Expanding the Core with Global Corporate Bonds

With nearly 13,000 securities in the Barclays Multiverse Index, which ones are worth investing in? In many instances, bond indexes take an agnostic view of a borrower’s creditworthiness. Just because one bond has a similar credit rating to another does not mean they have similar economic prospects. In an effort to mitigate credit and interest rate risk, we believe it is important to have an active manager monitoring the positions in the portfolio on a daily basis. Additionally, static or inflexible approaches to an evolving asset class seem inconsistent with today’s rapidly changing markets. We believe an experienced manager can help investors more fully take advantage of these opportunities.

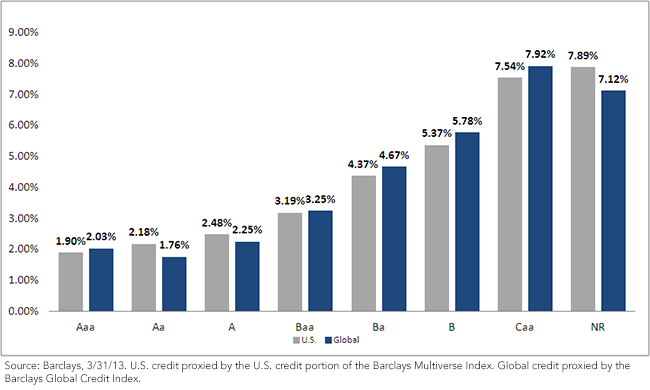

1Source: Barclays, March 31, 2013. Comparison based on the Barclays Global Credit Index vs. the U.S. credit portion of the Barclays Multiverse Index.

2Credit ratings based on Moody’s rating provided by Barclays, as of March 31, 2013.

With nearly 13,000 securities in the Barclays Multiverse Index, which ones are worth investing in? In many instances, bond indexes take an agnostic view of a borrower’s creditworthiness. Just because one bond has a similar credit rating to another does not mean they have similar economic prospects. In an effort to mitigate credit and interest rate risk, we believe it is important to have an active manager monitoring the positions in the portfolio on a daily basis. Additionally, static or inflexible approaches to an evolving asset class seem inconsistent with today’s rapidly changing markets. We believe an experienced manager can help investors more fully take advantage of these opportunities.

1Source: Barclays, March 31, 2013. Comparison based on the Barclays Global Credit Index vs. the U.S. credit portion of the Barclays Multiverse Index.

2Credit ratings based on Moody’s rating provided by Barclays, as of March 31, 2013.Important Risks Related to this Article

ALPS Distributors, Inc., is not affiliated with The Vanguard Group, Inc. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition when interest rates fall income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuers ability to make such payments will cause the price of that bond to decline.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.