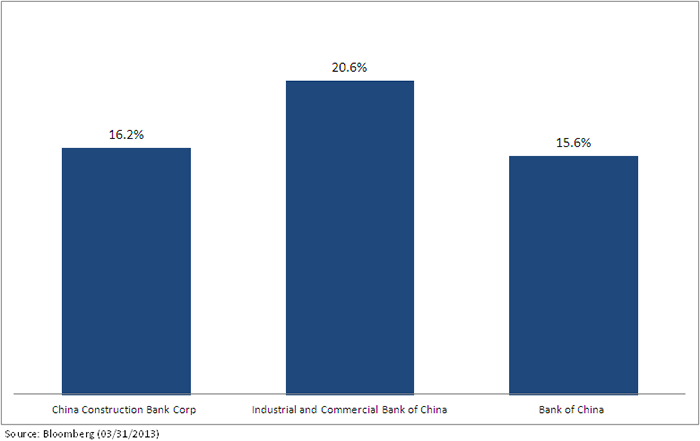

Chinese Banks Increasing Dividends

• China Construction Bank – the 16.2% dividend increase will increase its cash dividend stream by over $1.4 billion.

• Industrial and Commercial Bank of China – the 20.6% dividend increase will add over $570 million to its current dividend payments.

• Bank of China – declared a 15.6% dividend increase of over $319 million.

Increase in Equity Returns

The increased dividends and profitability have contributed to generating positive stock price performance since these companies were added to the WisdomTree Emerging Markets Equity Income Index.

• Industrial and Commercial Bank of China and China Construction Bank were new additions to the Index on June 18, 2012, at which point they received a collective weight of 9.57%. Bank of China was already a member of the Index before the rebalance.

• All three banks together made up 11.32% of the Index at the annual rebalance, and each has since posted positive equity returns of at least 20%. Returns below are from 06/18/12 through 03/31/13.

• China Construction Bank – 20.00%

• Industrial and Commercial Bank of China – 22.45%

• Bank of China – 25.36%

• WisdomTree Emerging Markets Equity Income Index – 11.88%

• MSCI Emerging Markets Index – 13.24%

Conclusion

We have been very pleased thus far with the Chinese banks’ contribution to the performance of the WisdomTree Emerging Markets Equity Income Index. The fundamental screening process for the Index identified attractively priced securities based on their dividend yields at the annual screening date and weighted them in the Index based on their trailing 12-month cash dividends, measured in U.S. dollars. Since being added to the Index, these companies have grown both their profits and their dividends, and their share prices have reacted positively as a result.

Data source Bloomberg unless otherwise noted.

For current holdings in the WisdomTree Emerging Markets Equity Index, click here.

1Profitability numbers are from 12/31/2011 to 12/31/2012; source: Bloomberg.

2Source: Bloomberg, as of 12/31/12.

• China Construction Bank – the 16.2% dividend increase will increase its cash dividend stream by over $1.4 billion.

• Industrial and Commercial Bank of China – the 20.6% dividend increase will add over $570 million to its current dividend payments.

• Bank of China – declared a 15.6% dividend increase of over $319 million.

Increase in Equity Returns

The increased dividends and profitability have contributed to generating positive stock price performance since these companies were added to the WisdomTree Emerging Markets Equity Income Index.

• Industrial and Commercial Bank of China and China Construction Bank were new additions to the Index on June 18, 2012, at which point they received a collective weight of 9.57%. Bank of China was already a member of the Index before the rebalance.

• All three banks together made up 11.32% of the Index at the annual rebalance, and each has since posted positive equity returns of at least 20%. Returns below are from 06/18/12 through 03/31/13.

• China Construction Bank – 20.00%

• Industrial and Commercial Bank of China – 22.45%

• Bank of China – 25.36%

• WisdomTree Emerging Markets Equity Income Index – 11.88%

• MSCI Emerging Markets Index – 13.24%

Conclusion

We have been very pleased thus far with the Chinese banks’ contribution to the performance of the WisdomTree Emerging Markets Equity Income Index. The fundamental screening process for the Index identified attractively priced securities based on their dividend yields at the annual screening date and weighted them in the Index based on their trailing 12-month cash dividends, measured in U.S. dollars. Since being added to the Index, these companies have grown both their profits and their dividends, and their share prices have reacted positively as a result.

Data source Bloomberg unless otherwise noted.

For current holdings in the WisdomTree Emerging Markets Equity Index, click here.

1Profitability numbers are from 12/31/2011 to 12/31/2012; source: Bloomberg.

2Source: Bloomberg, as of 12/31/12.Important Risks Related to this Article

You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.