Profitability and Prudence in Small-Cap Equities

Small-cap equities have captivated investors for decades, as the allure of exceptional returns and pursuit of diamonds in the rough have been the subject of extensive research and speculation.

The evidence of small caps outperforming larger companies over time, known as the size factor, was first documented in the seminal research of Eugene Fama and Kenneth French, and it has intrigued investors ever since.

But for every diamond in the U.S. small-cap market, there are dozens more that may be better off avoided.

The Russell 2000 Index is a broad benchmark for U.S. small-cap companies and has averaged about 18% of its weight in companies with negative earnings since early 2007. This trend is consistent across investment styles as well, with the Russell 2000 Value Index and Russell 2000 Growth Index maintaining 16% and 20% exposure, respectively.

What that means, is that no matter how you segment the market, nearly one in every five small-cap companies in the U.S. is currently unprofitable. That’s a harrowing thought.

But what if there was a way to access the U.S. small-cap market that steered investors away from unprofitable companies, whose valuations and business prospects are based largely on speculation?

Weighting by Earnings vs. Waiting for Earnings

In 2007, WisdomTree introduced a unique way to analyze small-cap equities that focused objectively on healthy businesses with robust operations and consistent profitability. Since then, the WisdomTree U.S. SmallCap Index and its earnings-weighted methodology have provided a track record of long-term outperformance with an emphasis on higher-quality companies.

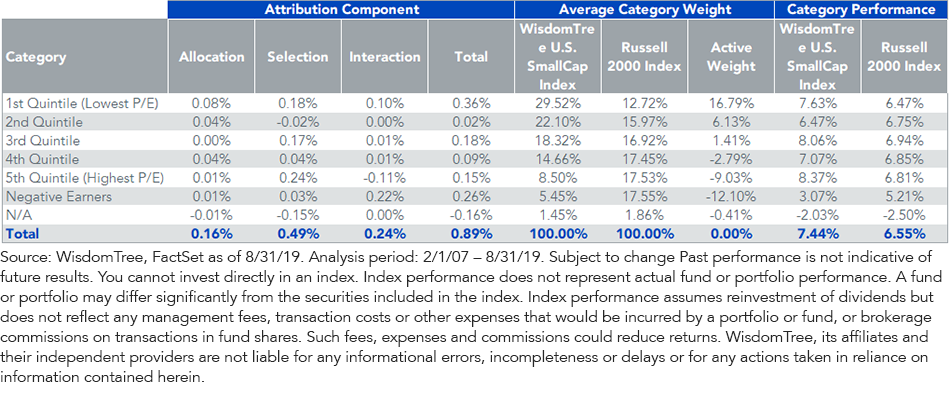

Since its inception, WisdomTree’s methodology has maintained an average 12% under-weight in companies with negative earnings compared with the Russell 2000 Index. The emphasis on profitable companies has been beneficial over the long term as well because WisdomTree’s methodology has outperformed the Russell 2000 Index by almost 90 basis points (bps). Likewise, the systematic under-weight in unprofitable companies has accounted for over 25% of this outperformance, making it the second-greatest contributor when analyzing performance by earnings yield.

Figure 1: Since Inception Attribution by Earnings Yield

For definitions in this chart, please visit our glossary.

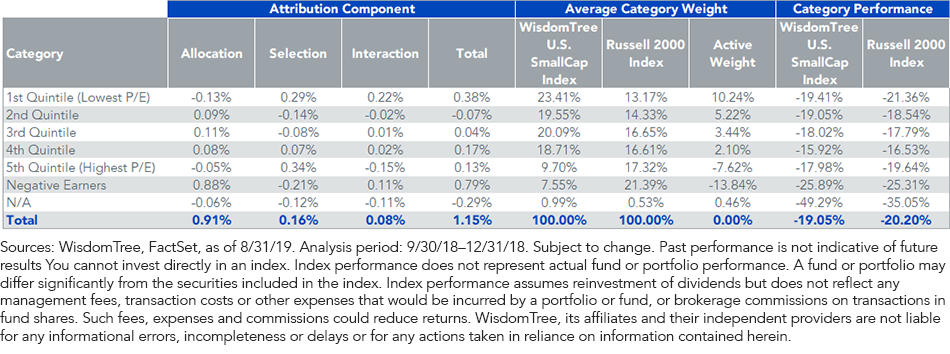

An earnings-weighted approach to small-cap equities can also help protect on the downside during periods of heightened volatility because high-quality companies can simultaneously provide a defensive allocation. During the painful fourth quarter of 2018, WisdomTree’s method managed to outperform the Russell 2000 Index by 115 bps, with its 13% under-weight in negative earners providing more than two-thirds of the advantage.

Figure 2: Earnings Yield Attribution During the Fourth Quarter of 2018

Seeking More than Just Profitability

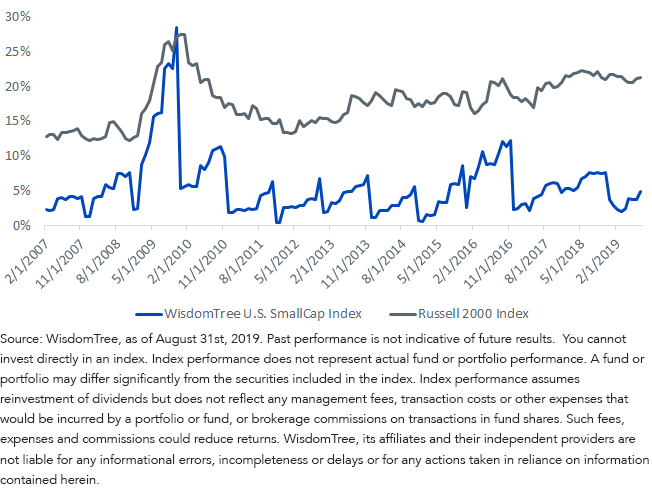

WisdomTree’s tendency to avoid unprofitable companies isn’t an anomaly or a by-product of the methodology; it’s an objective. When we screen for companies with positive earnings each November, ahead of the Index’s formal rebalance in December, we’re selecting the healthiest and most operationally efficient companies. As a result, we also eliminate a majority of those with negative earnings. Since inception, our methodology has managed to eliminate an average weight of 7% in unprofitable companies during every rebalance.

Figure 3: Percent Weight in Companies with Negative Earnings

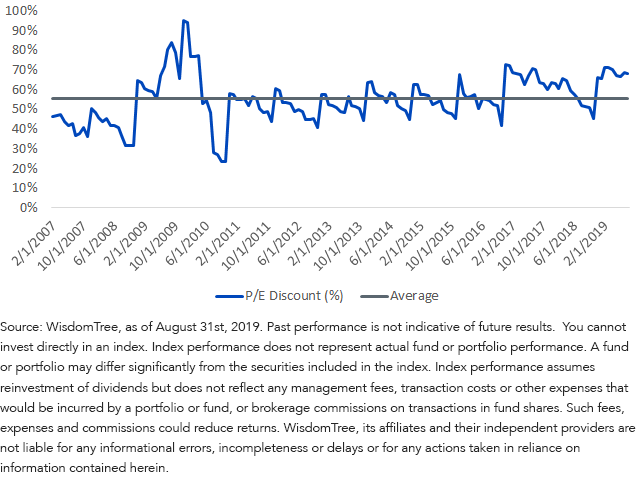

The reduction in unprofitable companies is especially valuable when you compare WisdomTree’s fundamentals against the Russell 2000 Index. The emphasis on companies with larger earnings directly reduces the Index’s price-to-earnings ratio, offering it at a 70% discount to the broader small-cap market. This is also consistent over time. Since inception, the Index has maintained a 55% valuation discount relative to the small-cap market.

Figure 4: WisdomTree Index P/E Ratio Discount (%) Relative to Russell 2000 Index

But the Index still has more to offer beyond attractive valuations in an expensive market.

The earnings-weighted methodology systematically improves the profitability profile of the Index as well. Both return on equity and return on assets are doubled relative to the Russell 2000, illustrating exactly how the strategy delivers higher-quality companies because of its earnings focus. Couple this with less expensive valuations, and WisdomTree’s methodology is capable of providing more than just profitable companies.

An Enhanced Approach to U.S. Small Caps

WisdomTree’s small-cap approach is systematically designed to avoid mediocre companies in favor of higher-quality ones, and the benefits of this approach are evident. In our view, financial markets will be ripe with uncertainty for the remainder of 2019, and that may extend well into 2020. We think now is an appropriate time to emphasize quality companies that can provide upside potential over the long term and downside protection during intermittent periods of volatility. Fortunately for investors looking to invest in small caps, the WisdomTree U.S. SmallCap Fund (EES), which seeks to track our Index,may be able to provide both.

Unless otherwise stated, all data is sourced from WisdomTree and FactSet as of 8/31/2019.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.