Emerging Market Small Caps Diverge from Large Cap Brethren in Early 2013

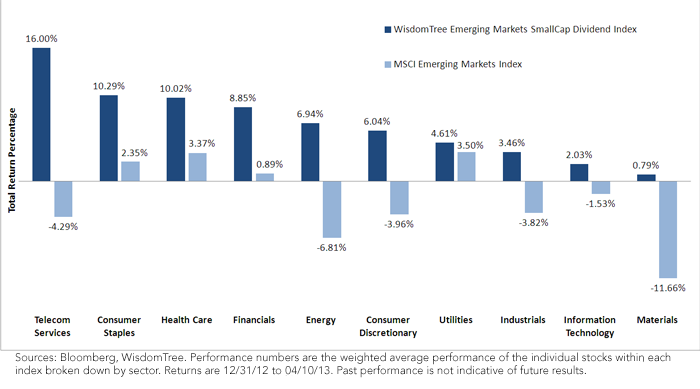

• Smaller Company Outperformance – The mid- and small-cap stocks in the WisdomTree Emerging Markets SmallCap Dividend Index have outperformed their large-cap peers, represented by the MSCI Emerging Market Index, in all 10 sectors. Every sector in the WisdomTree Index has posted a positive return year-to-date, while fewer than half the sectors of the MSCI Emerging Markets Index saw positive performance over the same period.

• Sector Differences – Compared to the MSCI Emerging Markets Index, the WisdomTree Emerging Markets SmallCap Dividend Index’s largest under-weight sectors are Energy, Telecommunication Services and Financials. The largest over-weight sectors are Industrials and Consumer Discretionary.

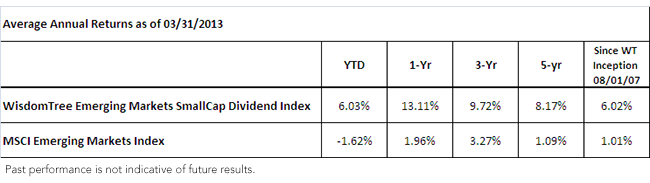

• Performance Differences – The WisdomTree Emerging Markets SmallCap Dividend Index is up 6.14% year-to-date and 15.33% over the most recent one-year period. The MSCI Emerging Markets Index is down 2.52% year-to-date and up 3.49% over the most recent one-year period.

Look to Small Caps for Potential Ties to the Emerging Market Consumer

Of course there are no guarantees that smaller-cap companies will outperform larger-cap companies going forward, but we think it is important to allocate to small-cap emerging companies. The positive economic growth in emerging market economies is translating into a growing class of citizens with more discretionary income. We expect this trend will continue in emerging market countries, and it is important to focus on this new class of emerging consumers. Large-cap companies are important to consider, but many are concentrated in the energy and financial sectors and are more dependent on global growth. To capitalize on this growing emerging consumer, we think one strategy is a focus on small-cap companies that are often more dependent on the growth from their own country and citizens.

• Smaller Company Outperformance – The mid- and small-cap stocks in the WisdomTree Emerging Markets SmallCap Dividend Index have outperformed their large-cap peers, represented by the MSCI Emerging Market Index, in all 10 sectors. Every sector in the WisdomTree Index has posted a positive return year-to-date, while fewer than half the sectors of the MSCI Emerging Markets Index saw positive performance over the same period.

• Sector Differences – Compared to the MSCI Emerging Markets Index, the WisdomTree Emerging Markets SmallCap Dividend Index’s largest under-weight sectors are Energy, Telecommunication Services and Financials. The largest over-weight sectors are Industrials and Consumer Discretionary.

• Performance Differences – The WisdomTree Emerging Markets SmallCap Dividend Index is up 6.14% year-to-date and 15.33% over the most recent one-year period. The MSCI Emerging Markets Index is down 2.52% year-to-date and up 3.49% over the most recent one-year period.

Look to Small Caps for Potential Ties to the Emerging Market Consumer

Of course there are no guarantees that smaller-cap companies will outperform larger-cap companies going forward, but we think it is important to allocate to small-cap emerging companies. The positive economic growth in emerging market economies is translating into a growing class of citizens with more discretionary income. We expect this trend will continue in emerging market countries, and it is important to focus on this new class of emerging consumers. Large-cap companies are important to consider, but many are concentrated in the energy and financial sectors and are more dependent on global growth. To capitalize on this growing emerging consumer, we think one strategy is a focus on small-cap companies that are often more dependent on the growth from their own country and citizens.

Data sources are WisdomTree and Bloomberg.

Data sources are WisdomTree and Bloomberg.Important Risks Related to this Article

You cannot invest directly in an index. The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Diversification does not eliminate the risk of experiencing investment losses. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.