The Inverted VIX Curve: Why It’s Important

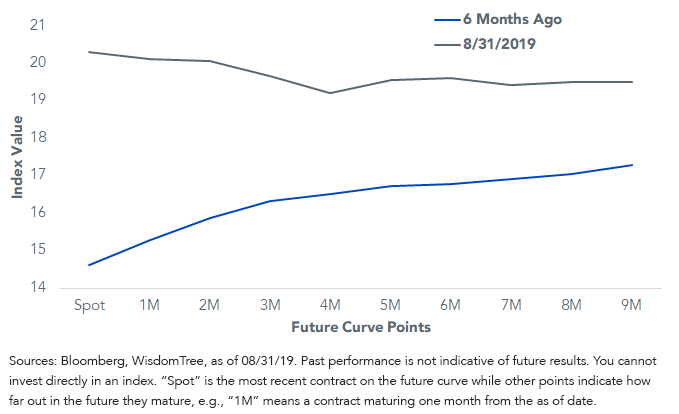

Besides the yield curve that our fixed income team likes to talk about, there is another curve that inverted recently, and that warrants attention from asset allocators in Q4 2019. Typically, the Chicago Board of Options Exchange (Cboe) Volatility Index (VIX) is an upward sloping curve—VIX contracts further out trade higher than the nearer contracts. This means there is more uncertainty as you go further out in the future.

However, in August, this trend reversed, and VIX one-month contracts traded higher than VIX three- and six-months contracts. We can blame this higher near-term uncertainty on trade tensions, slowing growth and Federal Reserve (Fed) policy. In any case, it means risk is back in vogue. For asset allocators, this implies hedging volatility is more critical now than it was earlier this year.

VIX Future Curve

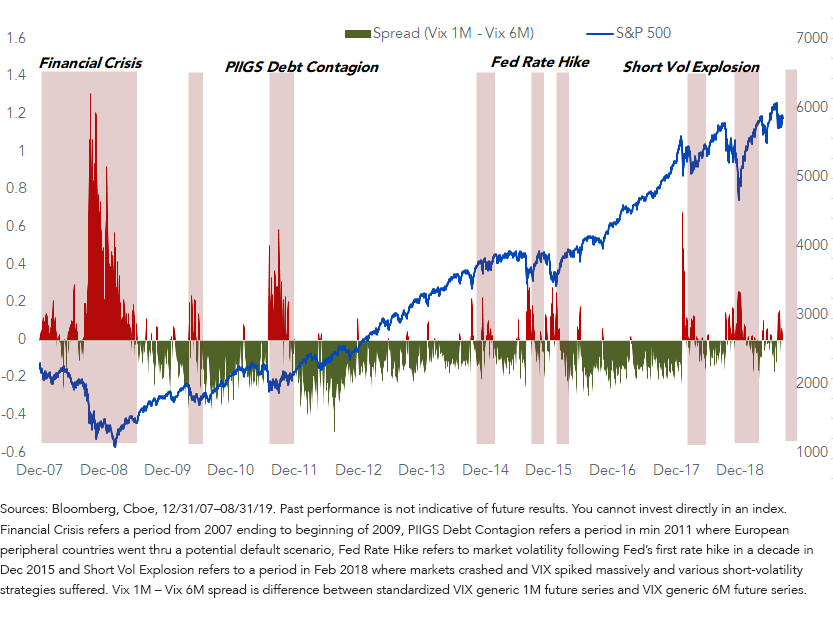

Historically, here’s what an inverted volatility curve has meant:

- Higher volatility in the near term.

- More negative equity swings.

- Higher income opportunity via selling volatility contracts.

VIX 1M Inversion: Canary in a Coal Mine

How Can WisdomTree Help?

As volatility comes back into the conversation, the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW), which tracks Cboe’s PutWrite Index (PUT Index) could be a great instrument for providing long exposure with the ability to mitigate downside risk during volatile markets.

A few PUTW highlights:

- During upward trending markets in 2017, PUTW still delivered returns above 10%. The S&P 500 Index was up ~+22%. Please visit PUTW’s Fund detail page for standardized performance.

- Similarly, in 2009, the PUT Index rose 31.5%, outperforming the S&P 500, which returned +26.46%

- PUTW has a beta of approximately ~0.6, thus reducing volatility.

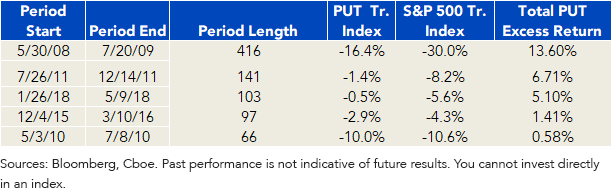

In periods when the VIX curve inverted, the PUT Index has beaten the S&P 500 by a large margin (table below):

Top 5 Longest Periods When Normalized VIX 1M Was Consistently Above Normalized VIX 6M

Conclusion

PUTW can be a great hedge in this environment. If there is a trade resolution or market rally, PUTW’s strong positive correlation to equities could potentially provide positive returns. If markets fall, it can help provide cushioning and income, especially in a more volatile environment. Investors should be cautious of buying either pure short or pure long vol strategies. The former can potentially wipe out total exposure, while the later can act as a drag on total returns due.

Important Risks Related to this Article

Double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for very short periods, should not be the sole factor in making your investment decision.

There are risks associated with investing, including the possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities, and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s NAV. Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the amount of option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at wisdomtree.com.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.