends.

In the emerging markets, the price-to-dividend ratios have contracted over the last 20 years, as price growth lagged dividend growth by more than 2.2% per year over the period.

These contracting valuation multiples (dividends becoming less expensive relative to prices) for the emerging markets are one reason why I believe that these stocks are attractive from their current valuation perspective.

Combining a Focus on Dividend Growth Stocks with Relative Value Rebalancing

WisdomTree believes that a focus on growth-oriented companies must be married with a disciplined focus on valuations, and when we consider dividend growth potential as a component of index methodology, we marry it with a sensitivity to valuation. Specifically, WisdomTree uses a rules-based rebalancing program that involves tying Index constituent weights back to the Dividend Stream to focus on valuations—as it does in all its dividend-based Indexes.

While many dividend-focused indexes in emerging markets focus on yield and valuation, there is a dearth of options that focus on dividend growth. We believe that the WTEMDG approach with its flexibility to respond to growth represents the future of dividend growth indexing.

Unless otherwise stated, data source is WisdomTree.

1Refers to the MSCI Emerging Markets Index performance over the period 6/30/2010 to 6/30/2013, which has lagged that of the MSCI EAFE Index and the S&P 500 Index.

2Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

3Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

4Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

Yet Emerging Market Dividends Are Volatile

Yet emerging market dividends behave differently than dividends from those in the United States. The dividend volatility over 20 years was twice as high for EM Equities as it was for U.S. Equities2. There is a different mentality in the United States than in the emerging markets when it comes to dividend policies. U.S. companies do not like to raise and lower their dividends; they often manage cash to maintain a certain dividend per share every quarter. By contrast, emerging market dividend growth often mirrors the behavior of earnings.

We think the volatility of these dividends in EM Equities helps motivate our new dividend growth Index to focus on stocks that rank highly on our proprietary quality and growth selection factors. We believe that our stock selection factors can potentially help manage the volatility that we see in emerging market Dividend Streams®.

The Link between Dividend Growth and Return: Valuation

While their dividend growth has disappointed recently, the emerging markets still possess some of the best prospects for economic growth over the long term. When investors get overly enthused about growth prospects, there is a tendency to overpay for this potential growth.

From this perspective, it is interesting to contrast how the price-to-dividend multiple has changed with respect to U.S. Equities and EM Equities over the last 10 and 20 years3.

Over the last 20 years U.S. Equities have seen trailing 12-month dividend growth of 5.0% and price appreciation of 6.7% per year4. This increase in price level was fueled by an expansion of 1.6% per year in the price-to-dividend ratio—or a valuation multiple of the market that measures the relationship between the index price level and the index’s trailing 12-month dividends.

In the emerging markets, the price-to-dividend ratios have contracted over the last 20 years, as price growth lagged dividend growth by more than 2.2% per year over the period.

These contracting valuation multiples (dividends becoming less expensive relative to prices) for the emerging markets are one reason why I believe that these stocks are attractive from their current valuation perspective.

Combining a Focus on Dividend Growth Stocks with Relative Value Rebalancing

WisdomTree believes that a focus on growth-oriented companies must be married with a disciplined focus on valuations, and when we consider dividend growth potential as a component of index methodology, we marry it with a sensitivity to valuation. Specifically, WisdomTree uses a rules-based rebalancing program that involves tying Index constituent weights back to the Dividend Stream to focus on valuations—as it does in all its dividend-based Indexes.

While many dividend-focused indexes in emerging markets focus on yield and valuation, there is a dearth of options that focus on dividend growth. We believe that the WTEMDG approach with its flexibility to respond to growth represents the future of dividend growth indexing.

Unless otherwise stated, data source is WisdomTree.

1Refers to the MSCI Emerging Markets Index performance over the period 6/30/2010 to 6/30/2013, which has lagged that of the MSCI EAFE Index and the S&P 500 Index.

2Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

3Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

4Source: Bloomberg, MSCI, 6/30/1993-6/30/2013

Important Risks Related to this Article

Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.