Positioning WisdomTree Model Portfolios for 2022

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Roughly one year ago, we wrote a blog post summarizing the various WisdomTree Model Portfolios and how they are built and managed to address multiple investor objectives. It is well past time to revisit those collective Model Portfolios, but with a slight twist. While we tend to be strategic investors who build Model Portfolios to perform as expected (based on their various mandates) over full market cycles, we do not ignore changing economic and market conditions, and we will reposition and reallocate our Model Portfolios from time to time to hopefully optimize performance under shifting market regimes.

In our December Model Portfolio Investment Committee (MPIC) meeting, we voted to implement several such changes as we head into 2022.

The WisdomTree Economic & Market Outlook for 2022

We recently published our Economic & Market Outlook for 2022. Before diving into the reallocations approved by the MPIC, let’s summarize that outlook to provide a frame of reference for the changes we opted for.

Focusing on what we believe are the primary market “signals”—economic growth rates, inflation expectations, monetary policy and corporate earnings growth rates—here is how we see the world over the course of 2022.

We believe 2022 will enjoy generally constructive economic and market conditions, with the usual caveat of not knowing the outcome of the current “known unknowns,” specifically:

- The ultimate outcome of the proposed “Build Back Better” plan (or, as is more likely, specific pieces of it),

- The continued evolution of the coronavirus pandemic and corresponding national, state and local responses, and

- Rising geopolitical tensions between the U.S., China, Russia, Europe and Iran.

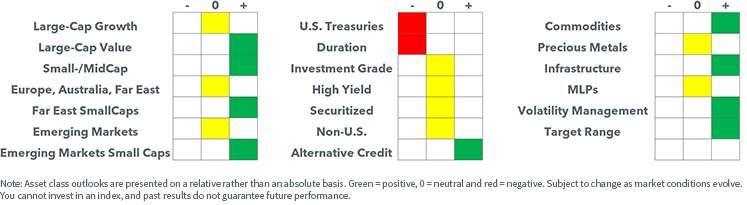

Our current asset class outlook is summarized as follows:

Our asset allocation guidelines are as follows:

- We maintain a strong preference for stocks over bonds.

- In equities, we remain roughly in line with the MSCI ACWI Index in terms of our regional exposures to the U.S., Europe/Australasia/Far East (“EAFE”) and emerging markets (“EM”).

- Somewhat uniquely (we think), we have an explicit over-weight in allocations to small-cap stocks in the U.S., EAFE and EM.

- Given the evolution of COVID-19 and its variants and the increasing global development of vaccinations and therapeutics, we think we may see a second “economic reopening” cycle, which will bode well for our allocations to quality, value, dividend-focused and small-cap stocks.

- Rising rates may provide a headwind to large-cap/growthier sectors and stocks, which tend to be more interest rate sensitive.

- The dollar rose steadily from June 2021–November 2021, before falling slightly in December. That general rally may continue in 2022, especially versus the euro and the yen. But we remain structurally bearish longer-term, and most of our non-U.S. positions remain unhedged.

- Within fixed income, we continue to favor shorter duration and an over-weight in quality credit (emphasis on quality) relative to the Bloomberg U.S. Aggregate Index. We see pockets of relative opportunity in securitized and alternative credit.

- We are bullish on the broader commodity complex as the global economy recovers.

- We continue to see value in real asset and alternative investment allocations for investors seeking to increase overall portfolio diversification.

- Generating relative and absolute returns will be key in 2022—that is, we believe 2022 will be a year when advisors and investors need to focus on “alpha generation” and not simply “beta wave” performance.

- Expectations for returns from traditional assets remain muted, given current rates, spreads and valuations, and the ability of traditional diversified portfolios to achieve objectives in the manner they have in the past will be challenged. Capital efficiency, alternatives, alpha-drivers and diversifiers will become increasingly important as we move through the year.

Reallocations within the WisdomTree Model Portfolios

With this market outlook and these asset allocation guidelines providing an appropriate framework, here is a summary of the changes we made within some of our Model Portfolios.

Endowment: This is a strategic multi-asset Model Portfolio that allocates to stocks, bonds, real assets and “nontraditional” or alternative assets to deliver a diversified “endowment-like” investment experience. Within this Model Portfolio, we voted to remove a hedged equity strategy in favor of a managed futures position (WTMF).

Volatility Management: This “outcome-focused” Model Portfolio is designed to act as a complementary sleeve to an existing multi-asset portfolio to provide additional diversification and potential drivers of lower-correlated returns. Within this Model Portfolio, we removed an interest rate and options-focused strategy and added in the same managed futures Fund (WTMF) we added into our Endowment Model Portfolio.

Disruptive Growth: This “outcome-focused” Model Portfolio is designed to act as a potentially volatile but high-growth complementary equity sleeve to an existing equity or multi-asset model. Given our view on interest rates, we reduced our exposures to high-growth but highly interest-rate-sensitive allocations to cloud computing and genomics, maintained our allocation to cybersecurity but swapped securities (into WCBR) and added in a new allocation to a “sustainable future” ETF that invests in companies focused on alternative energy, energy efficiency, green building, sustainable water and pollution prevention and control.

U.S. Multifactor: This “outcome-focused” Model Portfolio is designed to act as either a stand-alone equity model or as a total return and diversifying complementary sleeve to an existing equity or multi-asset model. Within this Model Portfolio, we removed our exposure to cloud computing and reduced our exposure to an earnings-weighted U.S. large-cap strategy. In exchange, we increased our existing exposures to a quality- and value-focused shareholder yield strategy (WTV) and a small-cap quality dividend growth strategy (DGRS).

Global Dividend: This all-equity Model Portfolio is designed to act as a stand-alone or a complementary sleeve to an existing equity model with the investment objectives of delivering both total return and enhanced current yield/income generation. Within this Model Portfolio, we reallocated from a technology-based dividend strategy to a banking-sector-focused strategy and reduced our exposure to an all-cap dividend fund in order to fund an allocation into a small-cap dividend Fund (DES).

Multi-Asset Income: Similar to the Global Dividend Model Portfolio, this is a multi-asset Model Portfolio (stocks, bonds and other assets) designed to deliver both total return and enhanced current yield/income. Within this Model Portfolio (and like the changes we made to the Global Dividend Model Portfolio), we reallocated from a technology-based dividend strategy to a banking-sector-focused strategy and reduced our exposure to an all-cap dividend fund in order to fund an allocation into a small-cap dividend Fund (DES).

Conclusions

As a reminder, while each of our Model Portfolios may have different investment mandates and objectives, they do share certain common characteristics:

- They are global in nature (with the exceptions of regional-specific Model Portfolios such as the U.S. Multifactor Model Portfolio). We are a global asset management firm, and we believe in global diversification.

- They are ETF-centric, as we believe this helps to optimize both fees and taxes—the two things any advisor has the most control over with respect to their client portfolios.

- They are “open architecture” and include both WisdomTree and third-party strategies. This is the right thing to do for the end investor, and it helps to improve the risk factor diversification of our models.

- The factor tilts inherent in almost all WisdomTree ETFs allow us to build “core/satellite” Model Portfolios that optimize fees and taxes and provide the potential for alpha generation versus plain vanilla cap-weighted “beta” portfolios.

- We charge no strategist fee—all revenue generated from our Model Portfolios comes only from the expense ratios associated with the WisdomTree products we choose to include in any given Model Portfolio.

Our Model Portfolios are designed to be strategic in nature and diversified at both the asset class and risk factor levels to potentially optimize risk-adjusted performance through full market cycles regardless of economic and market regimes.

As such, we remain largely comfortable with our core allocations and strategies—they have delivered a consistent performance in line with their objectives throughout the somewhat tumultuous past two years. We did, however, opt to make marginal changes as summarized above to position our Model Portfolios in accordance with our economic and market outlook as we head into and through 2022.

You can learn more about all our Model Portfolios, including full transparency into allocations, individual securities, fees, yield and performance, at our Model Adoption Center.

We invite you to take a look.

Important Risks Related to this Article

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.