What Additional Role Can the U.S. Dollar Play in Investor Portfolios?

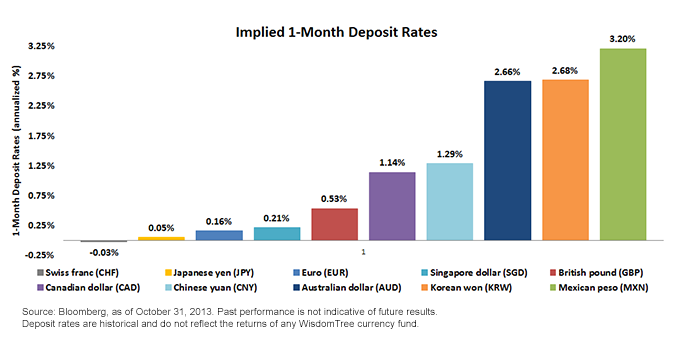

The implied 1-Month deposit rate represents the annualized interest rate embedded in forward currency contracts.

For definitions of indexes in the chart, please visit our Glossary.

A Hedge against Market Uncertainty

As we have seen recently, foreign currency risk is undesirable in certain market environments. During periods of economic stress, investors flock toward stable, liquid assets when attempting to reduce their exposure to the markets. Given the U.S. dollar’s current role as the world’s reserve currency, it tends to appreciate during periods of increasing global uncertainty. When an investor buys a currency such as the dollar, he is implicitly selling short a foreign currency to gain this exposure. Given the simple laws of supply and demand, this trade has the effect of driving up the price of the dollar against the foreign currency that was sold.

Portfolio Diversification through Negative Correlation

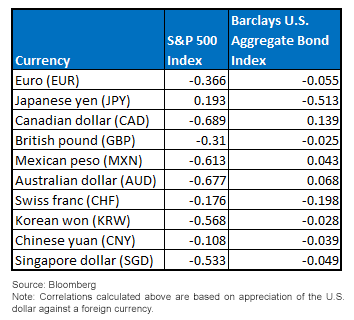

Historically, currency returns generally have a positive correlation with local asset prices. When U.S. investors buy foreign assets such as stocks and bonds, they must convert their dollars to the local currency and purchase locally denominated assets. This causes an increase in demand for the local currency as well as a rise in asset prices. The dollar, by comparison, is seen as a “safe haven” currency in the current market environment. Therefore, as risky assets decline in value, the value of the dollar may tend to increase. This perhaps overlooked current market dynamic has the impact of creating a negative correlation for most foreign currency positions against the S&P 500.

Weekly Correlations, October 31, 2008 – October 31, 2013

The implied 1-Month deposit rate represents the annualized interest rate embedded in forward currency contracts.

For definitions of indexes in the chart, please visit our Glossary.

A Hedge against Market Uncertainty

As we have seen recently, foreign currency risk is undesirable in certain market environments. During periods of economic stress, investors flock toward stable, liquid assets when attempting to reduce their exposure to the markets. Given the U.S. dollar’s current role as the world’s reserve currency, it tends to appreciate during periods of increasing global uncertainty. When an investor buys a currency such as the dollar, he is implicitly selling short a foreign currency to gain this exposure. Given the simple laws of supply and demand, this trade has the effect of driving up the price of the dollar against the foreign currency that was sold.

Portfolio Diversification through Negative Correlation

Historically, currency returns generally have a positive correlation with local asset prices. When U.S. investors buy foreign assets such as stocks and bonds, they must convert their dollars to the local currency and purchase locally denominated assets. This causes an increase in demand for the local currency as well as a rise in asset prices. The dollar, by comparison, is seen as a “safe haven” currency in the current market environment. Therefore, as risky assets decline in value, the value of the dollar may tend to increase. This perhaps overlooked current market dynamic has the impact of creating a negative correlation for most foreign currency positions against the S&P 500.

Weekly Correlations, October 31, 2008 – October 31, 2013

Conclusion

Investments in the U.S. dollar against foreign currencies can be used in a variety of ways in an investor’s portfolio. Given the low opportunity costs associated with long positions in the U.S. dollar against many developed market currencies, the current role the U.S. dollar plays in the global financial system and the potential for diversification from a negatively correlated asset to traditional asset classes, we believe that certain market environments may create opportunities to benefit from a strengthening U.S. dollar.

Conclusion

Investments in the U.S. dollar against foreign currencies can be used in a variety of ways in an investor’s portfolio. Given the low opportunity costs associated with long positions in the U.S. dollar against many developed market currencies, the current role the U.S. dollar plays in the global financial system and the potential for diversification from a negatively correlated asset to traditional asset classes, we believe that certain market environments may create opportunities to benefit from a strengthening U.S. dollar.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Diversification does not eliminate the risk of experiencing investment losses.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.