Are Investors Ignoring Important Dividend Payers?

(For Index definitions, go to Glossary.)

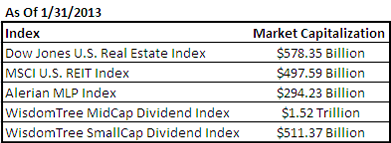

There are more than $10.5 billion invested in either ETFs or exchange-traded notes tracking the performance of the Alerian MLP Index, and more than $20 billion in ETFs designed to track the Dow Jones U.S. Real Estate Index and the MSCI U.S. REIT Index. Based on the aforementioned market capitalization statistics, I believe the biggest investment opportunity set by far exists in the ETFs that track the WisdomTree MidCap and SmallCap Dividend Indexes—and there is less than $1 billion invested in these funds.

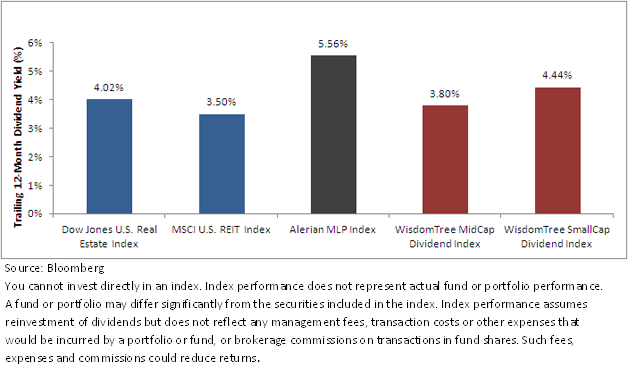

Moreover, the dividend yields have recently been fairly competitive with these smaller market segments.

Indexes Indicate Similar Yield Levels:

Trailing 12-Month Index Dividend Yields, As of 1/31/2013

(For Index definitions, go to Glossary.)

There are more than $10.5 billion invested in either ETFs or exchange-traded notes tracking the performance of the Alerian MLP Index, and more than $20 billion in ETFs designed to track the Dow Jones U.S. Real Estate Index and the MSCI U.S. REIT Index. Based on the aforementioned market capitalization statistics, I believe the biggest investment opportunity set by far exists in the ETFs that track the WisdomTree MidCap and SmallCap Dividend Indexes—and there is less than $1 billion invested in these funds.

Moreover, the dividend yields have recently been fairly competitive with these smaller market segments.

Indexes Indicate Similar Yield Levels:

Trailing 12-Month Index Dividend Yields, As of 1/31/2013

We recognize the inherent differences in methodology and market segments between these particular indexes, but we feel that the one common element—that many people consider these types of asset classes, be it real estate, REITS, MLPs and dividends--as income generators. Through the common theme of “income generation,” we believe there is merit to the comparison, but we acknowledge that people should consider the differences in potential risk profiles between these asset classes when conducting any analysis.

How Much to Allocate?

What would be an appropriate allocation to the mid- and small-cap dividend segments within an income-focused allocation? We believe that a good place to start could be an analysis of the exposure of mid- and small-cap stocks in broad market capitalization-weighted indexes. Of course, every investor will have different investment needs and should work with their investment advisor to determine the right balance for their needs.

Percentage of Market Cap Index: If we look at the Russell 3000 Index—one of the most often-cited measures of large-, mid- and small-cap equities in the United States—17.5% of the index comprises mid-cap stocks (defined here as those with market caps between $2 billion and $10 billion), while 6.6% is in small-cap stocks (defined here as those with market caps below $2 billion), for a combined mid- and small-cap weight of approximately 23%. This is a similar share as what we saw earlier in terms of the proportion of mid- and small-cap allocations across U.S.-focused ETFs.

Percentage of Dividend Index: Within the universe of U.S. dividend payers, and using the same market capitalization breakpoints as the Russell 3000 Index, 13% of the WisdomTree Dividend Index comprises mid-cap stocks and 4% is small-cap stocks.

We believe that these could be good starting baseline allocations. Many people often over-weight mid- and small-cap segments when it comes to their breakdown vs large caps in asset allocation. and the same can be done compared to large-cap dividend ETFs.

WisdomTree’s Jeremy Schwartz discusses the case for investing in Emerging Markets equities with Michael Johnston of ETF Database. Hear the podcast.

Source for data in this article: Bloomberg, as of 1/31/2013.

We recognize the inherent differences in methodology and market segments between these particular indexes, but we feel that the one common element—that many people consider these types of asset classes, be it real estate, REITS, MLPs and dividends--as income generators. Through the common theme of “income generation,” we believe there is merit to the comparison, but we acknowledge that people should consider the differences in potential risk profiles between these asset classes when conducting any analysis.

How Much to Allocate?

What would be an appropriate allocation to the mid- and small-cap dividend segments within an income-focused allocation? We believe that a good place to start could be an analysis of the exposure of mid- and small-cap stocks in broad market capitalization-weighted indexes. Of course, every investor will have different investment needs and should work with their investment advisor to determine the right balance for their needs.

Percentage of Market Cap Index: If we look at the Russell 3000 Index—one of the most often-cited measures of large-, mid- and small-cap equities in the United States—17.5% of the index comprises mid-cap stocks (defined here as those with market caps between $2 billion and $10 billion), while 6.6% is in small-cap stocks (defined here as those with market caps below $2 billion), for a combined mid- and small-cap weight of approximately 23%. This is a similar share as what we saw earlier in terms of the proportion of mid- and small-cap allocations across U.S.-focused ETFs.

Percentage of Dividend Index: Within the universe of U.S. dividend payers, and using the same market capitalization breakpoints as the Russell 3000 Index, 13% of the WisdomTree Dividend Index comprises mid-cap stocks and 4% is small-cap stocks.

We believe that these could be good starting baseline allocations. Many people often over-weight mid- and small-cap segments when it comes to their breakdown vs large caps in asset allocation. and the same can be done compared to large-cap dividend ETFs.

WisdomTree’s Jeremy Schwartz discusses the case for investing in Emerging Markets equities with Michael Johnston of ETF Database. Hear the podcast.

Source for data in this article: Bloomberg, as of 1/31/2013.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Funds’ prospectus for specific details regarding the Funds’ risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.