Bullish on Mexican Corporate Debt

Central to the Fund’s investment process, Western Asset Management (the Fund’s sub-advisor) prefers having exposure to the companies it believes will benefit directly from ongoing economic development in basic infrastructure. Currently, this strategy results in an over-weight to metals & mining, oil & gas and basic industrials.

Ultimately, we believe that emerging market corporate debt can provide a valuable complement to many investors’ bond portfolios as they seek to evolve their investments with the changing economic landscape. When comparing it to U.S. dollar-denominated EM government debt, we currently prefer EM corporate debt as an asset class, given its higher current yields, lower interest rate risk and higher credit quality issuers.6

For current holdings in the WisdomTree Emerging Markets Corporate Bond Fund, click here.

1Standard and Poor’s, March 12, 2013.

2Bloomberg, 2013.

3Bloomberg, 2013.

4JPMorgan Corporate Emerging Market Bond Index (CEMBI) – Broad.

5As of March 15, 2013.

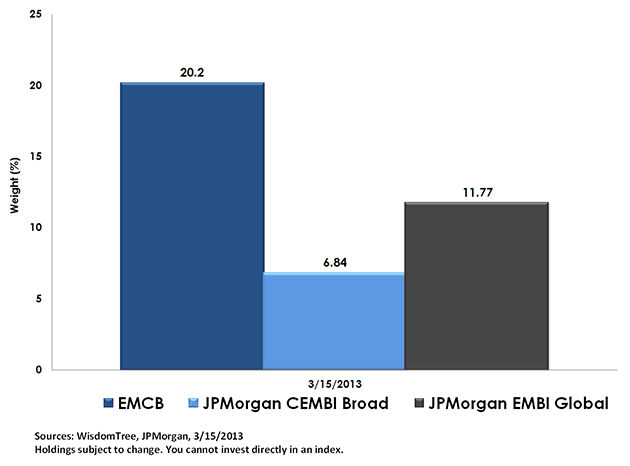

6Based on a comparison of the JPMorgan CEMBI Broad Index vs. the JPMorgan EMBI Global Index.

Central to the Fund’s investment process, Western Asset Management (the Fund’s sub-advisor) prefers having exposure to the companies it believes will benefit directly from ongoing economic development in basic infrastructure. Currently, this strategy results in an over-weight to metals & mining, oil & gas and basic industrials.

Ultimately, we believe that emerging market corporate debt can provide a valuable complement to many investors’ bond portfolios as they seek to evolve their investments with the changing economic landscape. When comparing it to U.S. dollar-denominated EM government debt, we currently prefer EM corporate debt as an asset class, given its higher current yields, lower interest rate risk and higher credit quality issuers.6

For current holdings in the WisdomTree Emerging Markets Corporate Bond Fund, click here.

1Standard and Poor’s, March 12, 2013.

2Bloomberg, 2013.

3Bloomberg, 2013.

4JPMorgan Corporate Emerging Market Bond Index (CEMBI) – Broad.

5As of March 15, 2013.

6Based on a comparison of the JPMorgan CEMBI Broad Index vs. the JPMorgan EMBI Global Index.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds (ETFs), there is no index that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objective will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. ALPS Distributors, Inc., is not affiliated with Western Asset Management Company, sub-advisor for the Fund.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.