Dividend Growers Cheaper Than Dividend Yielders?

For definitions of terms and indexes, visit our Glossary.

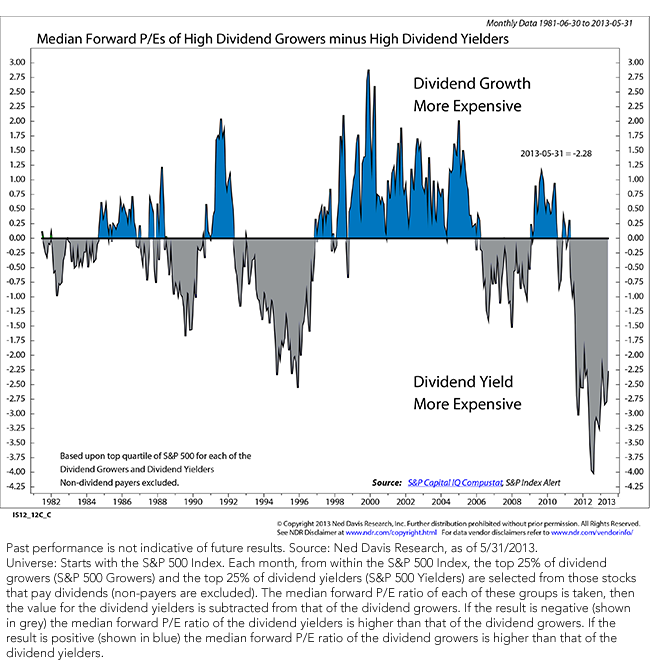

Ned Davis Research (NDR) recently published a note on a similar theme, where they conclude that the valuations of “S&P 500 Growers” is at one of the lowest points compared to “S&P 500 Yielders” based on their analysis of median forward P/E ratios from June 30, 1981, to May 31, 2013. In the last 30 years, it was rare for the discount on S&P 500 Growers to be as low as it currently is compared to the S&P 500 Yielders.

Conclusion

While the NDR research focuses on a different methodology, utilizing the S&P 500 Growers and S&P 500 Yielders, we believe that the ultimate conclusion—that the market may currently be paying more for dividend yield than for dividend growth—is the same as what we indicated through the statistics referenced on our Equity Income and U.S. Dividend Growth Indexes. NDR concluded in this latest research note that “dividend portfolios should include more than the highest yielders. Look for companies that are growing their dividends and have the earnings and cash flow to support the growth.”6

I agree fully with this statement, as well as with the valuation picture that NDR paints with the last 30 years of historical valuation data in the chart. I believe this indicates a potential opportunity among U.S. dividend payers characterized more accurately by dividend growth than dividend yield.

Data source is Bloomberg unless otherwise noted.

1“Dividend-paying stocks with the highest dividend yields” refers to those stocks in the defensive sectors, specifically the S&P 500 Telecommunication Services Index, the S&P 500 Utilities Index and the S&P 500 Consumer Staples Index, as of 5/31/2013.

2 The market refers to the S&P 500 Index. These three sectors indexes have higher price-to-earnings (P/E) ratios than the broader S&P 500 Index. P/E ratio refers to share price divided by earnings per share. Lower numbers indicate greater amounts of earnings per dollar invested.

3Refers to the U.S. 10-Year Treasury Note’s yield shifting from 1.67% as of 4/30/2013 to 2.13% as of 5/31/2013.

4 “Highest dividend-yielding stocks in the U.S.” refers to the top 30% of stocks ranked by dividend yield from the WisdomTree Dividend Index.

5 Refers to stocks from the universe of the WisdomTree Dividend Index with relatively higher long-term earnings growth expectations, return on assets and return on equity.

6Ed Clissold, CFA, and Dan Sanborn, “Did Bernanke End the Dividend Trade?,” Ned Davis Research Group, May 30, 2013.

For definitions of terms and indexes, visit our Glossary.

Ned Davis Research (NDR) recently published a note on a similar theme, where they conclude that the valuations of “S&P 500 Growers” is at one of the lowest points compared to “S&P 500 Yielders” based on their analysis of median forward P/E ratios from June 30, 1981, to May 31, 2013. In the last 30 years, it was rare for the discount on S&P 500 Growers to be as low as it currently is compared to the S&P 500 Yielders.

Conclusion

While the NDR research focuses on a different methodology, utilizing the S&P 500 Growers and S&P 500 Yielders, we believe that the ultimate conclusion—that the market may currently be paying more for dividend yield than for dividend growth—is the same as what we indicated through the statistics referenced on our Equity Income and U.S. Dividend Growth Indexes. NDR concluded in this latest research note that “dividend portfolios should include more than the highest yielders. Look for companies that are growing their dividends and have the earnings and cash flow to support the growth.”6

I agree fully with this statement, as well as with the valuation picture that NDR paints with the last 30 years of historical valuation data in the chart. I believe this indicates a potential opportunity among U.S. dividend payers characterized more accurately by dividend growth than dividend yield.

Data source is Bloomberg unless otherwise noted.

1“Dividend-paying stocks with the highest dividend yields” refers to those stocks in the defensive sectors, specifically the S&P 500 Telecommunication Services Index, the S&P 500 Utilities Index and the S&P 500 Consumer Staples Index, as of 5/31/2013.

2 The market refers to the S&P 500 Index. These three sectors indexes have higher price-to-earnings (P/E) ratios than the broader S&P 500 Index. P/E ratio refers to share price divided by earnings per share. Lower numbers indicate greater amounts of earnings per dollar invested.

3Refers to the U.S. 10-Year Treasury Note’s yield shifting from 1.67% as of 4/30/2013 to 2.13% as of 5/31/2013.

4 “Highest dividend-yielding stocks in the U.S.” refers to the top 30% of stocks ranked by dividend yield from the WisdomTree Dividend Index.

5 Refers to stocks from the universe of the WisdomTree Dividend Index with relatively higher long-term earnings growth expectations, return on assets and return on equity.

6Ed Clissold, CFA, and Dan Sanborn, “Did Bernanke End the Dividend Trade?,” Ned Davis Research Group, May 30, 2013.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.