Analyzing Our Top 20 U.S. Dividend Growth Stocks

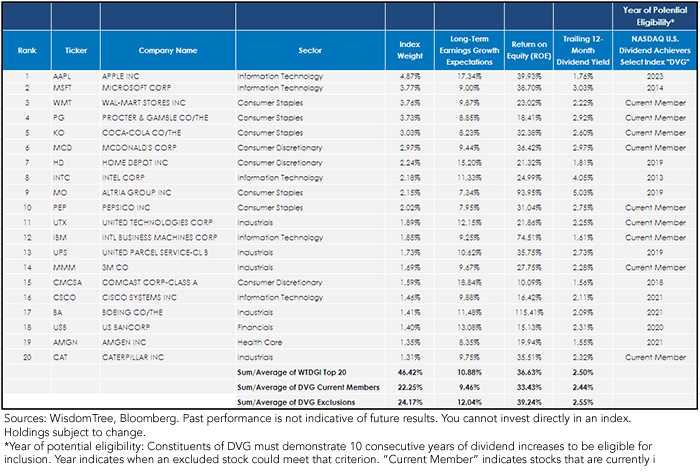

• Of the top 20 constituents of the WisdomTree U.S. Dividend Growth Index, nine are current constituents of the Achievers Select.

• Of the 11 excluded firms, many would not be eligible until around 2020, even if they continue to increase their dividends each year. These excluded firms tended to have higher average long-term earnings growth expectations, higher average ROE and even higher average trailing 12-month dividend yields.

• The Apple Effect: Apple has become the largest dividend payer in the United States1 and is the largest holding in the WisdomTree U.S. Dividend Growth Index. Apple is not eligible to be included in the Achievers Select until 2023.

• Higher Earnings Growth Expectations: One of the key summary statistics in this top 20 table are the earnings growth averages of companies included in the Achievers Select versus the averages of those excluded. Notably, of the 20 constituents of the WisdomTree U.S. Dividend Growth Index that are included in the Achievers Select, the average earnings growth expectation was 9.46%. That compares to the average of companies not included in Achievers Select (due to their more limited dividend history) of 12.0%.

Conclusion

There is little question that many of the firms comprised in this list are strong companies with brands that are essentially household names across the U.S. While there is no way to know whether any of them will raise their dividends in the future, we would question the exclusion of such firms as Apple, Microsoft, Altria, UPS and Boeing if the sole reason for doing so is a lack of 10 consecutive years of dividend increases. Each has a return on equity over 30%—with Altria and Boeing being substantially higher. While we can’t state whether those figures will directly impact future dividend growth or future returns, we believe that they indicate significant profitability and merit further consideration.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.

1This is based on Apple’s indicated dividends per share as of its latest earnings announcement dated 4/23/2013.

• Of the top 20 constituents of the WisdomTree U.S. Dividend Growth Index, nine are current constituents of the Achievers Select.

• Of the 11 excluded firms, many would not be eligible until around 2020, even if they continue to increase their dividends each year. These excluded firms tended to have higher average long-term earnings growth expectations, higher average ROE and even higher average trailing 12-month dividend yields.

• The Apple Effect: Apple has become the largest dividend payer in the United States1 and is the largest holding in the WisdomTree U.S. Dividend Growth Index. Apple is not eligible to be included in the Achievers Select until 2023.

• Higher Earnings Growth Expectations: One of the key summary statistics in this top 20 table are the earnings growth averages of companies included in the Achievers Select versus the averages of those excluded. Notably, of the 20 constituents of the WisdomTree U.S. Dividend Growth Index that are included in the Achievers Select, the average earnings growth expectation was 9.46%. That compares to the average of companies not included in Achievers Select (due to their more limited dividend history) of 12.0%.

Conclusion

There is little question that many of the firms comprised in this list are strong companies with brands that are essentially household names across the U.S. While there is no way to know whether any of them will raise their dividends in the future, we would question the exclusion of such firms as Apple, Microsoft, Altria, UPS and Boeing if the sole reason for doing so is a lack of 10 consecutive years of dividend increases. Each has a return on equity over 30%—with Altria and Boeing being substantially higher. While we can’t state whether those figures will directly impact future dividend growth or future returns, we believe that they indicate significant profitability and merit further consideration.

View Jeremy Schwartz discuss dividends (Video)

Read our Dividend Growth series here.

1This is based on Apple’s indicated dividends per share as of its latest earnings announcement dated 4/23/2013.Important Risks Related to this Article

Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.