Are Emerging Markets Poised for the Long Run?

It’s been a remarkable decade for the S&P 500 Index. Less so for global benchmarks.

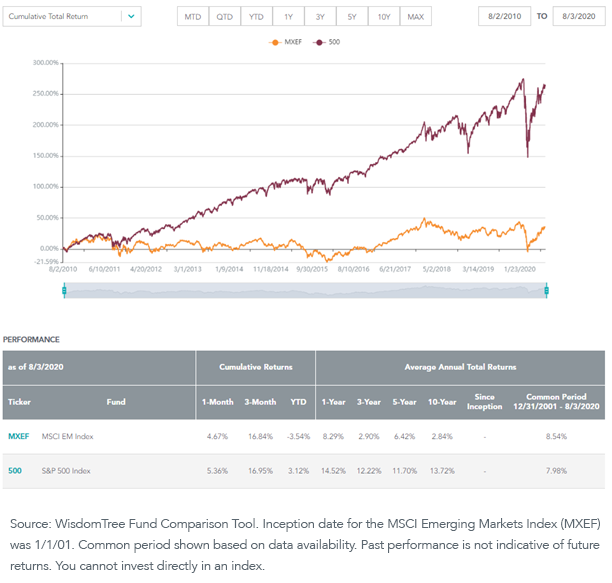

Exhibit A: The MSCI Emerging Markets Index lagged the S&P 500 by over 200 percentage points cumulatively over the trailing 10-years—an average of more than 10% per year!

Cumulative Total Return

But the opposite was true in the 10 years before this period, when the emerging markets index beat the S&P 500 by a similar magnitude. Since 2001, the return of the MSCI Emerging Markets is still ahead of the S&P 500.

That is the story of diversification.

And while global allocators like WisdomTree would have given a similar story during recent years, our expectation is that this trend of U.S dominance will not continue forever.

What is One of the Best Ways to Own Emerging Markets?

One reason the U.S. has outperformed global benchmarks is its dominance in large-cap tech giants. Europe and Japan and the developed world indexes are notably lacking any big companies that have rivaled those U.S. tech stars.

In emerging markets, China is the country competing with the U.S. for tech dominance. The U.S. has FAANG, while China brings a BAT (Baidu, Alibaba and Tencent) of strong growers.

China also has up-and-coming tech stars like Pinduoduo, Bilibili and TAL Education, which are in e-commerce, online education and online entertainment, gaining share against the BAT and exhibiting strong performance.

WisdomTree has been a proponent of value investing since our inception in 2006, when we introduced dividend-weighted global portfolios.

Yet for emerging markets, many of our strategic model portfolios and core allocations are anchored with a growth-tilted core emerging markets holding—the WisdomTree Emerging Markets ex-Stated-Owned Enterprises Fund (XSOE).

For standardized performance of XSOE, please click here.

Year to date1, this growth-tilted core strategy has outperformed the MSCI Emerging Markets Index by over 1,000 basis points (bps) at NAV, bringing its since-inception performance to over 200 bps per year ahead of its benchmark.XSOE accomplished these results by following a simple two-step process:

- Remove state-owned enterprises (SOEs): Identify all companies that have more than 20% ownership by the state. SOEs are most commonly found in China (almost half of all SOEs are in China), but also in banking and energy. Removing these means the remaining portfolio is overweight the technology and consumer sectors. These sector tilts were intentional elements of the strategy, and is a reason we believe this Fund is best aligned to the reason investors allocate to emerging markets in the first place—access to a large population that is seeing income levels catch up and grow relative to the developed world.

- The WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE) follows a market cap-weighted approach designed to be country neutral (i.e., no large bets to diverge from our universe) while keeping sector tilts fairly balanced relative to our starting universe.

Let’s look at what factors have driven the Fund’s outperformance.

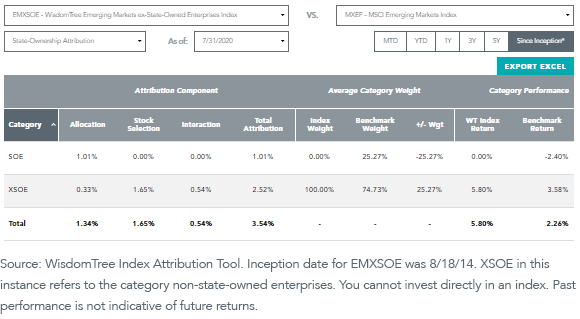

First, look at the returns of SOEs compared to those of non-SOEs since we launched EMXSOE.

- In the MSCI Emerging Markets Index, SOEs have declined 2.40% per year, while the non-SOEs have returned 3.58% per year.

- The 25% of the MSCI Emerging Markets Index that was exposed to SOEs dragged down the traditional benchmark returns.

WisdomTree’s methodology also delivered higher returns in the non-SOE segment—EMXSOE returns were 5.80% for non-SOEs compared to the MSCI Index returns of 3.58% in the non-SOE segment.

How much did the sector shift help?

As seen in the chart below, the allocation impact from sector deviations only represented 80 bps of the 354-bp total outperformance. Stock selection, and better returns within the sectors, was a key driver.

This is the impact from WisdomTree’s methodology removing SOEs, as both indexes follow a generally market capitalization-weighted approach.

In our view the decade ahead is unlikely to see the U.S. continue its major outperformance.

Emerging markets represent one of the global growth stories we see over the long run. To capitalize on this potential, we’d advocate for a growth-tilted core like XSOE.

1As of 8/04/20.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Diversification does not eliminate the risk of experiencing investment losses. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.