Asian Equities Valued at a Historically Sweet Spot

(For definitions of terms in this chart, please see our Glossary.)

Connecting the Current Period to the Historical Analysis

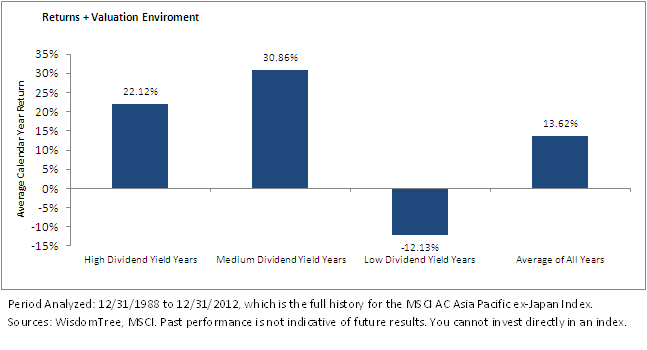

• 2/28/2013: As of this date, Asian equities had a trailing 12-month dividend yield of 2.85%, placing it squarely among the “Medium Dividend Yield Years.”

• Sweet Spot for Returns: The highest average actually corresponded to the performance of Asian equities during medium dividend yield years: 30.86%, which is more than 17% ahead of the average for all years. This is the range we refer to in the title of this piece—the “sweet spot” for valuations.

• Signaling Potential: During the High or Medium Dividend Yield Years, only four of the 16 periods exhibited losses, and the worst return was approximately -16%. The picture looks drastically different for the Low Dividend Yield Years: Five out of eight years saw negative returns, the worst being nearly -52%.

While certainly a valuable illustration of the point—namely that there has been an association between relatively higher or lower trailing 12-month dividend yields and subsequent higher or lower returns in the past—this may not always be the case and should not be viewed as an exact science.

For more information on the subject, read our research here.

(For definitions of terms in this chart, please see our Glossary.)

Connecting the Current Period to the Historical Analysis

• 2/28/2013: As of this date, Asian equities had a trailing 12-month dividend yield of 2.85%, placing it squarely among the “Medium Dividend Yield Years.”

• Sweet Spot for Returns: The highest average actually corresponded to the performance of Asian equities during medium dividend yield years: 30.86%, which is more than 17% ahead of the average for all years. This is the range we refer to in the title of this piece—the “sweet spot” for valuations.

• Signaling Potential: During the High or Medium Dividend Yield Years, only four of the 16 periods exhibited losses, and the worst return was approximately -16%. The picture looks drastically different for the Low Dividend Yield Years: Five out of eight years saw negative returns, the worst being nearly -52%.

While certainly a valuable illustration of the point—namely that there has been an association between relatively higher or lower trailing 12-month dividend yields and subsequent higher or lower returns in the past—this may not always be the case and should not be viewed as an exact science.

For more information on the subject, read our research here.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.