The Case for Emerging Markets Corporates

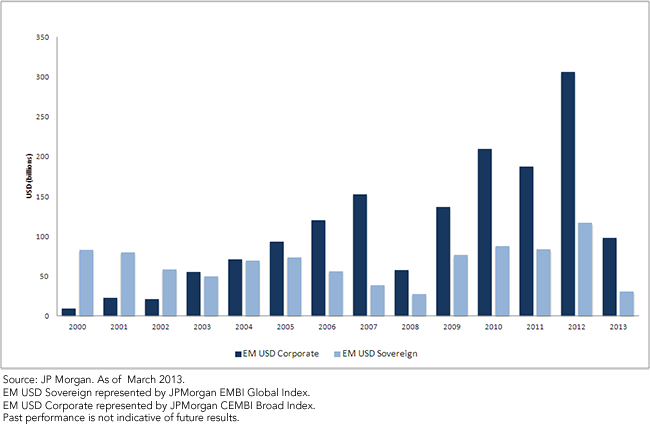

That is changing, and that could be a good thing. Given the popularity of emerging markets (EM) sovereigns, both the dollar-denominated and the local currency variety, it might be a stretch to think developing world corporate bonds could become an even more attractive asset class. At the very least, dollar-denominated EM corporates represent a larger asset class than their dollar-denominated sovereign counterparts.

In 2012, over $300 billion in dollar-denominated EM corporates were issued, or nearly triple the amount of dollar-denominated EM sovereign debt. That trend is continuing this year, with nearly $100 billion in dollar-denominated EM corporates being issued in the first quarter alone – more than triple the amount of dollar-denominated sovereign bonds.1

Higher Yields, Lower Duration

Average yields on emerging markets corporates are attractive—4.62% as of late March, up from 4.55% at the end of 2012 and far superior to what investors will find with the Markit iBoxx USD Liquid Investment Grade Index.

Bolstering the case for developing world corporate bonds are lower durations compared to government debt. The average duration of emerging markets government debt, a measure of sensitivity to interest rate movements, was 7.05 years, compared with 5.23 years for corporate securities, according to Bank of America.2

Defaults: Not What One Might Expect

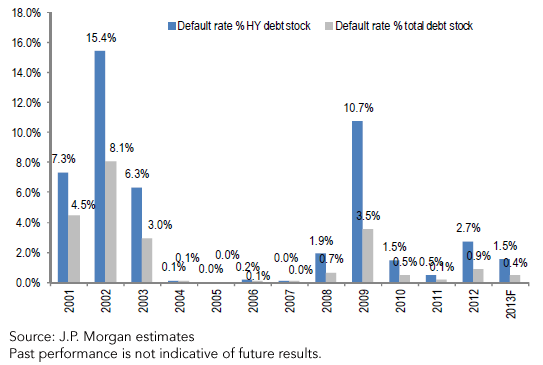

Surely the alluring combination of low durations and high yields must come at a cost, for example, increased default risk, right? Not necessarily. As the chart below indicates, the number of emerging markets corporate bond defaults among financial services issuers, both investment-grade and junk, have dwindled since the financial crisis.

At the regional level, Asia, which saw a spike in corporate defaults in 1998–1999 due to the region’s debt crisis, may now look attractive. In 2011, there was not a single default by an Asian EM corporate issuer. In fact, the only region that saw corporate defaults that year was EEMEA (Eastern Europe, Middle East and Africa).3

Believe it or not, emerging markets corporates usually have lower default rates than their developed world equivalents. Last year, the corporate default rate in emerging markets rose from 0.33% to 1.43%, but the overall trend is lower and a reversal of that trend should be seen this year due to transformed credit quality at the corporate and sovereign levels along with improved corporate fundamentals.

Ultimately, emerging markets corporates are not just a growing asset class, but they are also of growing importance to investors looking to establish well-rounded fixed income portfolios while maintaining exposure to potentially higher yields and tempering duration risk.

1Source: JP Morgan. As of Mar 2013. 2Source: Bloomberg, “Emerging Market Debt Posting Worst Start Since 1995,” 3/28/13. 3Source: Standard & Poor’s 2011 Inaugural Emerging Markets Corporate Default Study and Ratings Transitions.Important Risks Related to this Article

The information provided to you herein represents the opinions of Todd Shriber, ETF Professor of Benzinga.com and is not intended to be considered a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product, and it should not be relied on as such. Todd Shriber and Benzinga.com are not affiliated with WisdomTree and are not offered compensation for any written material. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. You cannot invest directly in an index.